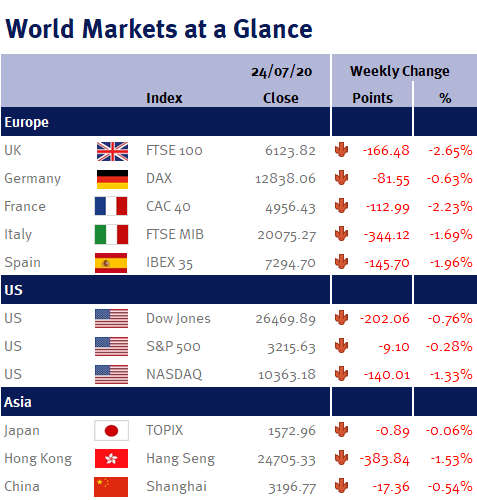

As you can see in the accompanying table, global equity markets closed this week slightly lower. However, just taking the table at face value doesn’t tell the full story, similar to watching the news headlines on TV! It is easy to find lots of reasons to be negative, but the relaxing of the coronavirus lockdown restrictions, coupled with the unprecedented government and central bank stimulus means the global economy will recover. However, as we have said many times in these updates, equity market volatility will remain elevated in the short-term as the road to any recovery is never a one-way street.

Week ending 24th July 2020.

27th July 2020

Mainland Chinese equity markets started the week strongly after the Chinese Central Bank, People’s Bank of China (PBOC), kept prime loan rates unchanged for July. This was a signal the PBOC is confident the reopening of the economy is sufficient not to require additional stimulus at this time.

Chinese relations with the US and UK were in the spotlight again this week as the UK suspended its extradition treaty with Hong Kong and placed it under an arms embargo, whist the US ordered the closure of China’s state consulate in Houston, Texas. This news certainly filled many headlines; however, China’s tit-for-tat response was encouragingly measured as they moved to close the US consulate Chengdu and removed English Premier League football matches from Chinese state television.

Asia and Emerging markets are a core feature in our client portfolios as they have some of the fastest growing economies in the world and their authoritarian responses to the coronavirus appear to have been effective as many aspects of life and the economy have quickly returned to normal.

Over in the US, labour market data this week showed an increase in initial jobless claims due to a pickup in coronavirus cases in some US states which forced some businesses to close once again. The US has been taking measures to mitigate the spread of the coronavirus and early signs are reassuring as reported cases and fatalities are starting to fall in many of the hardest hit states.

Despite the pickup in coronavirus cases, the US economy is still set for a third quarter bounce, thanks to the lifting of lockdown restrictions. Treasury Secretary Steve Mnuchin, expects to see a major rebound whilst Director of the US National Economic Council, Larry Kudlow, expects 20% growth in the third and fourth quarters.

If the US economic recovery isn’t a ‘V-shape’, it should be a ‘Nike Swoosh’ (i.e. still a strong recovery, just slightly slower) certainly not a ‘U’ or an ‘L’ and with many of the US’s initial support packages set to expire in the coming weeks, it is only a matter of time before the US announces a new raft of measures to support the economy.

After their second longest summit in history, European leaders reached a unanimous agreement on Europe’s financial response to the coronavirus pandemic this week. This was a big positive for the region as it demonstrates unity amongst its members, with the northern nations less impacted by the coronavirus willing to support the southern nations hardest hit.

However, with European leaders having concluded their marathon summit, investors were concerned they won’t give Brexit negotiations their full attention until after the summer which weighed on UK equity markets.

‘my wealth’ takes a long-term approach to investing, as evidence shows that this leads to better performance, as time in the market is more important than trying to time the market. When thinking about the UK equity market, we take comfort in the fact it is dominated by international businesses whose prospects are not determined by the outcome of Brexit.

Many companies in the FTSE-100 have compelling long-term investment cases yet are trading at significant discounts to their peers listed overseas, simply because of Brexit uncertainty. Brexit negotiations will be a feature of UK equity markets for the rest of the year, however, we are confident a deal will eventually be reached, probably in the 11th hour, similar to the way European leaders finally got there this week, at which point this discount is likely to disappear.

At an individual stock level in the UK, we were reminded this week that the coronavirus has not negatively impacted all companies. Shares in Kingfisher (the owner of B&Q and Screwfix) rallied strongly after they reported a very strong bounce in sales, despite stores having been closed for several weeks. With much of the UK in lockdown during the reporting period and many individuals unable to work, many homeowners turned to renovating their homes and gardens. Kingfisher does not feature in our client portfolios as we believe the coronavirus lockdown will have only a short-term positive impact on the company.

Unilever, which does feature in our client portfolios, has also released a positive update this week thanks to an acceleration in demand for personal care products, a trend we expect to continue long after the coronavirus subsides, as people’s attitudes towards personal hygiene are likely to be impacted positively for a long time to come.

One final company worth mentioning is AstraZeneca as it hit an all-time high this week after a positive update on a coronavirus vaccine it has been developing. AstraZeneca also features in our client portfolios however, not because of the prospect of a coronavirus vaccine, but thanks to a transformation in recent years. AstraZeneca previously faced a significant number of patent cliffs which threated its revenue prospects. They have successfully managed to turn this around by investing heavily in research and development in recent years which has created a very attractive, long-term pipeline of promising therapeutics.

Next week there are a lot more companies releasing second quarter trading updates. The US updates its interest rates policy whilst we will also see the initial estimate of how US GDP faired during the second quarter. In the UK, lockdown restrictions are due to be relaxed further as gyms, pools and sports facilities are scheduled to re-open on Saturday 25 July 2020.

Peter Quayle, Fund Manager

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.