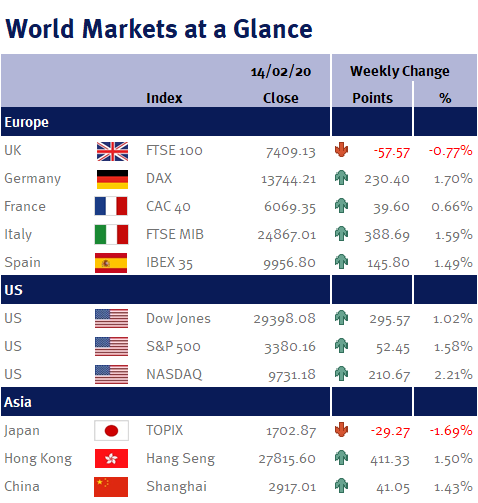

Most of the major equity markets extended last week’s rally, on hopes that the coronavirus outbreak is losing momentum.

Week ending 14th February 2020.

17th February 2020

The UK market was a notable underperformer after Rishi Sunak was appointed as our new Chancellor of the Exchequer following Sajid Javid’s resignation.

Rishi Sunak is reportedly in favour of increasing infrastructure spending and embracing more fiscal stimulus. So while we will hopefully see a loosening of the purse strings in next month’s annual budget, in order to boost economic growth, unfortunately this fiscal stimulus could encourage the hawks at the BoE to kibosh the chances of a UK interest rate cut – hence the pound strengthened and a strong pound is bad for the FTSE-100, as it lowers returns for exporters and the value of overseas earnings.

As for this coming week, we have UK employment data (unemployment rate and weekly earnings); UK CPI; UK retail sales; minutes from the last Fed meeting; and Japanese Q4 GDP.

We are also rapidly approaching the tax year end and so we would like to remind you that if you have not already taken advantage of your ISA allowance, now is the time to act. The current limit is £20,000 and if you don’t use it by 5 April 2020, you will lose it. Contact us using the details found in your email to start the process.

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.