The past week has been another where the day-to-day index moves have been dizzying, because, as we have previously said, equity markets hate uncertainty (and as the coronavirus outbreak is a big uncertainty), they are currently trading on every news headline.

There has been plenty of positive economic data helping equity markets over the week, including the Chicago Fed National Activity Index and the Kansas City Fed Manufacturing Activity index – which were both consistent with the previous week’s strong readings from the Empire State and the Philadelphia Fed surveys. Additionally, data today (Friday 26 June 2020), shows US consumer spending surged by a record 8.2% in May – clearly indicating that as lockdown restrictions are lifted people are comfortable to venture out to the shops and restaurants – which will clearly be positive for US employment as companies will start to rehire their laid-off workers.

Additionally, the UK, which is behind the reopening curve, also provided evidence this week of an economic recovery as PMI data readings were particularly impressive, with significant improvements across both manufacturing and services.

Unfortunately, offsetting these positive announcements was the news that coronavirus case numbers in the US reached an all-time high, which prompted Texas to close bars and restrict restaurant occupancy to help contain the virus – however, it is worth noting that the strict lockdowns we saw at the start of the outbreak are not being reimposed.

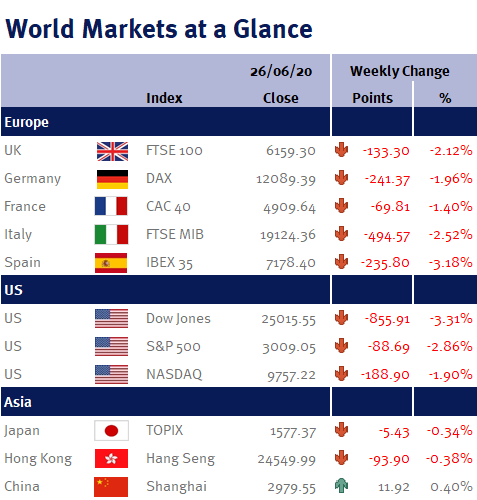

Additionally, with reports that Donald Trump is close to announcing another round of stimulus, it may not take much for equity market sentiment to quickly turn positive again – and interestingly, as you can see from the accompanying table, China’s CSI 300 was the only major global equity index to end the week higher as its economic reopening continues to be relatively smooth and successful. In fact, the CSI 300 index is now actually up 1.04% this year (which compares to -18.34% for the UK’s FTSE-100).

Consequently, as we have previously warned, until the coronavirus concerns are in the rear-view mirror we will have to live with taking two steps forward and one step back.

Please continue to read next week’s commentaries. Although data wise it is very quiet in the UK, Brexit trade negotiations restart with the EU. During the week we also have Eurozone CPI inflation, economic confidence and unemployment; along with Chinese PMI and Japanese retail sales.

However, most of our attention will again be on the important US data, which includes: consumer confidence; Markit and ISM manufacturing readings; minutes from the Fed’s monetary policy meeting held on 10 June 2020; the trade balance; US employment data (non-farm payrolls; unemployment rate; participation rate; and average earnings); and the weekly jobless claims data. Thankfully we will get a little respite on Friday (3 July 2020) as US equity markets are closed for Independence Day.

Investment Management Team