Global equity markets are trading slightly firmer this morning after the European Central Bank is showing that it will also do “whatever it takes” to calm markets and help the economy, by announcing a very large €750bn QE programme.

We learnt from the global financial crisis in 2008/9 that the major central banks had to return several times with larger stimulus packages before confidence started to return – and thankfully the European Central Bank has made it clear that it would up the ante again if needed.

However, with the coronavirus outbreak still developing, which is keeping financial markets on edge and making volatility the new ‘normal’, there may also be the need for out-of-the-box measures to be considered as extraordinary times require extraordinary action. For example, while the UK support package surpasses the US package in terms of GDP (the UK package amounts to 15% of GDP, compared to about 6% in the US), the US package includes cash handouts which are immediate and liquid, whereas the UK’s are targeted loan-based schemes, which may be too restrictive and slower to feed through to the economy.

Elsewhere the pound, which was trading at $1.31 against the US dollar just 10 days ago, has fallen to $1.15 – its lowest level since 1985. Although this weakness is partly due to Brexit and coronavirus uncertainty, the US dollar is seen as a safer currency.

While the outlook is currently uncertain, it’s always darkest before the dawn – and we can’t currently see how it can get much darker.

However, with the global equity market volatility we have seen over the month, it isn’t surprising if you, like many of our clients, are worried – and I would like to reassure you that diversification, discipline and risk management form the cornerstone of our investment philosophy.

Our long-term growth portfolios are diversified across a variety of asset classes (equities, fixed interest and cash) and geographies, such as Europe, Asia and the US.

Additionally, risk management is just as important to us as investment performance and returns, and the investment team work within a strict risk controlled and disciplined process.

Although our disciplined process hasn’t stopped your portfolios from falling, it has helped to protect against bigger losses. For example, at last night’s close (Wednesday 18 March 2020), the FTSE-100 is now down 33.35% since the last Portfolio Valuation Statement dated 5 January 2020, while a typical Cautious risked client is down 16.72%; Balanced -23.59%; and Adventurous -24.53% over the same period.

While we remain positive on equities over the long-term, particularly those in Asia and Emerging Markets, we currently have a short-term cautious stance with a slightly higher than normal level of cash.

However, given the market volatility, you may be wondering why we haven’t increased cash holdings further with a view to reinvesting later. We haven’t because my wealth takes a long-term approach to investing, because evidence shows that this leads to better outcomes as time in the market is more important than trying to time the market.

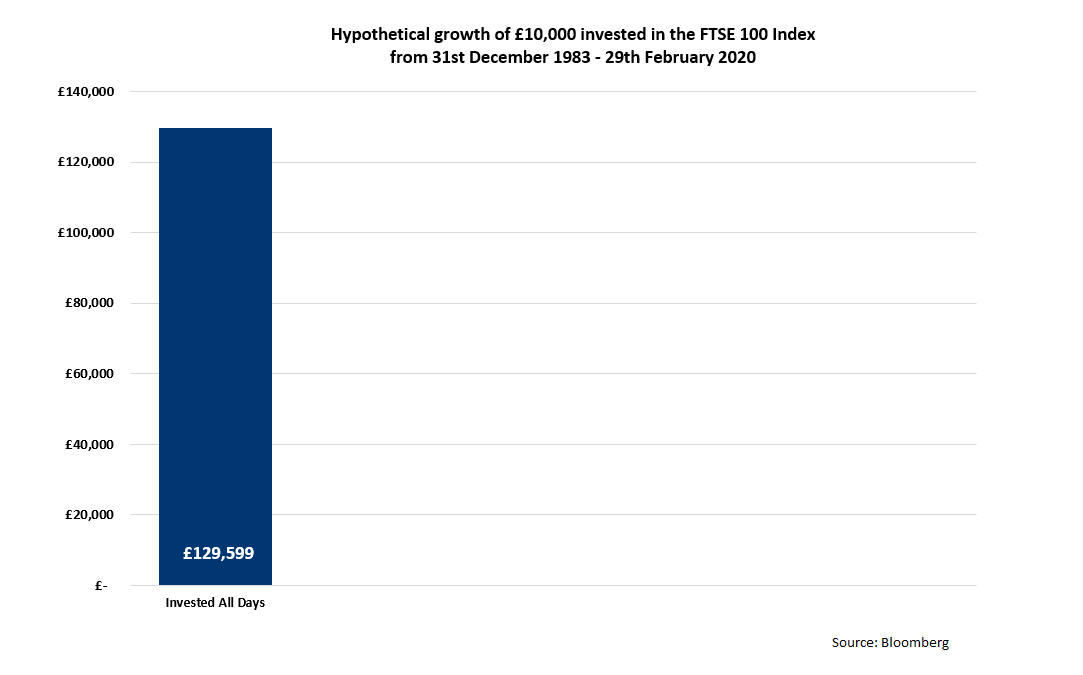

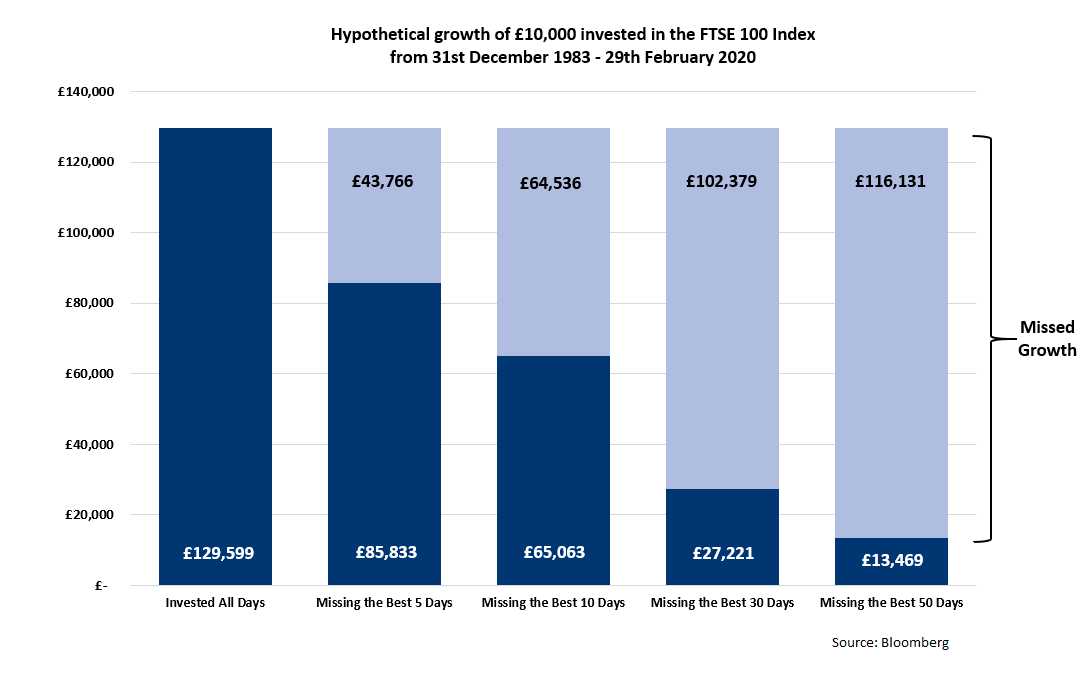

Chart 1 below shows what would happen to a £10,000 investment into the FTSE-100 when the index was first created at the end of 1983. As you can see this £10,000 would, at the end of February 2020, be worth £129,599. However, as you can see from Chart 2, if one tried to time the market and then missed the 5 best days in the index’s history, this £10,000 would only have grown to £85,833 (i.e. simply missing those five days reduce the return by £43,766). Likewise, if one missed the best 10, 30 or 50 days, the missed growth increases dramatically – and as you can see, missing the best 50 days means £10,000 would only have grown to just £13,469.

While the negative impact from coronavirus is clearly an ongoing and developing story, we believe that the negative impact on the global economy (and company profits) is likely to be limited to the first half of 2020 – and as a result, we believe that once demand picks up in during the second half of 2020, global equity markets are likely to recover strongly and obviously a fully invested portfolio will benefit from this recovery.

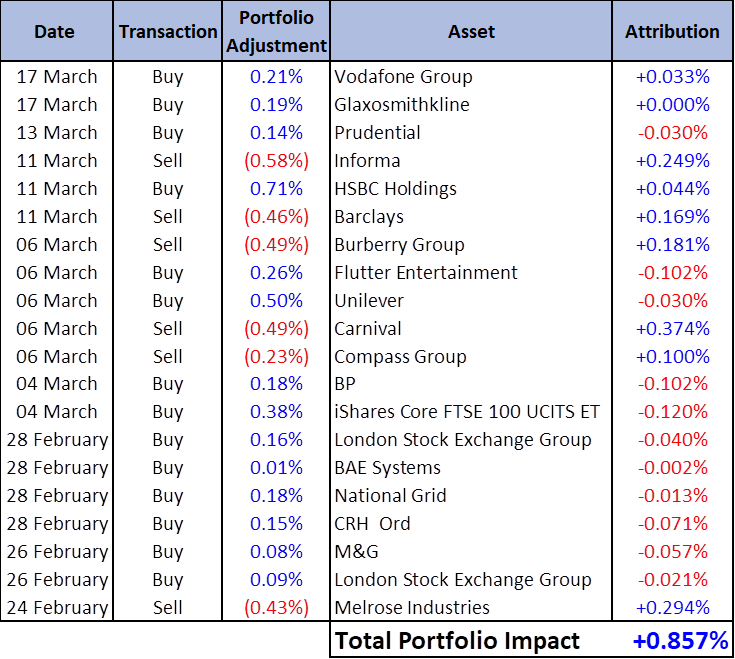

However, that doesn’t mean we have a simple ‘buy and hold’ strategy – as we have been actively managing client portfolios. As you can see from the accompanying table (Table 1) we have made a number of changes to our clients’ discretionary portfolios over the past month which has prevented the portfolios from falling further.

We have reduced or sold holdings in companies where we believe coronavirus risks are pronounced, such as Carnival Cruises, Burberry, Compass, Informa and Melrose Industries. For example, while we still believe in the long-term potential for cruises given the growing middle-class (especially in the Emerging Market countries like China) and an aging global population, we have sold clients’ holding in Carnival Cruises due to the expected financial impact from the coronavirus outbreak and will look to buy back the shares when value re-emerges. While it was painful to sell the shares at £20.24, as they were trading at over £40 this time last year, the shares are currently £6.69! This sale has saved a typical discretionary Balanced portfolio nearly 0.40% in investment performance.

These proceeds have been invested in more defensive companies, such as Unilever, GlaxoSmithKline and Vodafone.

Although some of these changes haven’t contributed to performance, overall these changes have contributed 0.857% to the performance of a typical discretionary Balanced portfolio.

While the path for financial markets is unlikely to be smooth as we fully expect market volatility will remain elevated in the short-term, it is important to resist the urge for any knee-jerk reactions and maintain a long-term perspective, by looking past the negative news headlines and negative economic data releases that we will undoubtedly start to see, as equity markets have weathered and recovered from lots of negative and uncertain events in the past – and this time will not be any different.