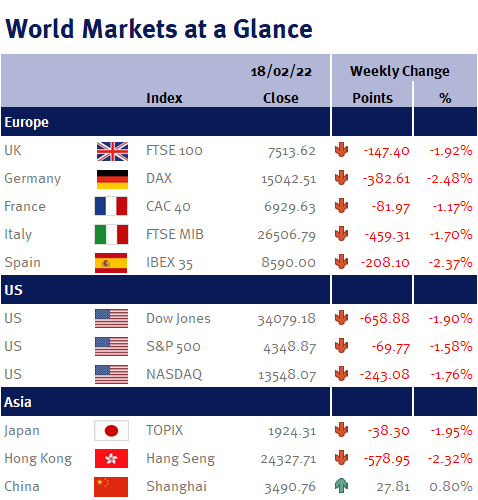

Global equity markets like predictability, not uncertainty – and that was evident this week as equity markets were at the mercy of every new news headline about Ukraine.

Unfortunately, this uncertainty and equity market volatility was exacerbated thanks to the long weekend for US financial markets, which are closed on Monday (21 February 2022) for Presidents’ Day, coupled with rising coronavirus cases in Hong Kong and the prospects of higher interest rates due to recent inflation readings.

On a positive note, despite the concerns over Ukraine, oil actually ended the week lower (albeit still close to $100 per barrel) due to signs of progress in talks with Iran on a nuclear deal (which could result in Iranian oil supplies coming back to the market) – and regular readers of our commentaries will know that a lower oil price while help ease the current inflationary pressures and help economic growth.