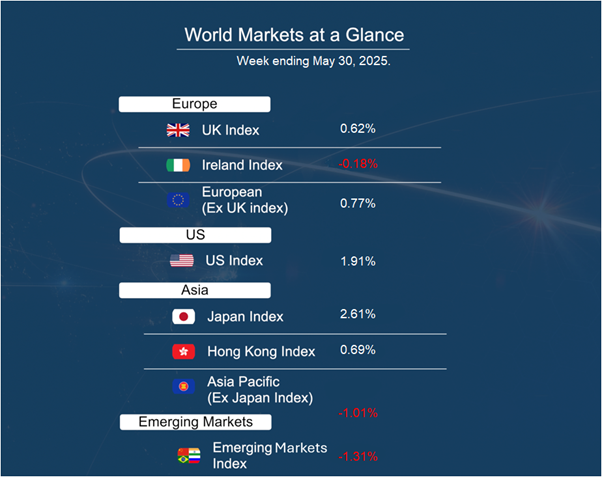

As you can see from the accompanying table global equity closed out May on a broadly positive footing, with strong gains in the U.S. and Asia helping offset softer performances in parts of Europe and emerging markets. Equities were supported by encouraging inflation data and evolving trade policy developments. Despite a shortened trading schedule due to Memorial Day in the U.S. and the Spring Bank Holiday in the U.K., risk appetite remained intact, allowing investors to extend gains from an already strong May.

In the U.S., all major indices advanced over the week, capping a solid month for equities. The S&P 500 delivered a total return of over 5% in GBP terms in May—a marked recovery from April’s softer performance.

Sentiment received an early lift from news that President Trump would delay implementation of a proposed 50% tariff on EU imports until 9 July, providing a window for renewed negotiations. Markets reacted positively again midweek when the U.S. Court of International Trade struck down most of the Trump-era global tariffs. While equities initially rallied, gains were trimmed after an appeals court temporarily paused the ruling, pending further review.