Tax efficiency and income planning

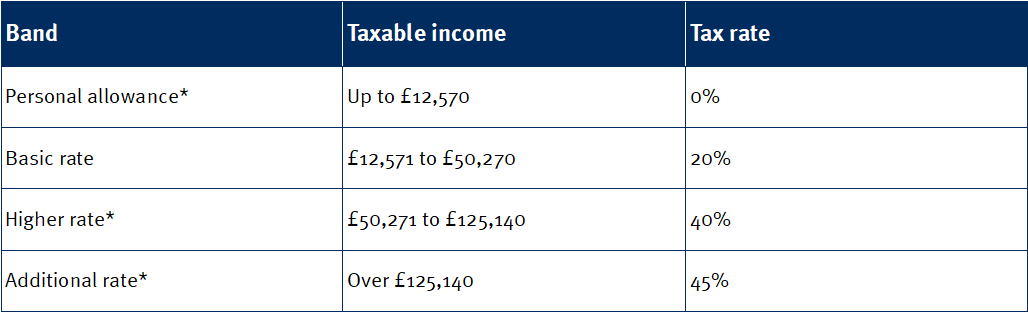

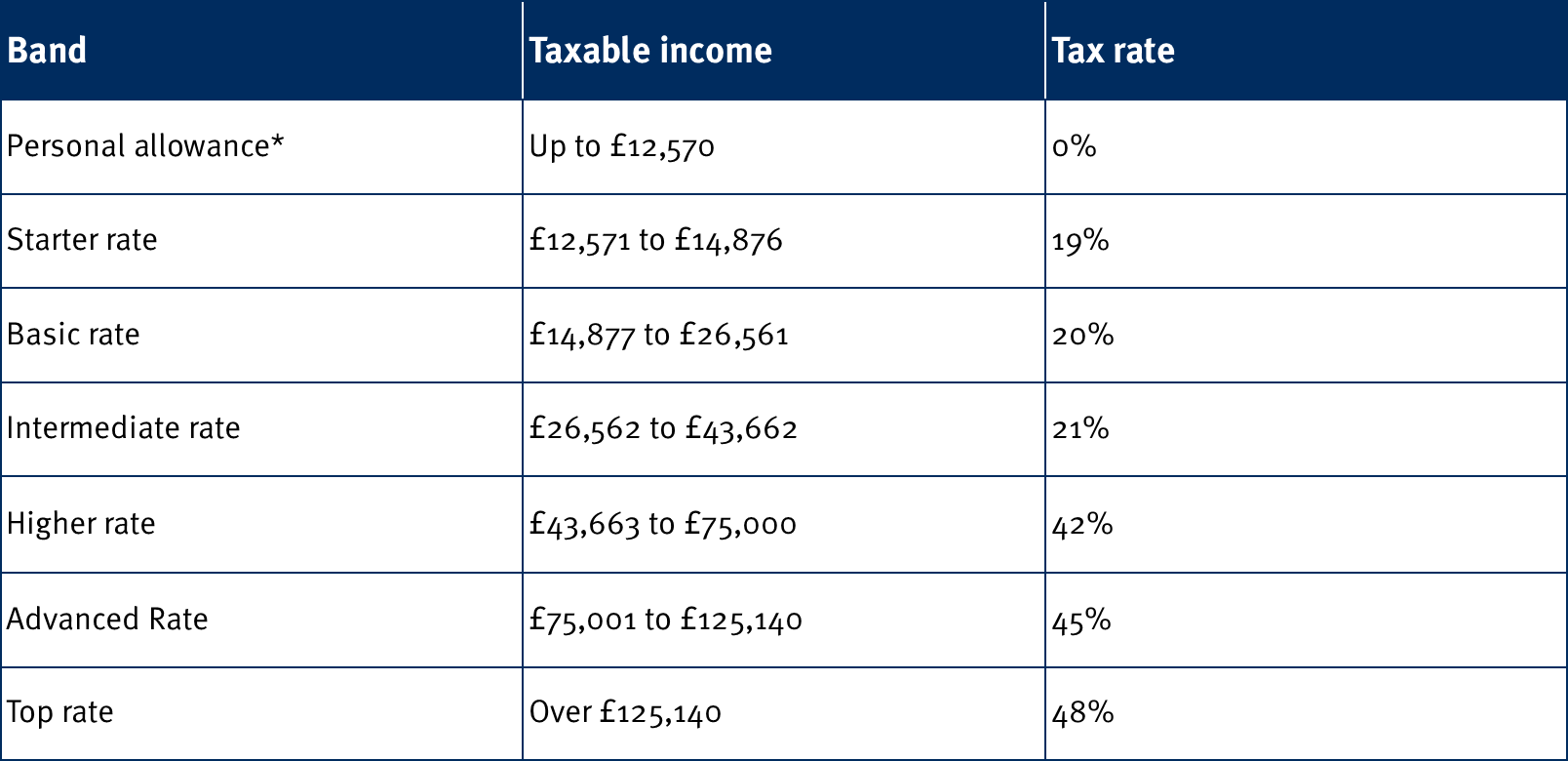

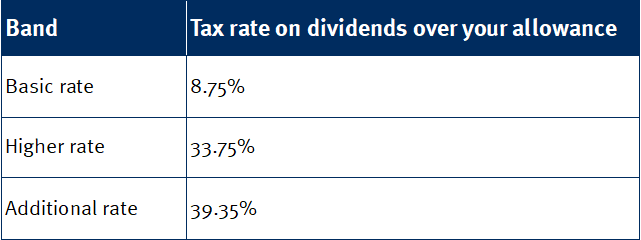

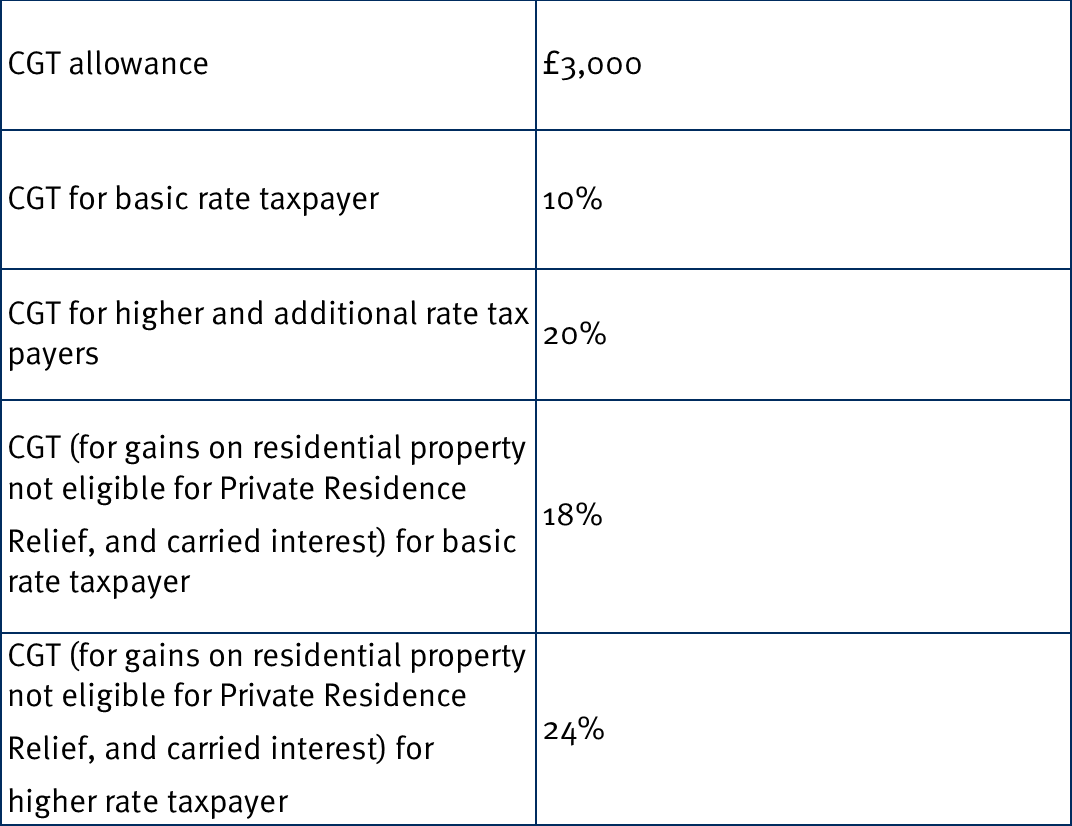

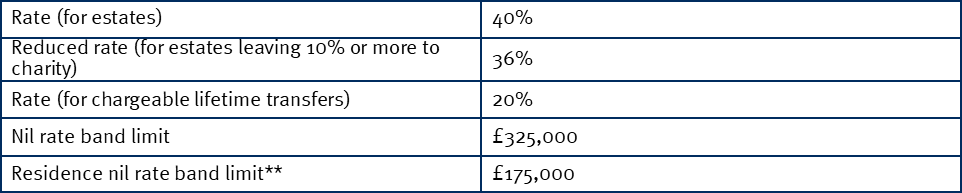

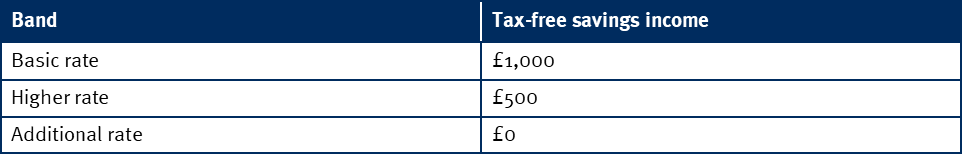

Generating your retirement income in a tax efficient manner can help increase your returns and extend how long your funds will last. It is important to not only consider your income tax position but also other taxes to which you may be subject; such as capital gains tax and inheritance tax.

Pension funds are now far more accessible and you should consider how your capital is invested and how your retirement income needs are addressed. Retaining as much money as possible in the tax efficient wrappers of a pension and ISA will make the most of your returns. Available tax allowances and reliefs should also be utilised where possible and all sources of income should be considered for efficient tax planning.

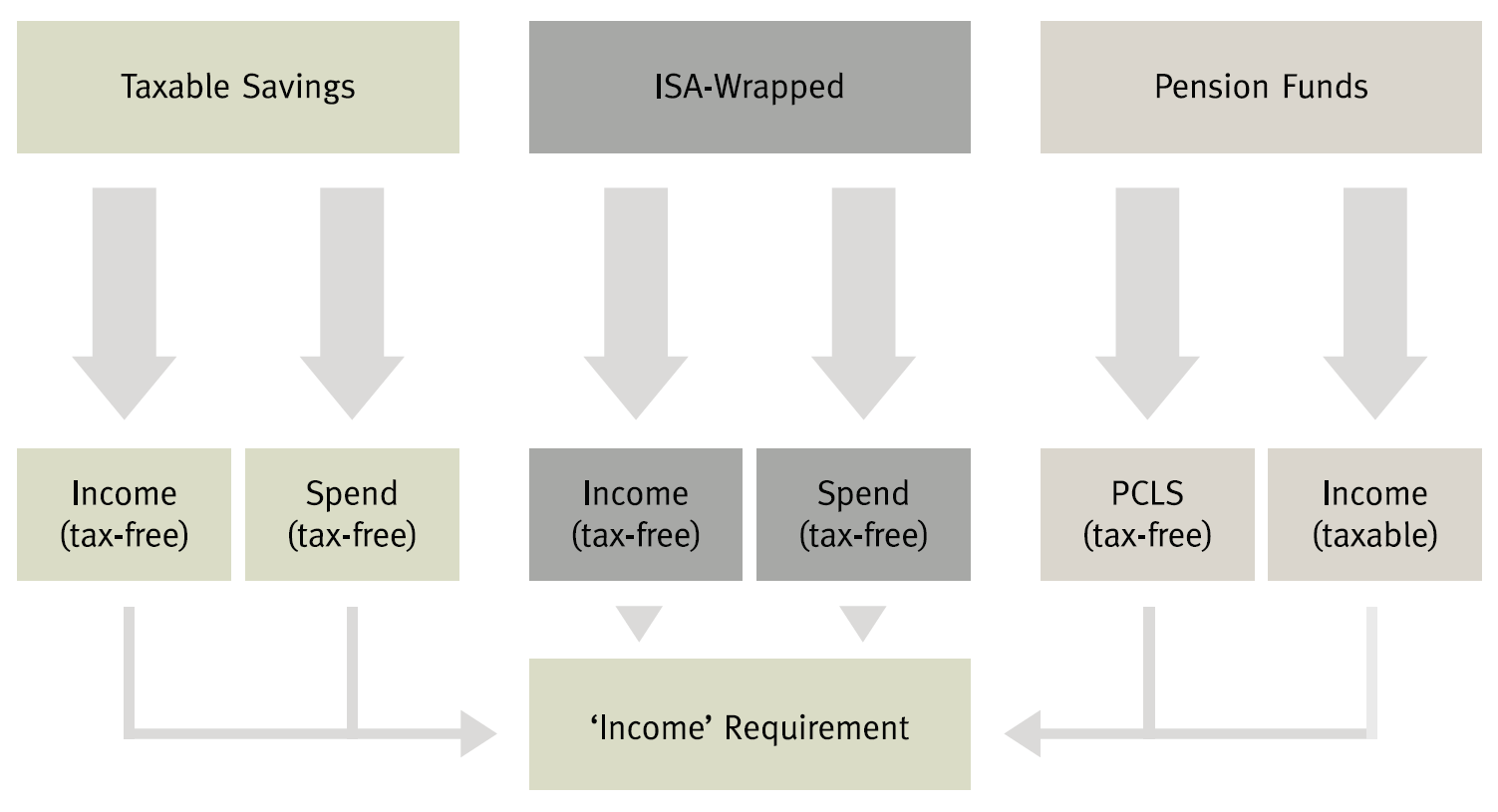

The diagram below shows the tax effect of drawing money from regular savings accounts, ISAs and pension funds: