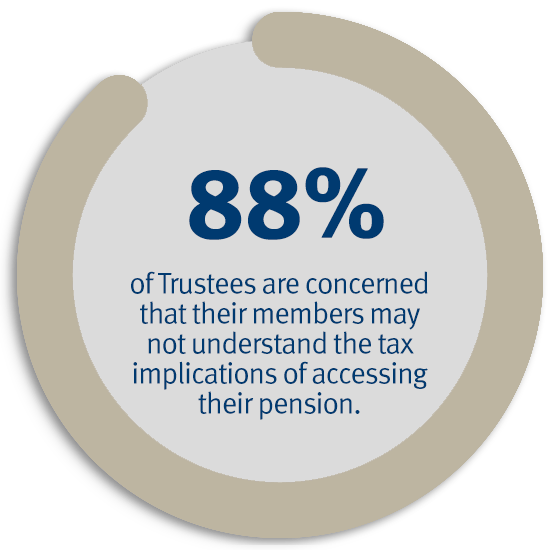

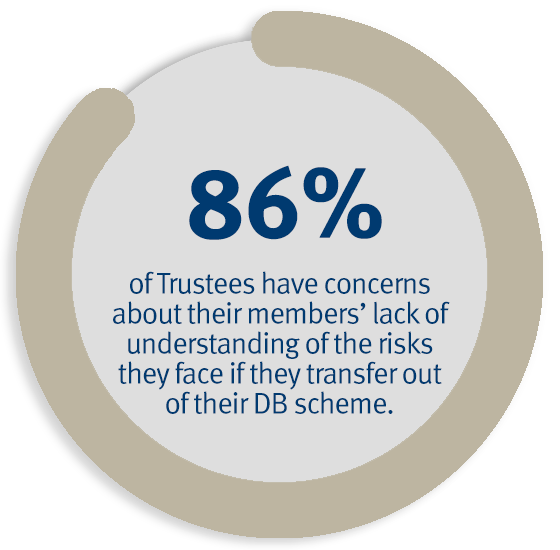

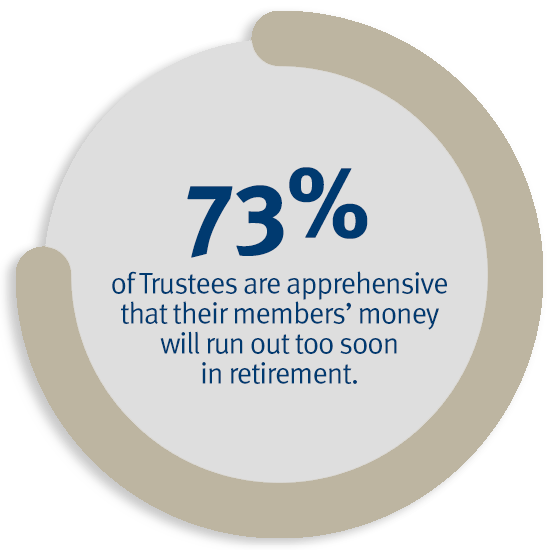

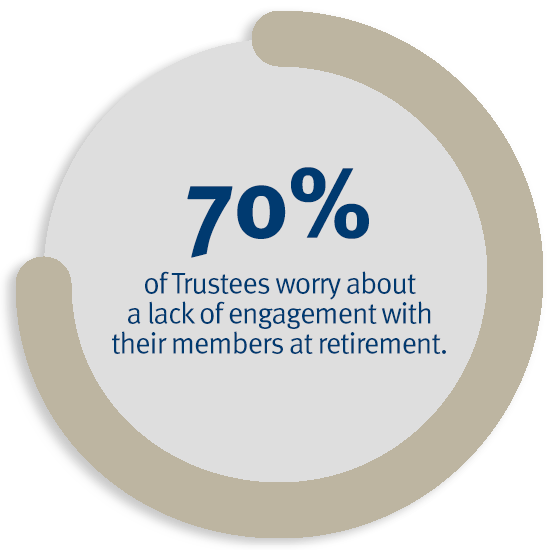

Freedom and Choice in pensions has increased the risks and complexity that employees and pension scheme members face in the lead up to and at-retirement including; falling for a scam, buying inappropriate retirement products, paying more tax than necessary, running out of money, or not understanding the risks around defined benefit pension transfers. This has created a growing need to provide support for employees and members at this stage.

Our research found:

Our retirement income options service is available to pension schemes, trustees and employers and consists of:

Our comprehensive financial education programmes can help your employees and members understand the key considerations faced in the lead up to and at-retirement.

Examples of retirement specific financial education include:

Pre-retirement

Aimed at those who are still a number of years away from retirement to check they are on track. Covers areas such as tax efficiency, planning for retirement and understanding retirement income options.

Support at-retirement

Aimed at those who are looking to retire within the next year or two and need help understanding their options and how to implement their plan; including retirement goals and considerations, accessing retirement savings, understand the risks, tax planning and how to seek further financial guidance and investment advice.

Executive service

For senior employees with more complex benefits and who may be facing Lifetime Allowance or Annual Allowance issues.

Bespoke modules

Typically for ad hoc events or significant pension scheme changes such as defined benefit scheme closures, glide path and investment fund choices for defined contribution schemes, pension increase exchange and pension transfer options.

We offer financial guidance services for employees and pension scheme members who need one-to-one support including;

Financial guidance clinics – bespoke clinics for employees and pension scheme members on a project basis either face-to-face, by video call or over the telephone (via a helpdesk).

Financial guidance at-retirement – available for employees and pension scheme members who are deciding how to best access their workplace pensions and retirement savings.

Support with the implementation of retirement income options

We can help employees and pension scheme members implement their chosen retirement income option(s) – whether that is an annuity, income drawdown, cash withdrawal or a combination of options. As requirements and circumstances will often change, we also provide ongoing support throughout retirement.

We offer support with the following:

Cash withdrawal – Our Cash Drawdown Service offers employees and members the flexibility to access their pension savings as cash, either on a regular monthly basis or as a lump sum whenever they need it.

Purchasing an annuity – This is a guaranteed income payable for the rest of an individual’s life. We access annuities from the whole of the market taking into account medical and lifestyle factors.

Selecting income drawdown – This is a popular alternative to buying an annuity since the pension freedoms. Our service allows employees and members to draw an income from their pension fund, while the rest of the fund remains invested in a discretionary managed portfolio.

Taking a combination of options – Employees and members don’t have to choose just one option when deciding how to access their pension. They can access a combination of the options above, taking cash and income at different times to suit their needs.