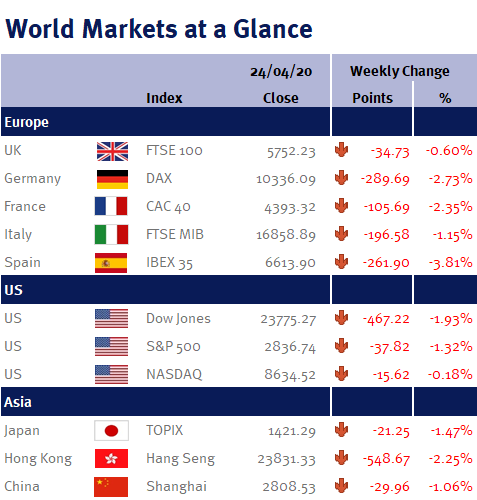

Global equity markets this week bounced between gains and losses, before finishing the week slightly lower, as volatility and uncertainty was again the key theme given the mixed coronavirus headlines; the oil price, economic data; and US Q1 company earnings.

Week ending 24th April 2020.

27th April 2020

While the economic data was horrendously bad, it didn’t tell us anything we didn’t already know (i.e. the global economy has hit a brick wall). Additionally, once the data goes beyond a certain point, it almost fails to matter, let alone shock.

For example, on Monday (20 April 2020), when the price of a barrel of West Texas Intermediate (WTI) oil fell below $0 for the first time in its history, it didn’t make a substantial difference when it went on to touch -$40, as we all knew that the world was running out of storage space given the glut of oil due to the fall in demand caused by the coronavirus lockdowns.

Similarly, was the UK Purchasing Managers’ Index (PMI) reading of 12.9 actually worse than the US reading of 27.4, when any reading below 50 signifies economic contraction?

Likewise, news that the US lost another 4.43m jobs last week, taking the total number of US jobs lost in the past five weeks to over 26m, had no negative impact on equity markets, as again, we all know that it is due to the coronavirus lockdowns which has hit those jobs with a high risk of layoff particularly hard, such as those in restaurants and retail.

Given the negative data, it is not unreasonable to ask why we are so sure that we will see a V-shaped economic recovery, given this negative news flow.

We fully understand that this may appear bemusing as the global economic damage from the coronavirus outbreak is massive, however our belief is based on the fact that while some consumer purchases and business investments will be lost forever, many will simply be delayed.

For example, we won’t all get our haircut twice next month simply because we couldn’t get it cut this month. Likewise, given all the sporting fixtures (such as Wimbledon) and concerts that have been cancelled, means wages won’t be earnt, flights and hotels won’t be booked, souvenirs won’t be collected and less alcohol will be consumed. This is all income and expenditure that is permanently lost – and therefore a permanent loss to the global economy.

However, some events, such as the 2020 Summer Olympics or UEFA Euro 2020, have simply been postponed to 2021, so that delayed expenditure will help the economic rebound.

Likewise, as we saw in South Korea last weekend, once the lockdown restrictions were lifted, long queues formed outside shops such as Apple – so clearly purchases of iPhones, iPads and AirPods have simply been delayed, which means it is only a temporary loss to the global economy, not a permanent loss – and shows that once the lockdowns are lifted people are happy to quickly get back to business as usual (i.e. consume).

As a result, while we have no doubt that it will be a sharp and painful downturn (in fact, we wouldn’t be surprised if UK Q2 GDP shows a decline of over 30% compared to the same quarter last year), as much of our expenditure will only be delayed, the downturn should be relatively short with a sharp acceleration on the other side of this horrible coronavirus outbreak – hence our view that we will start to see an economic recovery towards the end of the year. As a result, while UK GDP will be negative for 2020, it may only be in the single digits, while 2021 could be one of the strongest years since the global financial crisis in 2008/9.

Hence our V-shaped economic recovery view – and why we believe it is best to focus on the likely duration of the economic decline rather than the depth.

Nevertheless, that doesn’t mean the path for financial markets will be smooth as we fully expect market volatility will remain elevated in the short-term – however, because we believe that we will see a V-shaped recovery, it is imperative to maintain a long-term perspective by looking past all these short-term negative news headlines that we are currently seeing and resist the urge to sell your investments.

As Charlie Mackesy, the author of the book, titled ‘The Boy, The Mole, The Fox, and The Horse’, wrote: “What’s the best thing you’ve learned about storms?” “That they end” said the horse.

Looking ahead to this coming week we have Q1 GDP data from both the US and Eurozone (and both could easily contract by a couple of percentage points or so thanks to the coronavirus lockdowns which kicked in during March); the Fed’s preferred inflation measure, the PCE; Eurozone CPI inflation (which is likely to continue decelerating due to lower oil prices); weekly US jobless claims on Thursday (30 April 2020); and Chinese PMI.

Additionally, both the Fed and ECB have monetary policy meetings this week; while in the UK, we have over 20 FTSE-100 companies reporting results (of which 10 are held in client portfolios), including BP, Royal Dutch Shell, HSBC, Lloyds, Barclays, GlaxoSmithKline, AstraZeneca, Glencore, Reckitt Benckiser and Next.

Investment Management Team

Monday 27th April 2020

Equity markets have opened higher this morning after Friday’s strong close on Wall Street, which saw the Dow Jones and S&P 500 both rise over 1%, coupled with a weekend of slowing coronavirus deaths and news that Italy, France and Spain are moving towards a gradual easing of lockdowns – and judging by the queues we saw at B&Q over the weekend after the DIY store reopened their stores in the UK, consumer activity is likely to quickly recover as lockdowns are lifted and economies reopen.

Additionally, overnight Asian markets were strong after the Bank of Japan joined their global counterparts by allowing its stimulus program to purchase corporate debt and commercial paper in addition to government bonds.

As we write, the FTSE-100 is up around 100 points, or just over 1.7% at 5,850.

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.