In what is likely to be the last fiscal event before the next general election, the Chancellor Jeremy Hunt has today delivered his Spring Budget.

As such, it was the final opportunity for the Chancellor to set tax policies that will steer the Conservatives towards the general election. With the Conservatives trailing Labour by around 20 percentage points, the Chancellor was under pressure to announce voter-pleasing tax cuts but as the phrase goes, ‘what the right hand giveth, the left hand taketh away’.

The right hand giveth…

As has been the pattern for many years, most announcements had already been leaked or rumoured in the days and weeks preceding the Budget. It was therefore no surprise when it was announced that National Insurance will be cut by a further 2%, down from 10% to 8%. This cut will mean someone on the average salary of £35,000 p/a will save up to £450 a year, adding up to £900 when combined with last year’s reduction.

This cut reduces the personal tax burden for employees, but this positive impact doesn’t extend to pensioners who don’t pay National Insurance.

The left hand taketh away…

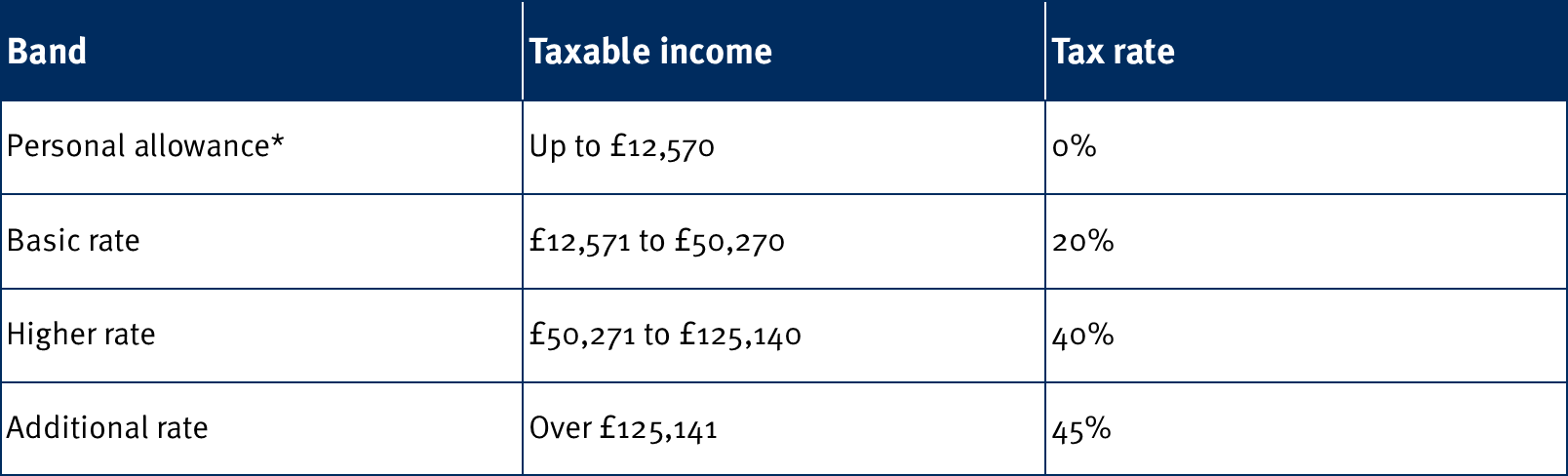

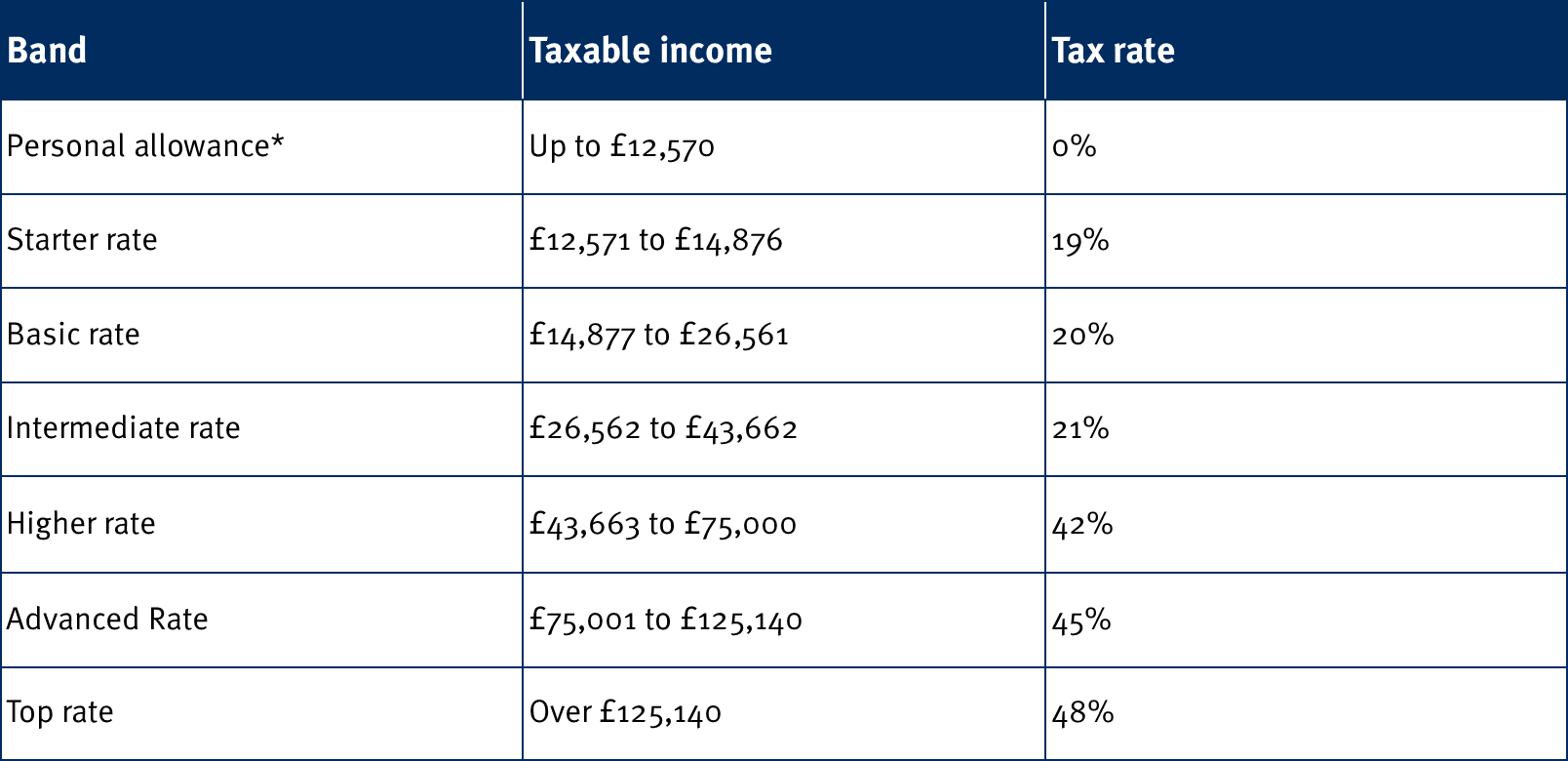

Personal Tax Allowances and thresholds will continue to be frozen at 2021/22 levels until April 2028. One benefit of increasing the Personal Allowance would be that it could remove many pensioners from having to pay tax on their State Pension income.

However, continuing to freeze allowances and thresholds rather than raising them in line with inflation increases tax receipts, as rising wages and pensions tip ever greater numbers into the tax system or into higher rates -a ‘stealth tax’ through what is known as ‘fiscal drag’.

ISAs

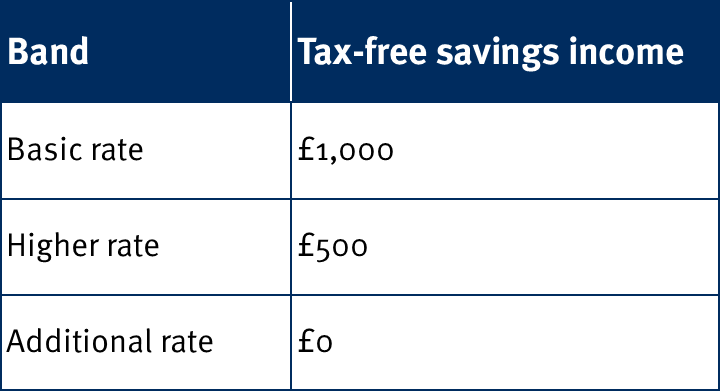

In the Autumn statement, the government confirmed the freezing of the tax-free allowances for 2024/25 for the following:

- Individual Savings Account (ISAs) – £20,000

- Junior ISA – £9,000

- Lifetime ISA – £4,000 (excluding government bonus)

- Child Trust Fund – £9,000.

Jeremy Hunt has introduced the concept of a new ‘UK ISA’, which will allow an additional £5,000 ISA allowance for investment in ‘promising UK businesses’.

The new UK ISA allowance will sit alongside the £20,000 that can be invested across other ISA wrappers currently available, but it is unclear yet whether the extra £5,000 will be limited to small and mid-cap companies or all UK companies. A consultation will be published alongside the Budget later today and no doubt we’ll get further clarity in due course.