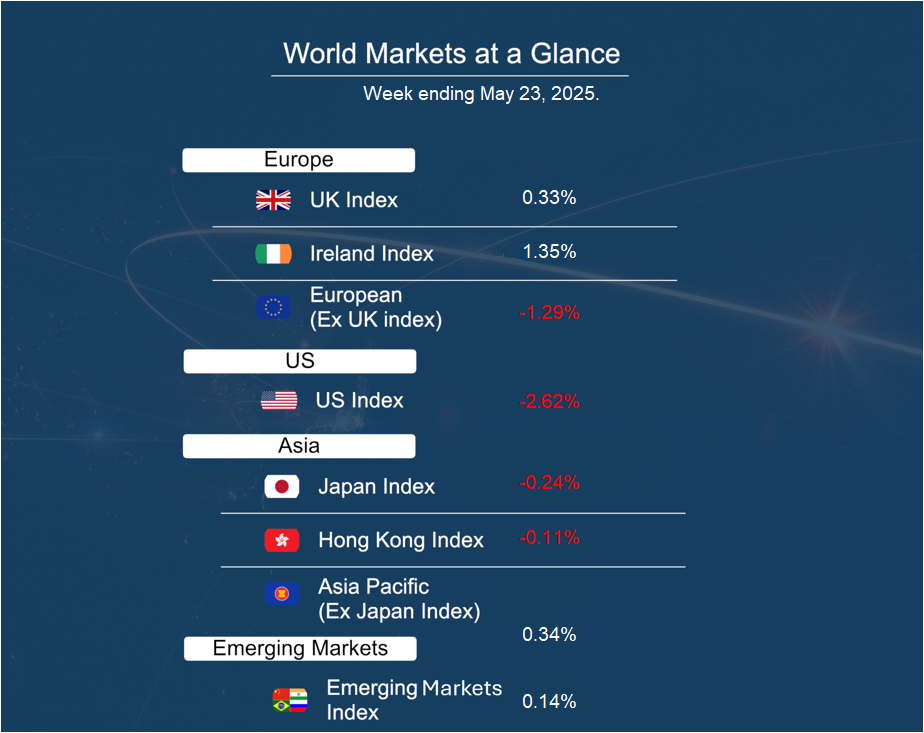

Global equity markets pulled back this week amid a spike in U.S. Treasury yields, renewed trade tensions, and concerns over fiscal policy. The S&P 500 and Dow Jones Industrial Average fell back into negative territory for the year, while the Nasdaq, though more resilient, still declined by 2.5%. In Europe, markets followed suit, though the UK’s FTSE 100 ended modestly higher, up 0.4%.

Adding to market activity, the U.S. House of Representatives passed President Trump’s new tax cut bill, which extends existing cuts and introduces additional measures aimed at supporting economic growth. The bill now moves to the Senate for further discussion and potential amendments. While some concerns were raised about the bill’s long-term fiscal impact—particularly its effect on the U.S. deficit—longer-dated Treasury yields edged higher, a move that also followed a recent Moody’s downgrade. Although the downgrade drew attention earlier in the week, it does not signal an immediate risk to U.S. creditworthiness or alter the key fundamentals underpinning the economy and markets. Treasuries remain a core global safe haven, and yields eased back later in the week.