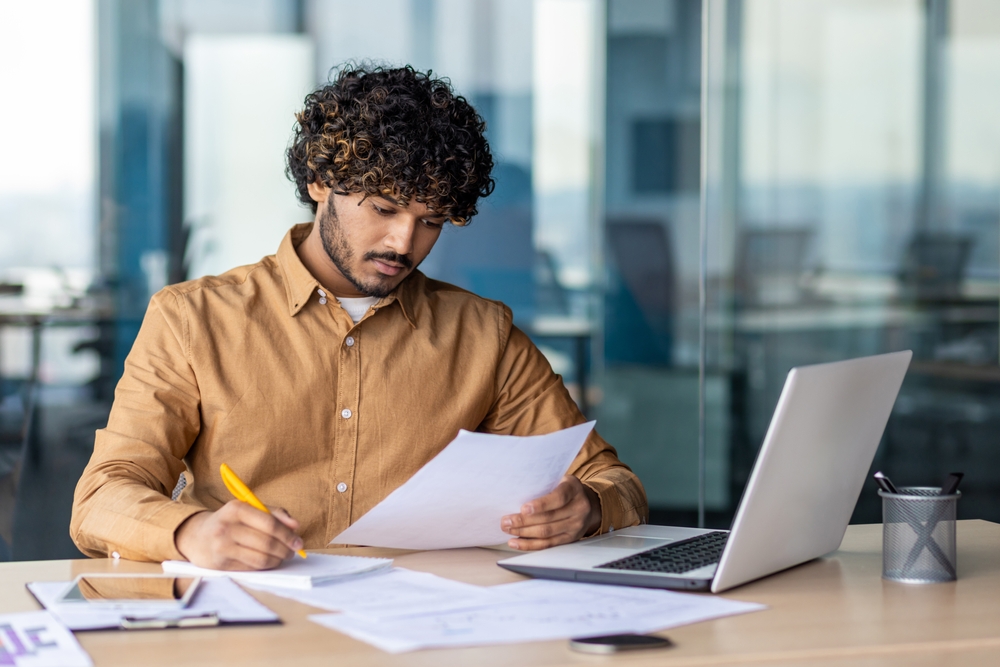

my wealth provides investment advice to employees of many of the UK’s leading companies and pension scheme members to help them understand their personal financial situation, whether they’re saving for their future, or looking how best to make the most of their income at the point of retirement.

In particular, our investment advice service helps those approaching retirement by creating tailored investment strategies to meet an individual’s personal objectives, which are flexible enough to adapt to changing needs.

This is achieved by creating portfolios of investments, with the underlying assets being selected from the whole-of-the-market. The portfolios are then actively managed on a discretionary basis to take account of changing market conditions.

When providing advice on retail investment products i.e. pensions and annuities, this is done on an independent basis.