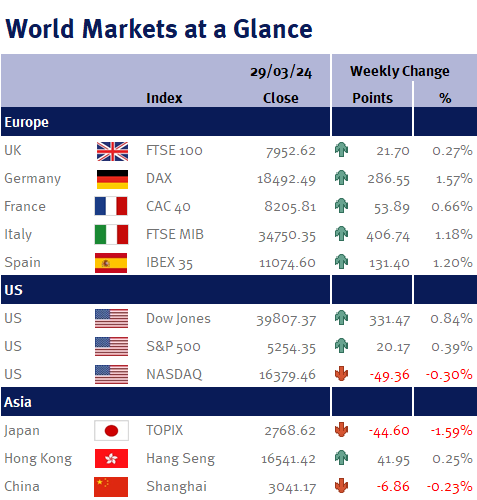

Markets mostly concluded the week on a positive note, with major indexes posting gains despite the shortened trading week due to Good Friday closures.

Despite the confirmation of a mild recession in Q4 of 2023, marked by a 0.3% contraction in GDP, the FTSE 100 concluded March and the quarter on a positive note. Closing the quarter up near 3% with a total return of 4.14%, the FTSE 100 benefited from improving earnings and less hawkish monetary policy positions the index favourably for the remainder of the year.

In the US, reports confirmed a 3.4% year-over-year increase in real GDP for the fourth quarter of 2023, surpassing earlier estimates of 3.2%. This unexpected uptick provided additional confidence to investors.

On Friday, data revealed the Federal Reserve’s preferred measure of inflation, the Core PCE index, which excludes food and energy, increased by 2.8% year-over-year in February and by 0.3% from the previous month. While these results met expectations, with markets closed we will have to wait until next week to observe investors’ reaction.