The income element is designed to generate a regular and reliable income, while controlling the amount of risk taken with your capital. Bonds are useful for this purpose because they are designed to offer a degree of certainty:

- The bonds we use pay a fixed income (the ‘coupon’) each year

- They generally run for a fixed term with a pre-set maturity date

- On maturity, the face value (‘the nominal’) of the bond is returned

Three types of bonds are used in our client’s portfolios:

- Corporate bonds issued by companies

- Supranationals e.g. World Bank, are typically founded and funded by several nations and for prestige alone are not normally allowed to collapse and therefore, have a very high credit rating

- British Government Stocks. They are often referred to as gilt-edged securities, or gilts, and because they are issued by the British government, are considered to be one of the most secure investments available

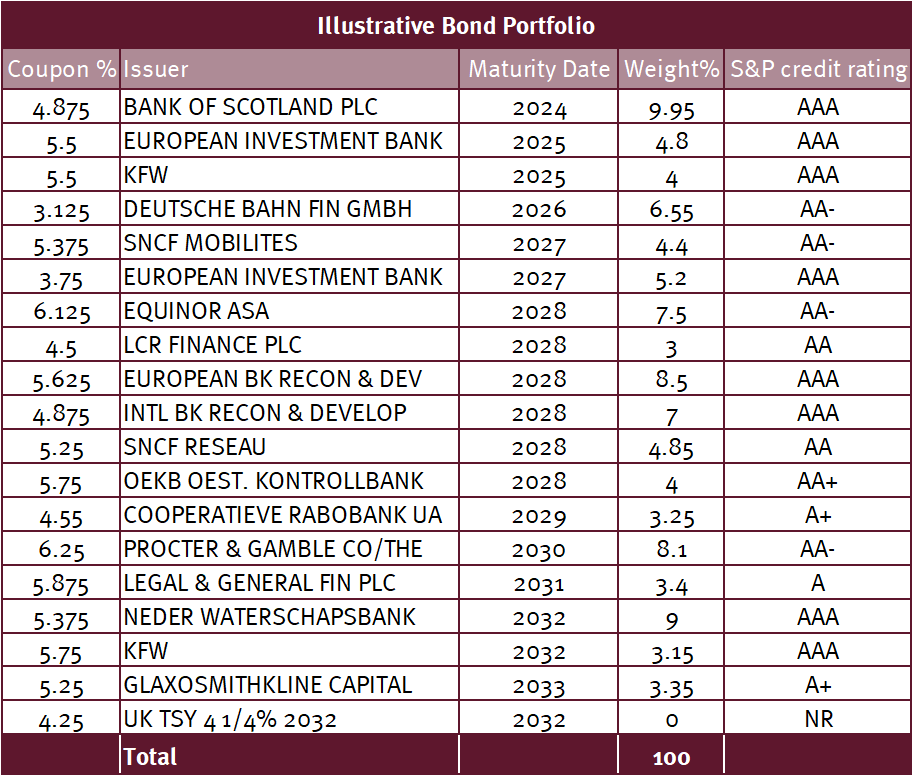

When selecting bonds, our Investment Management team will carefully monitor every bond and use analysis from leading credit rating agencies to assess each issuer’s ‘creditworthiness’. By only selecting high quality, investment-grade bonds i.e. those issued by strong companies with a high credit rating and by spreading your investment across a diverse portfolio of different bonds, the risks can be effectively managed.

Both gilts and corporate bonds can be traded on the stock market. However, our Investment Management Team will generally aim to hold bonds from purchase until maturity to minimise the risk taken with your capital. That said, they will have discretion to sell bonds at any time if they feel it is in your best interest.

We have two bond portfolios available; one investing primarily in AAA/AA credit rated bonds (extremely strong/very strong capacity to meet its financial commitments) and the other investing primarily in A/BBB rated bonds (strong/adequate capacity to meet its financial commitments). In order to determine which portfolio is suitable for you, we will assess your attitude to the risks associated with bonds.