The Chancellor of the Exchequer Kwasi Kwarteng, has today delivered the mini-budget report. Please see our summary below:

Income tax and National Insurance

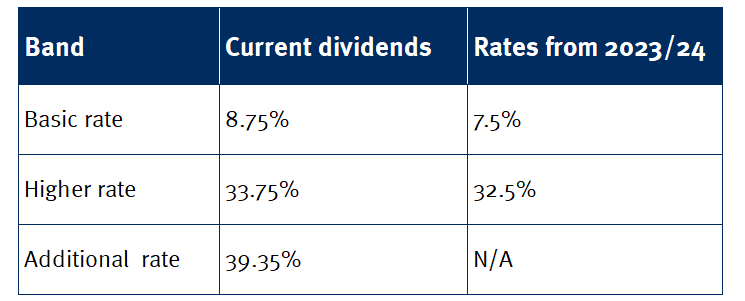

As heavily rumoured, the planned cut in the basic rate of income tax from 20% to 19% has been brought forward to next tax year (April 2023) from April 2024. And in a surprise announcement, the Chancellor is also abolishing the top ‘additional rate’ of income tax which is currently 45% and paid by those earning over £150,000 for taxpayers in England, Wales and Northern Ireland.

As the additional rate of income tax will be removed current additional rate taxpayers will also benefit from the Personal Savings Allowance of £500 for higher rate taxpayers.

The Chancellor reiterated that a recent rise in National Insurance will be reversed from 6 November. This will benefit all employees earning more than the annual equivalent of £12,570 in 2022-23. The average saving is around £330 next year and an additional saving of £135 this year. Additionally, 920,000 businesses will see an average tax cut of £9,600 in 2023-24.

Company Share Option Plan (CSOP)

From April 2023, qualifying companies will be able to issue up to £60,000 of CSOP options to employees, double the current £30,000 limit.