Creating an investment strategy to fit around your ever-changing needs may seem like a tall order. But by following a few simple rules, it is possible to build a flexible investment strategy that can work for you throughout your life.

Your investment choices

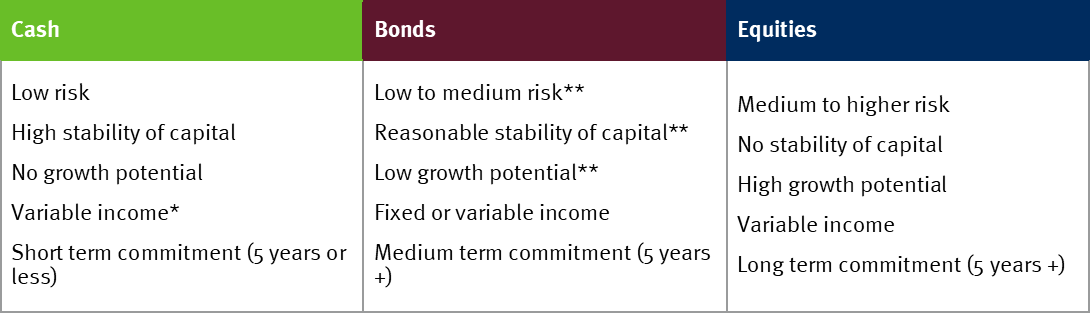

The range of investment products on offer in general can seem incredibly confusing. So it can be surprising to learn that most of these products usually boil down to just three key ingredients; cash, bonds and equities (i.e. shares).

These are known as the three key financial asset classes and are the building blocks of our investment strategy.

Cash, bonds and equities have different characteristics, which mean that – when put together in the right combination – they can create an investment strategy that precisely matches your risk profile, your time horizon and your need for income and/or growth.

The table below summarises the different characteristics of each: