Whilst the past few weeks have been centred on sentiment overreacting to US President Donald Trump’s proposed September China Tariffs, earlier this week we saw conversations between both US and Chinese trade representatives result in the US delaying the 10% tariff on the majority of key goods until December, with the Chinese easing off on their proposed US agriculture tariffs. The following days went on to see Trump ‘talk up’ the possibility of meeting (or a call) with Chinese President Xi Jinping ahead of September’s trade talks… and whilst the Chinese are yet to confirm their attendance at September’s meeting in Washington, all indicators suggest these trade talks will go ahead.

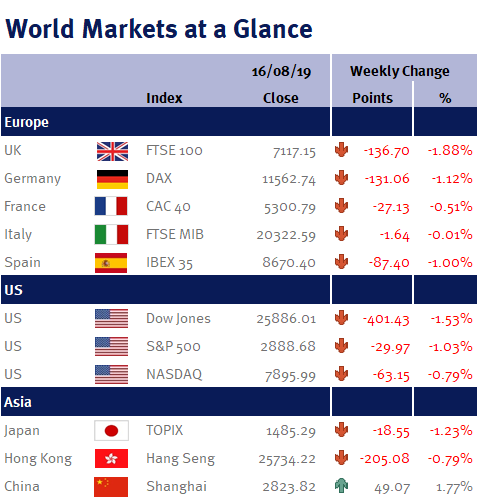

Week ending 16th August 2019.

19th August 2019

With the above in mind, the other news stealing the headlines this week was the ‘yield curve inversion’ in the UK and US bond markets. This is essentially when you are getting less return for bonds that have longer maturities. Now, whilst it seems fundamentally wrong and in the past has been a precursor to a recession, it must be remembered that the economic climate that surrounds this inversion differs massively from what has gone before! A true recession seems unlikely as, whilst global growth is predicted to slow, it is growth nonetheless, and with economic fundamentals in many key regions robust, and with valuations/corporate profitability in these areas still conducive of a good investment environment, it appears that investor sentiment’s risk-off attitude has presented plenty of short term opportunities. So the question remains, why do we believe this? Well, ultimately there has been a lot of negativity so far this year, yet equity markets are by far and away the best performing asset class. If we look at what has happened this week alone, the nervousness surrounding the recent trade exchange between the US and China has tipped sentiment over the edge and has seen investors seek solace away from risk assets (equities) and indeed bonds with short term maturities. This aversion of risk is centred around short termism, and surrounding a scenario that has occurred several times over the past year already, ‘Donald Trump threatening tariffs, and then backing down’… but the markets appear to have not quite yet factored in Trump’s recent comments that saw him this week acknowledge for the first time that the US consumer could bear the brunt of the China trade spat, which is why he delayed the tariff introduction ahead of the September trade talks. With this in mind, and given throughout his entire term he has ‘hung his hat’ on the fact that the US markets have performed well and economically the US has remained robust, it is not likely that he is going to allow trade negotiations to impact the US consumer and electorate so close to next year’s US Presidential elections! With that in mind, any form of trade calm following next September’s US/China trade talks, accompanied by central bank accommodation, could see a return to risk assets, a catalyst for the attractive valuations in many areas caused by the recent pull back in markets.

Elsewhere we saw Jeremy Corbyn’s attempt to oust Boris Johnson and become UK ‘caretaker’ Prime Minister, fall flat on its face. In an attempt to avoid a no-deal Brexit, Corbyn wrote to a number of party leaders, including select Conservative Party members in an attempt to get backing with a view to eventually calling a general election. This attempt fizzled with a general view that he would be unable to unite rival parties and rebel conservatives. We too saw the Italian Senate (and the majority of the former 5 Star movement) reject far-right leader Matteo Salvini’s request for a swift no confidence vote on Monday, instead deciding that Prime Minister Giuseppe Conte would address the current political crisis on the 20th August… but let’s face facts, this type of political upheaval in Italy is the norm!

There has only been a handful of data sets released this week, but nonetheless quite significant ones. Tuesday saw US inflation (Consumer Price Index) come in well above prior and ahead of expectation at 1.8% year on year, a huge win for the US Federal Reserve. Tuesday also saw UK unemployment come in marginally higher than expected at 3.9%, but with data from the Office of National Statistics suggesting wage growth is at an 11 year high for the first 6 months of the year. Tuesday saw China release its industrial production and retail sales data, both coming in slightly lower than expected, which comes as no surprise given trade uncertainties! That being said, the Euro Area also released second quarter GDP data, maintaining its 0.2% level quarter on quarter in spite of current sentiment surrounding trade. On Thursday, UK and US retail sales for July beat expectations across the board.

Now, whilst I appreciate all of the above is key from an investment standpoint, I know a number of you who will have read my piece last week will be wondering how much the original 1994 Mclaren F1 sold for at the Sotheby’s auction… well it is unfortunately yet to be auctioned off, but for anyone interested, it is lot number 261! Only 106 were ever made, of which only 64 left the factory road legal!

Jonathan Wiseman, Fund Manager

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.