Many employees struggle to understand basic financial and investment issues and often fail to realise the various benefits on offer in the workplace. Our comprehensive financial education programmes can aid understanding around this and can help your employees make well-informed decisions throughout their career and lead to improvements in their financial wellbeing. This is especially important at-retirement when facing life changing decisions about how to maximise retirement income.

Following financial education, employees and pension scheme members have access to a telephone helpline for those who would like to speak to someone to clarify any general financial queries they may have.

Financial education topics

We can tailor financial education topics to the needs of your company – whether it is a programme to encourage increased take-up of benefits, a series of share scheme seminars to highlight key benefits and risks, or providing support on how best to take income at-retirement.

Life stage financial education

Early

Designed to support employees beginning their careers to understand how their company benefits could be used to help improve their financial wellbeing and to create good money management skills and savings habits. Topics can range from general money management, managing debt and improving credit scores, through to saving for the short, medium and long-term.

Later (pre-retirement)

Aimed at those who are still a number of years away from retirement to check they are on track. Covers areas such as tax efficiency, planning for retirement and understanding retirement income options, clearing debt and maximising pension benefits and other savings.

Mid

To help employees make the most of their employee benefits and ensure they are on track with their saving and investment goals. Topics can include reviewing financial goals, developing an investment strategy, maximising tax efficiencies and how to plan for retirement.

Support at-retirement

Aimed at those who are looking to retire within the next year or two and who need help understanding their options and how to implement their plan; including retirement goals and considerations, accessing retirement savings, understanding the risks, tax planning and how to seek further guidance and investment advice.

Event driven financial education

Share schemes

Understanding the benefits of different share schemes, maximising tax efficiency to provide a boost to savings and managing the risk of holding shares.

Annual ‘flex’ windows

Helping employees understand the benefits available to them and the tax and savings advantages of these.

Executive service

For senior employees with more complex benefits and who may be facing Lifetime Allowance or Annual Allowance issues.

Bespoke modules

Includes TUPE transfers, pension scheme changes, redundancy and money management.

Defined benefit closures

To support employees through the process and aid understanding around what’s changing and future options.

Redundancy programmes

To help employees take control of their finances and help them make the most of their redundancy pay.

Methods of financial education

We deliver financial education in a number of different ways. Although face-to-face seminars have been our most popular and effective communication method, this may not always be possible. We can utilise online education formats including online seminars which can recreate the classroom experience digitally and also webinars. We can also create interactive games, webcasts, animation and tailored microsites which are also useful methods of communication.

Ensuring employee engagement

We deliver interactive and meaningful communications to encourage employee engagement and maximise take-up.

This includes…

- Delivering awareness campaigns before the introduction of a programme.

- Utilising digital nudge technology through email invitations and reminders and SMS text messages to encourage participation.

- Delivering websites and tools to provide supporting knowledge.

The impact of financial education

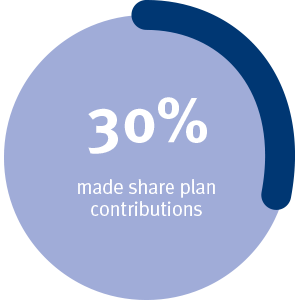

Over 61% of employees who had attended retirement planning seminars said they had taken specific financial actions as a result of attending the seminars. Of these;

Figures provided in 2018 by FTSE 100 client

What our clients say…

Ian Hodson, Head of Reward, University of Lincoln

“Our financial education programme is all based around disseminating information and we very much strive for a layered learning …”

Read More

Sarah Ruggles, Head of Pensions and Benefits, JLL

“We researched a number of providers to deliver financial education and chose to appoint WEALTH at work to help us…”

To see what our seminar attendees had to say about our financial education seminars, please click here.