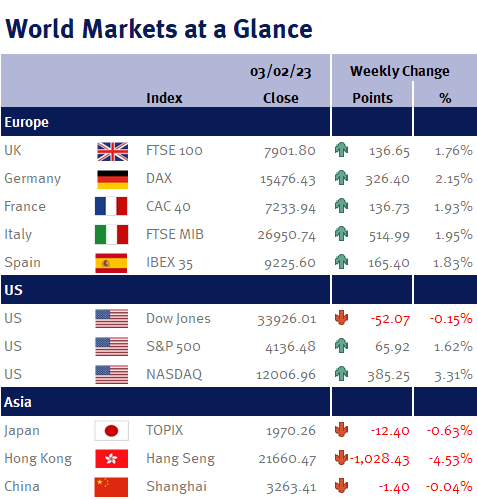

It has been a busy week as the Fed, BoE and ECB all had monetary policy meetings – and as you can see from the accompanying table, global equity markets liked what they heard.

On Wednesday (1 February 2023), the Fed significantly slowed its aggressive tightening with an interest rate increase of just 0.25% as the Fed Chair, Jay Powell, noted that US inflation was clearly on a downward path.

Although Jay Powel refused to rule out further interest rate increases (which is sensible as the Fed won’t be updating December’s economic projections or dot plot until its next meeting on 22 March 2023), the end of the Fed’s current tightening is clearly in view.

In fact, we wouldn’t be surprised if the Fed only does one or two more small increases, given today’s (Friday 3 February 2023) US employment data: while payrolls increased by 517,000 (far higher than consensus estimates of 188,000), pushing the unemployment rate down to 3.4%, year-on-year average hourly earnings growth slowed from 4.8% to 4.4%, thanks to an increase in the participation rate. Additionally, the US ISM Services reading came in at 55.2, up from 49.2 in December – and as 50 is the line separating expansion and contraction, today’s reading is positive as it suggests that a soft economic landing is still a possibility.