Global equity markets had a better day yesterday (Tuesday 17 March 2020) thanks to fiscal stimulus announcements in the UK & the US.

The UK announced a government loan guarantee program of up to £330bn – which should provide confidence for the banks to continue lending.

The US stimulus amounts to $1.2tr – which includes $500bn of cash payments to households.

These policy responses are positive as it shows that governments and central banks are finally starting to catch up with what the economy needs.

Unfortunately, as the coronavirus outbreak continues to spread around the world, resulting in ever more drastic containment measures, the true extent of the damage is obviously unknown and as a result, more stimulus may be needed. As such global equity markets have, unfortunately, fallen again this morning. As I write, the FTSE-100 is down 4.8% at 5,040.

As we have previously said, we see this coronavirus crisis as a transient issue and as such it is highly likely that we will see a V-shaped recovery as soon as we get greater clarity on the spread of the coronavirus and the current fears dissipate.

Yes, the spread of the coronavirus outbreak will negatively impact the global economy in the coming months and quarters, but it is very different from the global financial crisis in 2008/9 when the banks were close to collapse, which could have capsized the whole of the financial system.

While we appreciate that both the coronavirus and the resulting equity market weakness is unnerving, it is very important to maintain a long-term perspective and resist the urge for any knee-jerk reactions. Equity markets hate uncertainty – and the coronavirus outbreak is a big uncertainty.

However, while the coronavirus outbreak is concerning from both a human and an economic standpoint, it is worth highlighting that equity markets have weathered and recovered from lots of negative and uncertain events in the past – and this time will not be any different.

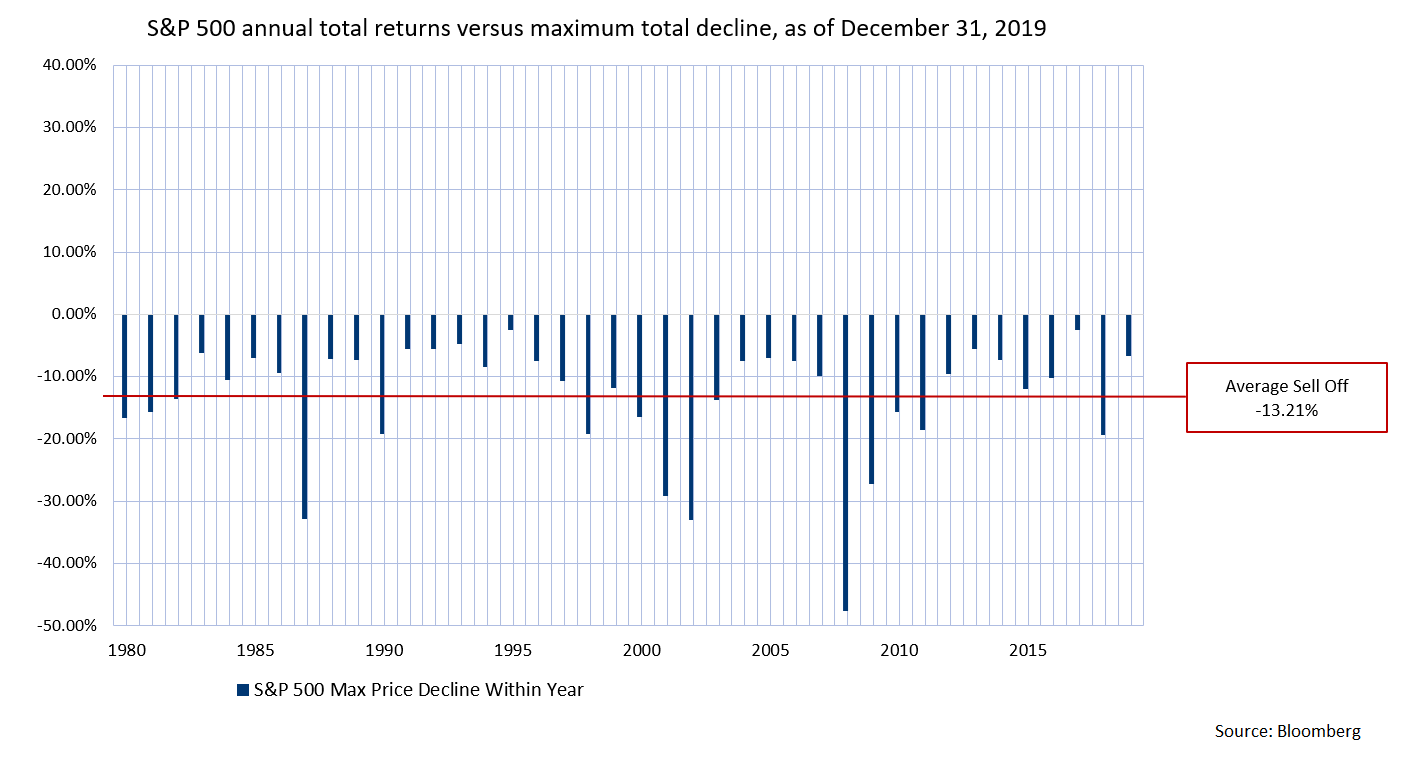

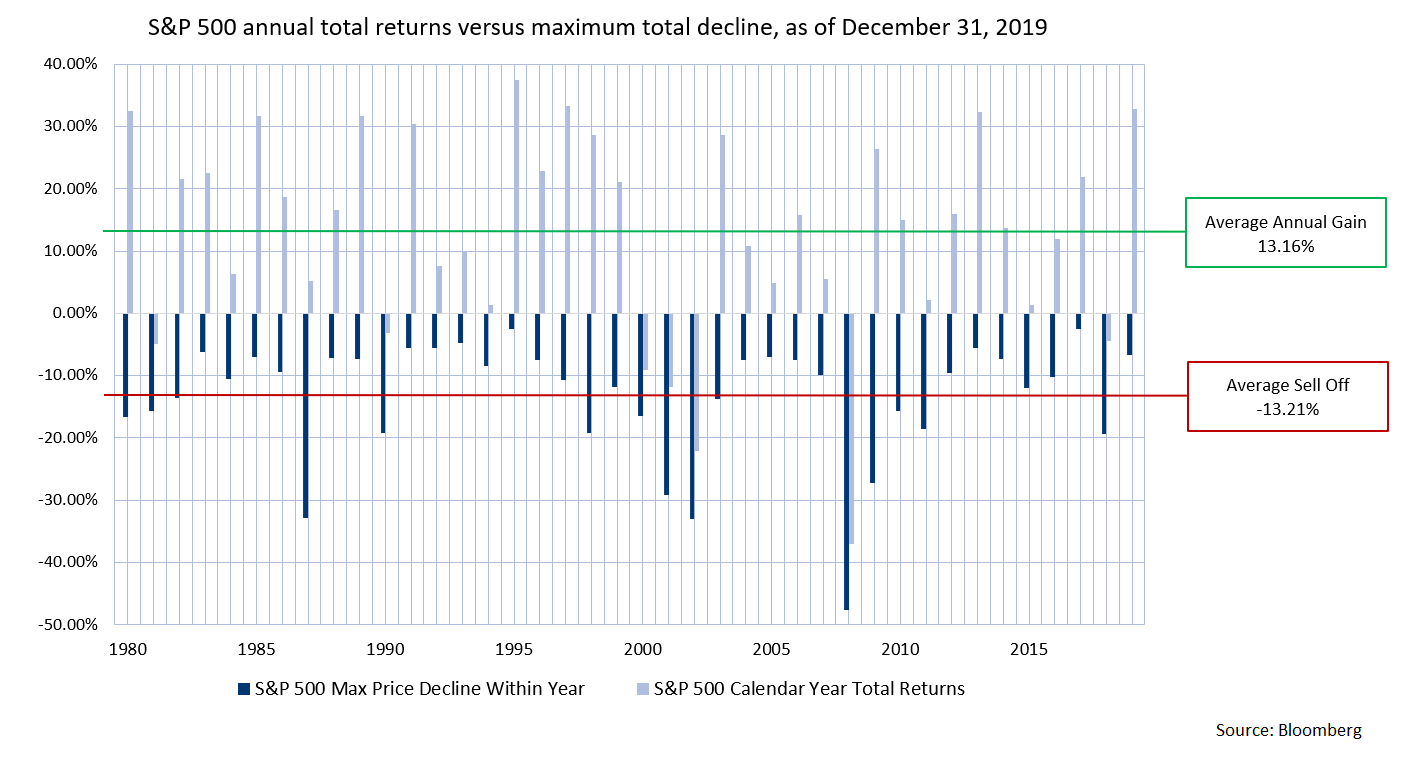

In fact, equity market sell-offs are normal. As you can see on the accompany chart (chart 1), of the S&P 500 going back 40 years, the market typically sees a sell-off during the year (dark blue line), averaging 13.21%, but as you can see from Chart 2 with the light blue lines, for the majority of years, the market ended in positive territory, with an average gain of 13.16%.

As long-term investors, we currently see plenty of opportunities to make long-term gains as equity market panics are almost always the best time to invest – and we believe that we have reached that point as the current sell-off and weak market sentiment now appears to be feeding on itself.