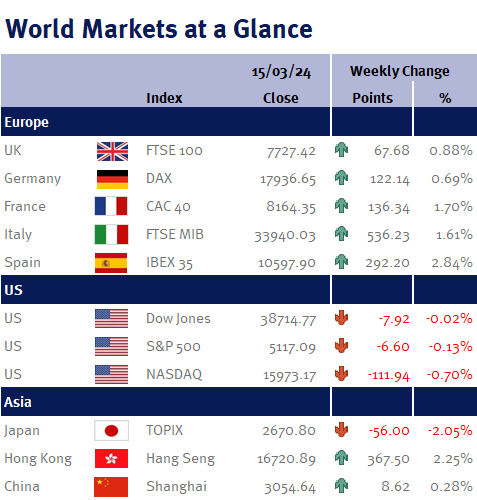

As you can see from the accompanying table, it was a mixed week for markets as investors digested upside to inflation and signs of weakening consumer spending.

Investors shrugged off the hotter than expected US CPI report earlier in the week. However, the subsequent unexpected rise in Producer Price Index seemed to evoke greater concerns about when the Federal Reserve will look to cut interest rates this year. Producer prices rose by 0.6% on month in February greater than 0.3% estimated marking the largest increase since August last year.

The data supports the Fed’s stance of maintaining rates within the 5.25-5.5% range, however February’s retail sales indicate fading spending momentum, particularly in the services sector. Retail sales rose by 0.6% month-over-month in February 2024, following a revised 1.1% drop in January and below market forecasts of a 0.8%. This aligns with the expectation of slower consumption growth ahead despite narratives of economic reacceleration fuelled by recent inflation and jobs data. With a focus on price stability and maximum employment, the Fed is expected to keep rates unchanged at the upcoming meeting. The focus for markets will be on the central bank’s new dot plot which displays the interest rate projections of individual Federal Open Market Committee members, giving valuable insight into the direction of monetary policy.