This week global equity markets extended the previous week’s losses amid heightened coronavirus uncertainty.

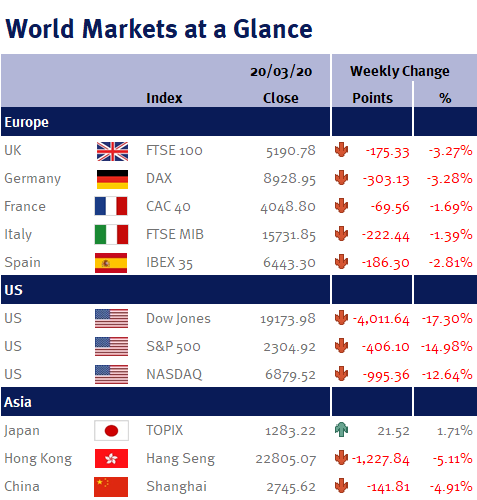

Week ending 20th March 2020.

23rd March 2020

As you can see from the table, the US equity markets suffered the biggest losses, with the S&P 500 Index ending the week nearly 15% lower and the Dow Jones down over 17%. The Dow has now lost 35.12% since its peak on 12 February 2020 and as a result has now reversed all of the gains it had made during Donald Trump’s presidency.

As the spread of the coronavirus escalated, so did the countermeasures as governments and central banks attempt to protect the global economy from the outbreak and the resulting lockdowns – for example, in the UK the BoE restarted QE and made another emergency interest rate cut.

Although it is disappointing that this week’s positive moves by governments and the major central banks have not been able to reverse the extreme and cheap valuations which companies now trade, the current disconnect between fundamentals, valuations, and market prices is a positive for patient, long-term investors as the best time to invest is when others are suffering from disbelief and demoralisation.

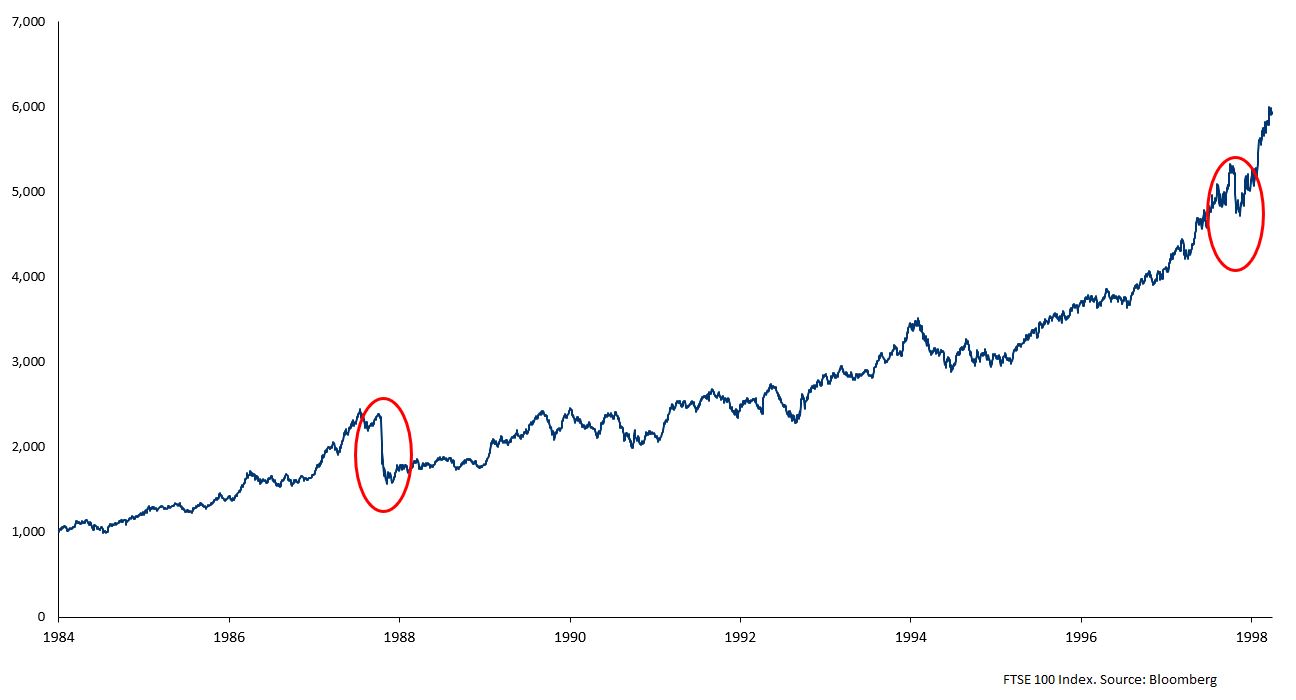

While we fully expect market volatility will remain elevated in the short term and are expecting to see evidence of economic damage continue to rise and company profitability to fall, we believe it is vital to resist the urge for any knee-jerk reactions and maintain a long-term perspective by looking past the negative news headlines and negative economic data releases as equity markets have weathered and recovered from lots of negative and uncertain events in the past – and this time will not be any different.

In fact, history is littered with periods where equity markets have fallen sharply for a couple of weeks or months – and market shocks always tend to be greater on the downside than on the upside. For example, if we look at the stock market crash in October 1987, when the FTSE-100 fell over 32%; or 10 years later in October 1997, when the FTSE-100 fell over 10% thanks to the Asian Stock Market Crisis – while both of these periods were very scary at the time, they now look like small blips on a long-term chart.

Equity markets hate uncertainty and thanks to the scars from the global financial crisis in 2008/9, equity markets have tended to react disproportionately to any uncertainty or disappointment – and unfortunately, this is one of those periods where panic and fear has gripped financial markets.

However, we invest in a diversified selection of companies and funds that we believe can survive periods of crisis such as this. While their prices have been impacted by an indiscriminate and emotionally-driven sell-off, it may not actually require much good news for confidence and, in turn, higher shares prices, to return.

The timing of a potential rally is, of course, difficult to predict. But, we take a longer-term view, because evidence shows that time in the market is more important as it leads to better outcomes than trying to time the market.

Looking ahead to this coming week we should start to get a sense of the damage coronavirus is creating. Of most interest to us will be weekly US jobless claims on Thursday 26 March 2020 which could easily surge to well over 1 million from last week’s reading of 281,000. Other key US data includes the Chicago Fed national activity report; PMI; durable goods; GDP; consumer spending and PCE (the Fed’s preferred inflation measure).

Elsewhere we have Eurozone PMI and consumer confidence; and UK CPI, PMI, retail sales and a BoE monetary policy meeting.

Investment Management Team

Monday 23rd March 2020

It is another challenging day today, with the FTSE-100 down 5%, or 260 points as we write, at 4,930 as the US equity market is expected to open lower after the Democrats blocked Donald Trump’s stimulus package. Additionally, the President of the Federal Reserve Bank of St. Louis, James Bullard, warned that the US unemployment rate may hit 30%, while the US investment bank, Morgan Stanley, forecasts US Q2 GDP could contract 30% on an annualised basis.

While this is disappointing, we expect the US to agree a new stimulus plan in the next day or two. Furthermore we wouldn’t be surprised if the new stimulus plan ends up being significantly larger than the original $1.2tr plan (announced just last week) given that more US states are going into lockdown – which should hopefully put a floor under the equity markets.

While we appreciate the uncertainty of the potential economic damage from an effective global standstill will cause, the government and central bank responses have been swift and significant – and are likely to be increased further. As such we still believe that economic growth will quickly recover and long-term economic damage will be limited.

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.