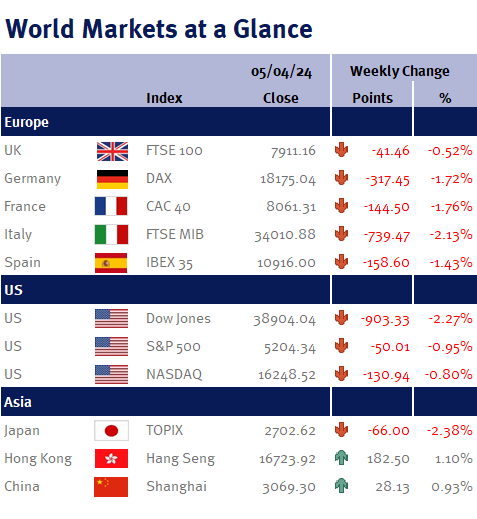

As you can see from the accompanying table markets moved lower in a lackluster trading week shortened by market closures in observance of national holidays.

With the Federal Reserve maintaining a data dependent stance, all eyes were on US non-farm payrolls data on Friday. Given the strength of other key economic indicators in recent weeks, investors grew wary on Thursday, mindful that any unexpected data readings could potentially delay anticipated rate cuts which many had pinned their hopes on for June.

Data revealed the unemployment rate dipped to 3.8% in March 2024, a slight improvement from the previous month’s two-year high of 3.9%. Markets were reassured by moderating wage growth and average hourly wages rose by 0.3% in March in line with forecasts. However, more significantly, the US economy added a robust 303,000 jobs in March, well above expectations of 200,000, marking the highest monthly gain in ten months. Following the release of the jobs report, Treasury yields climbed, and investors pared bets on rate cuts later this year. However, the stock market appeared to view the robust jobs report positively closing the day higher, with investor focus remaining on the health of the economy, consumer spending and corporate profits.