The new pension changes may allow you complete access to your pension pot once you have reached 55 years of age. In such circumstances if you take your savings and spend them, then that is your choice and the new pension changes will allow you the freedom and flexibility to do so.

However, if you are planning to use them to provide an income in retirement; then you need to be aware of a number of factors that will affect the value of your pension savings and how you might use them.

The following information details risks to consider when planning for your retirement.

Longevity risk is where you live for a long time but run out of money to support yourself in retirement.

Did you know that a male retiring now at age 65 can expect to live on average to age 83 and a female to age 85? That means their money has to provide them with an income for about 20 years!

However, these figures are average life expectancies and some individuals will live longer which means their money has to last longer too.

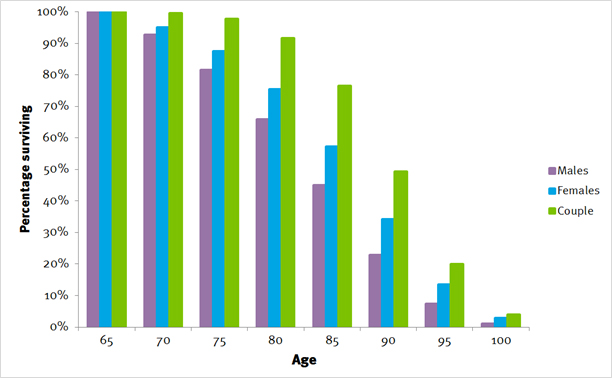

The table below shows the likelihood of someone aged 65, or at least one member of a couple both aged 65, surviving to a particular age in the UK.

Source: ONS – UK National Life Tables 2011 – 13.

So if you are male aged 65 you have about a 1 in 4 chance of surviving to age 90, if you are female you have about a 1 in 3 chance. For a couple both aged 65 there is a 50:50 chance that one of you will live to that age.

Remember when you are planning your retirement income, the trend in people living longer has been historical fact for over a century and is expected to continue into the future.

To book an appointment, please contact us or ask for more details.

Mortality risk is the risk that you will pass away shortly after you retire and won’t enjoy the value from your pension and benefits that you have worked to provide. This risk can also extend to dependents that you have not provided for should you pass away earlier than expected.

For example, if you were to buy an annuity with a £25,000 pension fund based on your life only (not taking into account any spouse’s benefits and depending on your circumstances), you could receive around £1,200 per year. If you were to pass away shortly after your retirement, you would have received just £1,200 in return for you spending £25,000.

To book an appointment, please contact us or ask for more details.

Inflation reduces the buying power of your money but what is the impact over time?

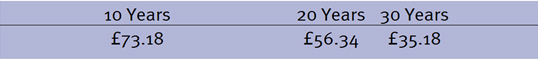

Using 2% and 3% as example inflation rates, the following table details what £100 will be worth in today’s terms after a number of time periods.

The following table shows what £100 would be worth in today’s terms (October 2014), over a number of time periods, using actual historic inflation rates.

For example, if you were to spend £100 on groceries today, then a 3% inflation rate could mean that within 10 years, you would have to spend £134 in order to buy exactly the same items.

It is important that you protect yourself against inflation. With increased life expectancy you might need to support your retirement for longer, and if you don’t protect yourself against inflation then you could have to live your retirement on an income that will buy you less and less over time.

To book an appointment, please contact us or ask for more details.

Your circumstances can change over time and it is unlikely that you are in the same position today that you were in 20 years ago; and it is unlikely that your circumstances in 20 years’ time will be the same as they are when you retire.

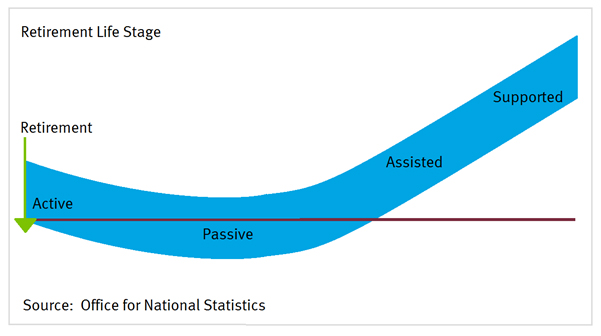

It makes sense to plan your retirement with the same degree of flexibility that you planned your finances during your working life. The chart below shows when people typically need their money in retirement, spending more at the beginning and at the end of their retirement. This is called a ‘U’ shaped income and it is important that your retirement income plan is flexible enough to adapt to changing circumstances throughout your retirement.

- Active stage – typically enjoying more leisure time, spending on the home or even continuing to help children financially

- Passive stage – people may have done many of the things they ‘planned to do’ when they retired and as a result their expenditure reduces

- Assisted and Supported stages – are mainly about failing health and incurring social care and health costs, perhaps in later life moving into residential care.

It is advisable to plan your finances to be able to adapt to changing income needs in retirement, as well as the other risks for example inflation risk.

To book an appointment, please contact us or ask for more details.

Investment risk is where an investments return will be different to what was originally expected; this includes the possibility of losing some or all of the original investment.

It is important to understand that accepting some investment risk may be necessary to offset other types of risk, for example inflation risk, or achieve your investment objectives (which differ for different people) .

Typically you experience increasing levels of investment risk when investing in Cash, Bonds, Property and Equities respectively, but conversely you should expect greater returns over time as well.

In general, the greater level of investment risk you accept, the greater the return you should expect to receive over the longer term. It is important to remember however that investments can fall as well as rise and you might not get back what you originally invested.

All income taken from your pension savings will be taxed according to your particular rate of income tax (marginal rate). For example, if you take enough income from your pension savings to put you into the higher rate tax band, then you only pay 40% tax on the income that is in excess of the basic rate tax band. If you are unsure how this works please contact us.

To book an appointment, please contact us or ask for more details.