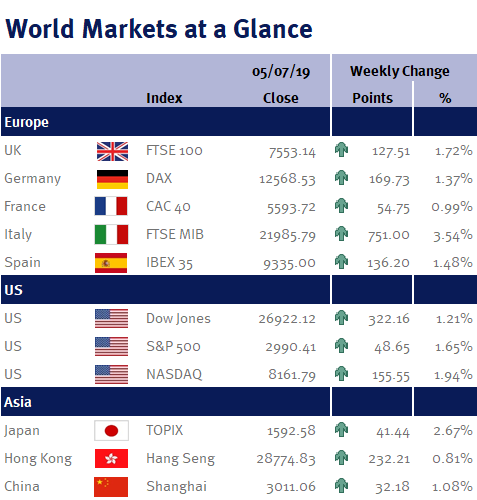

As we entered the second half of the year, positive momentum in global equity markets continued as the side meeting at the G20 last weekend (29-30 June) between US and Chinese Presidents, Trump and Xi, concluded positively, giving markets a good start to the week.

Week ending 5th July 2019.

8th July 2019

The US and China both agreed to resume trade talks; the US agreed to cancel any further tariffs on Chinese imports and to ease restrictions on Huawei, whereas China agreed to purchase US agricultural products. Whilst this is a positive development, an outright resolution is still some way off and although negotiations have resumed, both positive and negative developments are likely to continue influencing equity markets for some time.

Not content with a positive week of trade news, the US reignited its threat to impose tariffs on the EU by adding a further $4bn of products to the $21bn already threatened in April. The threats are in retaliation for EU aircraft subsidies to Airbus which the US estimates costs the economy $11bn a year.

The World Trade Organisation (WTO) has already concluded that the EU subsidies violate international trade rules; however, the EU has its own pending case with the WTO against the US regarding the subsidies it provides to Boeing.

Whilst the dispute should be adjudicated by the WTO (which is expected to decide how the US should respond in the coming months), the EU published a retaliatory $12bn list in April, with a focus on farm products from areas which form President Trump’s political base.

Trump has always appeared mindful of the impact his policies have on equity markets and with presidential elections taking place in November next year, a positive resolution to trade disputes could be central to his campaign for re-election. However, timing will be key, if agreements are reached too soon, they will be forgotten come election time. Although, should negotiations drag on too long, his opponents could intentionally push back on the basis that they could hamper his campaign, with a view to negotiating with his potential replacement.

In Europe, equity markets were relieved with the election for the next ECB President as Christine Lagarde will succeed Mario Draghi in October. In her current role as chair of the International Monetary Fund, Lagarde is often encouraging countries to do more to stimulate their economies, either through monetary policy, fiscal expansion or structural reform and is therefore expected to maintain current ECB President Mario Draghi’s dovish stance. Her appointment was also a relief, as it ruled out German Bundesbank chief Jens Weidman who was against many of Draghi’s economically supportive policies.

Finally on Friday, US nonfarm payroll data showed 224k new jobs were created in June, beating expectations of 160k. This reduces pressure on the Fed somewhat and as a result, we expect US interest rates will be cut 0.25% later this month and not 0.5%.

Next week, the Fed and ECB releases minutes of their June meetings. The Bank of England publishes the semi-annual Financial Stability Report and Fed chairman Jerome Powell will deliver the Monetary Policy Report to a Senate panel.

Peter Quayle, Fund Manager

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.