It’s not uncommon for individuals to face financial worries at various stages of their life – whether that is dealing with debt, concerns over retirement savings or making the monthly budget work.

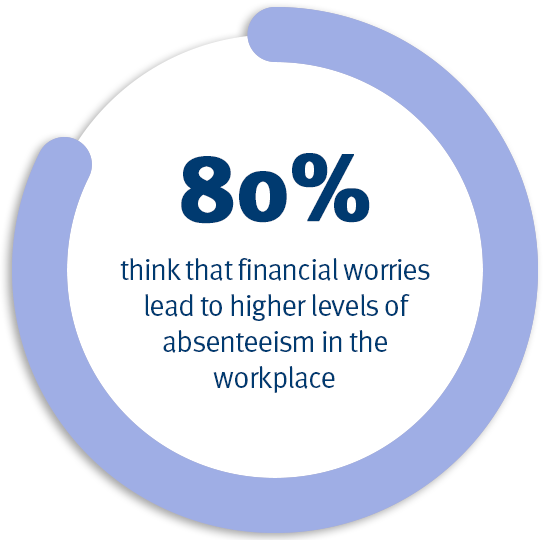

The link between financial worries and stress, lower productivity and absenteeism are becoming increasingly recognised by employers.