Week ending 5th January 2018.

8th January 2018

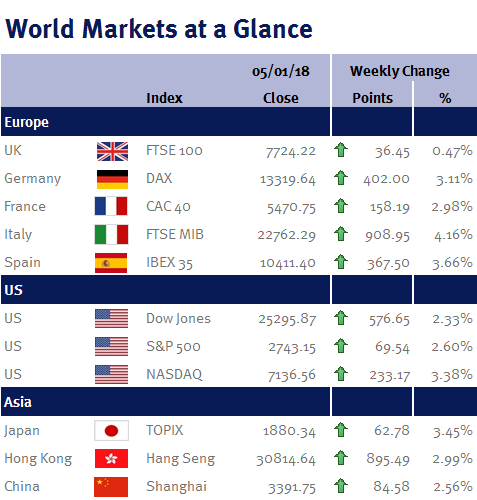

Global equities got off to a great start to the new year amid signs that the non-inflationary global economic expansion continues to gain momentum.

In the US, the Dow closed above 25,000 for the first time, while the S&P 500 climbed past 2,700 and the Nasdaq surpassed 7,000.

Minutes from the last Fed monetary policy meeting indicated that policymakers debated the risks to the US economy, with some emphasising low US inflation, while others pointed to the robust economic growth potentially getting a further boost from Donald Trump’s tax cuts.

Elsewhere, the ECB’s 2% inflation target remains elusive, as eurozone CPI slowed to 1.4% in December from 1.5% in November, while the core reading was unchanged at 0.9%. Hopefully, this will quieten those ECB policymakers who have been pushing for an end to crisis-era stimulus measures.

This coming week, we have a number of Fed policymakers speaking along with US retail sales and CPI data and minutes from the ECB’s last monetary policy meeting.

Ian Copelin, Investment Director

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.