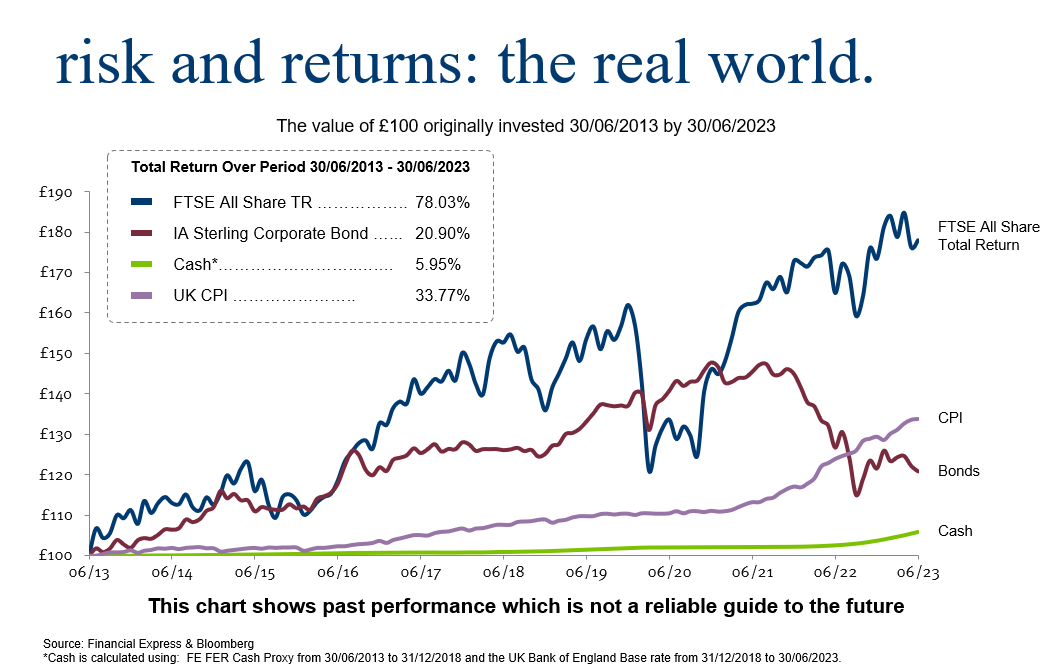

Money held in cash is ideal for meeting short term needs and bonds for providing medium term income requirements. However, over the longer term, equities (share-based investments) have traditionally achieved much higher returns than those offered by traditional savings accounts and bonds and are essential to provide a portfolio with the best opportunity of keeping pace with inflation.

Growth Element

The growth element should not be considered as capital to meet short-term requirements, but as a long-term investment, which in the future can be used to top up the cash and income elements.

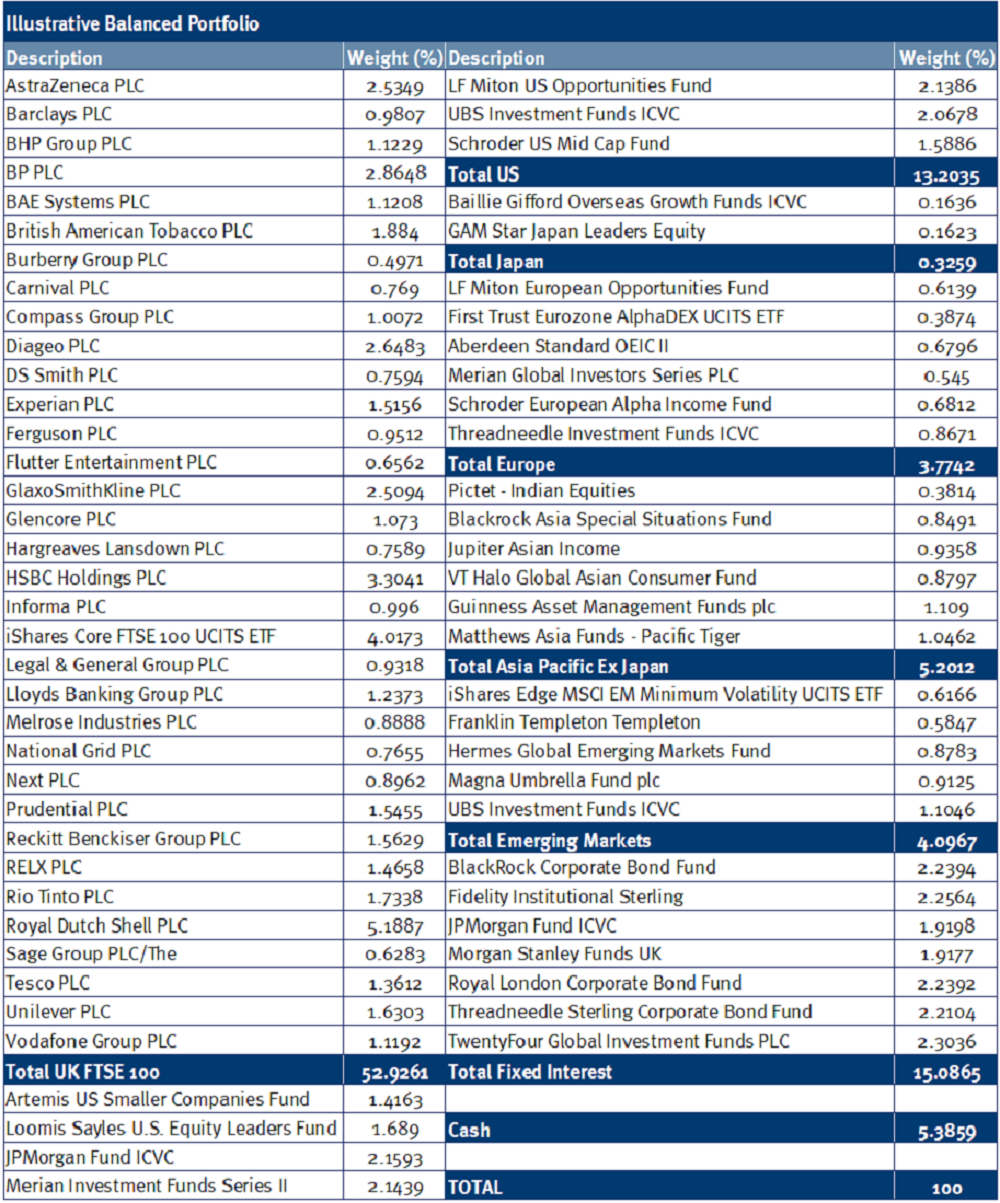

my wealth applies an institutional investment approach which will give you a wide spread of investments within your portfolio (typically around 50 individual holdings). Spreading your investments is especially important with equities; as the main risk in equity investments is that of being too heavily invested in one company, one sector or one market. Diversification reduces your exposure to the risk of any single investment, sector or market failing to perform.

A typical portfolio will contain a diversified spread of assets, with approximately 30 UK holdings and around 20 holdings providing exposure to the bond market and overseas markets, including Europe, US, Japan and Emerging Markets.

As with all investments, we believe the longer term growth element of a portfolio should be professionally selected and actively managed on your behalf.

For illustrative purposes, please see an example of how a balanced portfolio may be set up: