On Wednesday, market participants awaited further updates on US-China trade talks following officials’ preliminary deal in London. There was also discussion of a potential agreement on rare earth minerals— a critical area for technology and manufacturing supply chains. Despite the optimism, the absence of formal details kept investor response cautious and subdued.

This week, UK GDP data revealed a 0.3% contraction in April, a sharper decline than expected. While the headline might cause some concern, the drop was mainly due to disruptions from US tariffs introduced earlier this year. Many UK factories accelerated orders to avoid additional costs, creating a temporary pull-forward effect. Although exports may remain somewhat subdued until the new UK-US trade deal is fully implemented, the broader market outlook remains encouraging. The FTSE 100, with its significant international exposure, is less tied to the UK economy and often benefits from a weaker sterling. Moreover, signs of economic softness—such as this week’s weak jobs report—could encourage the Bank of England to cut interest rates.

Geopolitical tensions in the Middle East escalated this week following a series of Israeli airstrikes on Iranian targets. Oil prices surged sharply, with Brent crude rising 7.02% to around $74 per barrel, after earlier spiking more than 13% to an intraday high of $78.50 amid concerns over potential supply disruptions.

Iran, a member of the Organization of the Petroleum Exporting Countries (OPEC), produces about 3.3 million barrels per day and exports over 2 million barrels per day of oil and fuel. OPEC+ is believed to have enough spare capacity to offset potential supply disruptions, roughly matching Iran’s output. However, any threat to supply chains can still trigger price volatility.

Even so, prices remain more than 10% lower than this time last year and well below the highs seen in early 2022, when Russia’s invasion of Ukraine pushed crude above $100 a barrel. Crucially, there has been no major disruption to shipping through the Strait of Hormuz so far—a vital corridor for global oil supply. Historically, geopolitical events can cause short-term price movements but tend not to have a lasting impact on oil markets or broader investment returns. Our diversified portfolios are specifically constructed to withstand market volatility. While we carefully monitor geopolitical developments, we remain focused on long-term strategy rather than reacting to short-term headline-driven fluctuations

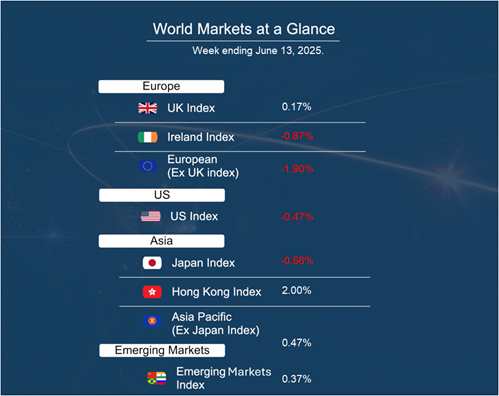

While equity markets in Europe and Asia have come under some pressure, the UK’s FTSE 100, a key allocation within our portfolios, has remained more resilient. Its performance has been supported by gains in the energy sector, reflecting the index’s substantial exposure to oil majors.

Data-wise next week, we will see key releases including Chinese industrial production and unemployment rates, US retail sales and industrial production, UK CPI and inflation figures, as well as Japan’s balance of trade and the Bank of Japan’s interest rate decision. The Federal Reserve and the Bank of England are both expected to announce their interest rate decisions, with policymakers widely anticipated to hold rates steady at 4.5% and 4.25% respectively.

Kate Mimnagh, Portfolio Economist