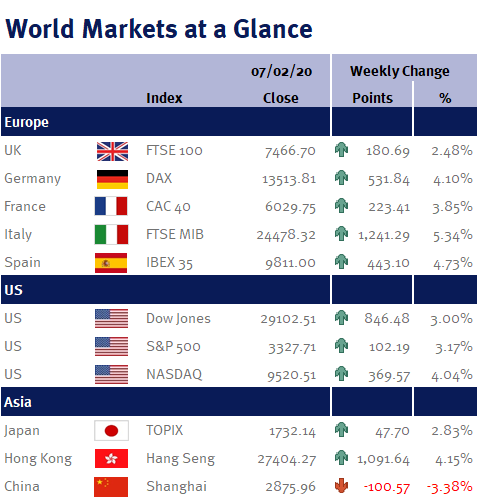

Global equity markets rallied strongly this week on hopes that China is succeeding in containing the spread of the coronavirus and as a result the outbreak won’t significantly affect the global economy. Sentiment was also supported by economic data which suggests that the global economy has started the year strongly.

Week ending 7th February 2020.

10th February 2020

However, while we have argued that the coronavirus is likely to be a transient worry for equity markets, we would caution against the speed of this week’s recovery, as it may be slightly premature. The current euphoria feels like equity markets are being too complacent that the worst of the coronavirus is already over.

While there is a reasonable chance that by the end of the year the coronavirus could simply look like a hiccup for global growth (and global equity markets), we do need to be mindful of the short-term impact on China and the knock-on effects for the rest of the world – and we believe that actual impact on both the Chinese economy and the global economy is currently unclear and things may get worse before they get better.

There are lots of production facilities outside of China that are already experiencing disruptions given today’s ‘just-in-time’ manufacturing and supply chains. For example, Hyundai Motor Company this week said it is stopping car production in South Korea because of a component shortage caused by the coronavirus.

Additionally, Burberry (held in clients’ discretionary portfolios) today (Friday 7 February 2020) warned that the coronavirus is hurting its Chinese sales as it has closed 24 of its 64 shops in the country.

Obviously, the longer Chinese factories and shops remain closed, the greater the impact as the knock-on effects may start to compound.

However, perversely if Chinese factories and shops reopen over the next week or so, the battle to contain the virus could suffer a setback as more people come into contact with each other!

Although we remain positive on equities over the long-term, particularly those in Asia and Emerging Markets, given the current uncertainties and potential for equity market volatility (we believe that the coronavirus is likely to keep equity market sentiment on edge until the full economic impact is known), we are maintaining our short-term cautious stance with a slightly higher than normal level of cash (including liquidity funds).

Away from the coronavirus, US employers continued hiring in January and wage growth rebounded. Non-farm payrolls increased by 225,000 and hourly earnings climbed to 3.1% – although a rise in the labour market participation rate meant the unemployment rate edged up to 3.6% from 3.5%.

Looking ahead to this coming week we have UK & Eurozone Q4 GDP; and US CPI and retail sales.

We are also rapidly approaching the tax year end and so we would like to remind you that if you have not already taken advantage of your ISA allowance, now is the time to act. The current limit is £20,000 and if you don’t use it by 5 April 2020, you will lose it. Contact us using the details found in your email to start the process.

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.