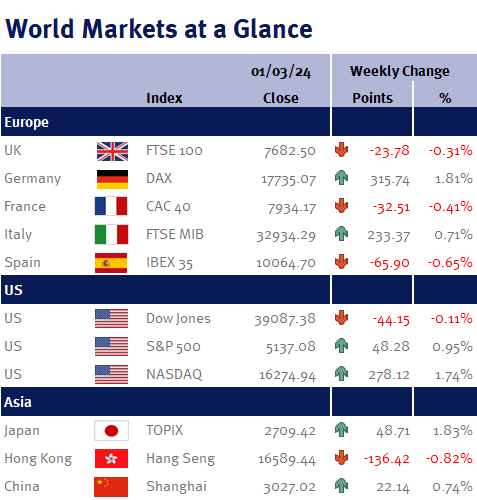

As you can see from the accompanying table it was a mixed week for markets.

The heavily anticipated US PCE on Thursday matched expectations. Markets reacted positively as the core PCE rate which is the Federal Reserve’s preferred inflation gauge cooled to 2.8% on year in January down from 2.9% December 2023. On month prices increased by 0.4% in January, keeping mid-year interest rate cuts on the table. The data provided a reassuring contrast to the Labour Department’s earlier consumer price index report. The latter had shown core prices exceeding predictions at 3.9%, sparking concerns.

The path towards the 2% target is turning out to be a bumpy ride after markets were initially over optimistic pricing in aggressive rate cuts. We have always highlighted that policymakers remain data dependent; their primary goal is to achieve price stability. Disinflation momentum has slowed in recent months highlighting the Fed’s apprehension to cut rates until they are confident that inflation is moving towards the 2% target. Data this week also revealed the latest estimate of Q4 GDP was revised down slightly to 3.2% from 3.3%. Policymakers will continue to hold restrictive rates as they await further evidence that the labour market and wages are moderating.