It is important to have plans in place to achieve your goals. It is also essential that you know how you will fund your goals so that you can turn them into reality. In this section we aim to help you understand savings and investments by looking at 4 key areas – Budgeting & setting goals, principles, risk & return and lastly ISAs and LISAs.

Saving and investing

The first step of being in control of your finances is to create a budget planner.

Without knowing your true income and outgoings, there is no way you can accurately plan ahead to meet your goals – whether that is to be debt free, to save or invest for a specific purpose.

- In its simplest form, a budget planner is a list of all your income and all your outgoings. Your income would be everything you gain money from including your job, investments or any other income.

- Your outgoings should be all of your outgoings including monthly direct debits, any debt repayments and one off spends like an annual holiday or planned home improvements.

- To create an accurate budget planner you’ll need to be honest with yourself. The easiest way to do this is by having access to your bank and credit card statements.

- If you budget as a couple, it is a good idea to do this with your partner. Not only will that enable you to get an accurate spend but by working on this together, you’ll both know where you are financially and you can agree to both move towards the same goals. Money Helper have put together a handy budgeting tool that is simple and free to use. Click here to access the budgeting tool. This calculator will give you a breakdown of where you’re spending your money. Following that, you’ll receive personalised tips on how to reduce your spend, if it’s not already obvious from the results of the budget planner.

Money Helper have put together a handy budgeting tool that is simple and free to use. Click here to access the budgeting tool. This calculator will give you a breakdown of where you’re spending your money. Following that, you’ll receive personalised tips on how to reduce your spend, if it’s not already obvious from the results of the budget planner.

This is the first step towards taking control of your financial wellbeing. Once you have a clear picture of income, outgoings and how you could save money, you can begin to set your financial goals.

This goal could be anything, for example, to save for an emergency fund to pay off a debt or to begin investing.

Whatever your goals, it’s important that they are SMART.

- Specific

- Measurable

- Achievable

- Realistic

- Time-bound

An example of this could be:

My goal is to pay off my interest free credit card within 6 months. There is an outstanding balance of £600 and after budgeting; I know I have £100 per month spare. By paying off £100 at the end of each month, I will have paid off my credit card in 6 months.

This method could be applied to both saving and debt repayment.

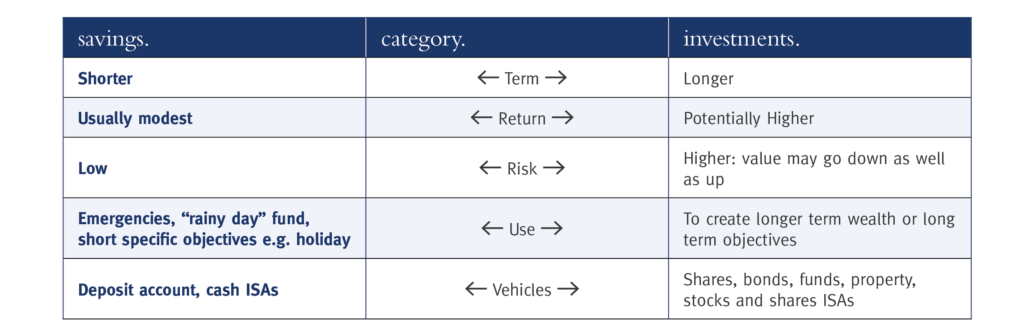

Savings are generally shorter term, lower risk, placed to earn interest and are available for withdrawal, sometimes subject to notice. Investments are generally longer term, with varying levels of risk, aim to grow in value and may not be ‘easy access’.

See the table below for a brief summary of the differences between the two.

Remember: No one type of investment or savings vehicle will meet all needs so a balance of these is necessary, if you are to have a stable standard of living and a sense of financial security.

There are a number of considerations for you to take into account when planning how to save or invest. See below for more information.

What are your goals?

First you must assess your financial needs and goals. Ask yourself:

- What is the end goal?

- How much can I invest and for how long?

- Do I want/need easy and quick access to my money?

- Have I considered the impact inflation may have on my savings?

- How might tax affect the returns on my savings?

- Am I willing to increase risk in exchange for the potential of higher investment returns?

- How would I react if I could see my investment losing value?

Answering these questions will be a useful way to help work out what the most suitable way to save or invest your money could be. Highlighted below are some external factors that could affect your returns and will be important to keep in mind when making a decision on how you will save or invest your money.

Inflation

Over time inflation will reduce the value of your capital in real terms.

For example, if inflation was at 5% p.a. the real value of £10,000 after 5 years will be £7,835; after 10 years, £6,139; and after 20 years£3,769. These figures are illustrative only as inflation has been lower than 5% over the last five years so the true value of your capital in real terms would be higher.

Security

How safe is your capital? Money lost through speculative investment can be hard to recover and may affect your standard of living for the rest of your life. There are two factors that can give you an element of security:-

- Choose investments that are inherently safe;

- Spread your investments and bear in mind that deposits of savings in authorised financial services firms may be protected by the Financial Services Compensation Scheme (FSCS) if the firm is declared in default. Current limits of compensation are up to £50,000 for an investment firm and £85,000 for a bank/building society.

Tax implications

The impact of taxation on your savings and investments is a crucial factor in their selection. If your savings or investments are not in an ISA or pension, any gains could be taxable.

A comparison of the ‘gross’ (i.e. before tax) returns is often misleading. A better indicator of returns is the ‘net’ (i.e. after tax) position.

Flexibility

If your circumstances change, or if the tax or investment climate changes, the way in which you have invested your money originally may no longer be appropriate. Therefore, it is important to review your investments to make sure your investment strategy still aligns with your end goal.

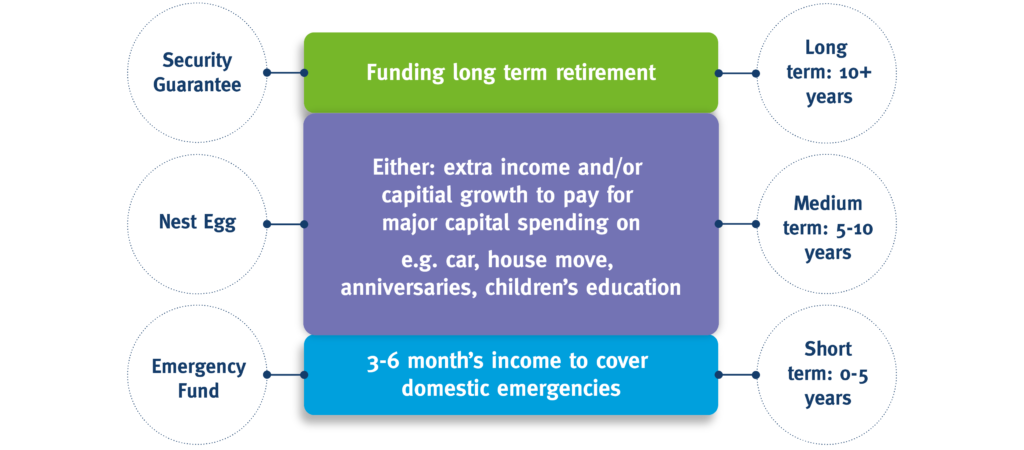

Savings & investment segmentation

Below is an example of how your money could be needed, from providing a short term emergency fund for everyday needs through to potentially providing money for longer term requirements at-retirement. This will not be applicable to everyone, but gives an idea of how money could be segmented. Once you know how your money is segmented, you will have more of an idea about how much you can save and how much you could invest.

Your attitude to risk will play a major part in how you approach financial planning during your lifetime.

In general, the more risk you take the higher the potential returns. Also, the longer you are looking to invest, the higher your risk tolerance could be, as investments are more likely to smooth out over the long term.

However, there are different levels of risk. For example, buying shares in a large multinational company and buying shares in a start-up company are both investments, which have some element of risk. One may be considered safer than the other as it is larger and more financially stable, although potential returns may not be as high. Of course, there is always a risk that even the largest companies can fail and you can lose some or all of the money you invest with them.

Being aware of your risk appetite is especially important when planning your long term financial future. The aim is to put together a savings and investment strategy that matches your financial goals but doesn’t leave you worried about the level of risk.

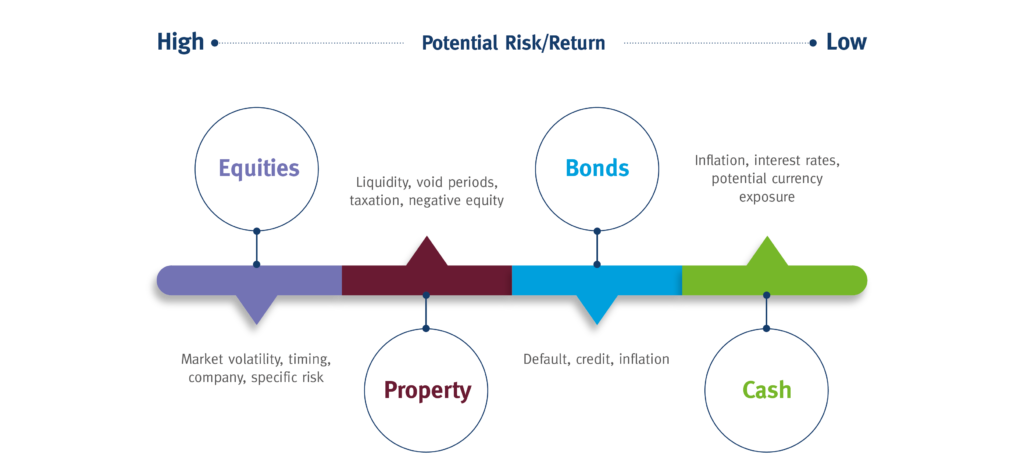

The risk ladder below gives you some indication of where on the risk line various savings and investments fall and what risks you could be exposed to.

Equities – Investing in stocks and shares either individually or through a portfolio.

- Market Volatility – Investments will go up and down during the time you’re holding them. How would you react if your money lost 20% in value?

- Timing – You could buy at the wrong time as investments have hit their peak

- Company specific risk – If a large percentage of your investment is in one company, you’re relying on them to succeed for your investment to succeed.

Property – A property purchased with the intention of making a return on your investment.

- Liquidity – How quickly could you get access to the money from your investment if you needed to?

- Void periods – Could you cope financially if a property was empty?

- Taxation – Profit from property investments may be subject to tax.

- Negative equity – How would you manage if the property value dropped below the outstanding mortgage?

Bonds – A loan made to the government or a company in return for a fixed interest over a fixed period of time. How risky these are depend on who the bond is with.

- Default – Although bonds are considered relatively safe, there is a risk that they could default and you could lose your investment.

- Credit – There is a risk that the corporation that you have a bond with could default on its debt obligations.

- Inflation – Is the savings rate enough to outperform inflation?

Cash – physical cash or money held in an account with a regulated financial institution.

- Inflation – Is the savings rate enough to outperform inflation?

- Currency exposure – Holding investments in cash means you’re exposed to the rises and falls of that currency.

- Interest rates – Holding cash means that you are at risk of low interest rates and in turn, low growth

Tax-Efficient Savings

- Costs can have an impact on the return of savings and investments. One cost which you can influence is the amount of tax you pay on any gains earned by holding your investments in a tax-efficient way. ISAs and Lifetime ISAs are types of savings vehicles that can save on the amount of tax you pay.

An ISA is a type of savings account that can be used to store either cash or investments in a tax-efficient way.

Returns received from cash or investments held in an ISA are paid free of any UK tax.

ISAs have become more flexible over recent years, offering the option to switch holdings within an ISA between cash and investments and to have a mixture of the two. The maximum an individual can pay in total into ISAs each year is £20,000. You can normally withdraw money from an ISA at any point, unless you have a fixed term interest product where you have locked away your money in return for a specific interest rate.

- Stocks and shares ISAs invest your money in stocks or shares, which mean that your savings value could go up or down, if your investment value fluctuates. In the worst case, you could lose all of your money. These should be viewed as long term savings vehicles and you should plan to invest for at least 5 years in order to see growth.

- Another type of ISA is a cash ISA. This ISA is simpler and gives you a set interest rate for investing your money. Like savings accounts you can either lock away your money for a longer time or have an easy access ISA, normally with a lower interest rate. Your money is safer inside a cash ISA when compared to a stocks and shares ISA but potential growth may not be as high and current rates are below inflation.

Lifetime ISA (LISA)

Since 2017, the government has offered a new sort of product known as a Lifetime ISA or LISA. The main purpose of this product is to help people save towards retirement or their first home.

This is structured the same as other ISAs, being available as either stocks and shares or cash and still shelters your savings growth from tax.

There are a few key differences to the LISA when compared to a standard ISA:

- Only people aged between 18-40 can open a LISA

- An individual can only put £4,000 per year into an LISA until the age of 50

- The government will add a 25% bonus to any contributions until you’re 50

- The LISA can only be withdrawn for a deposit on a first home or after age 60

It’s important to note that the £4,000 limit, is included in your £20,000 annual ISA allowance. So, if you contributed £4,000 to a LISA, you could only contribute a maximum of £16,000 to other ISAs that year.

There is also a clause which allows you to withdraw your money for reasons other than to buy a first home and before age 60. This would result in a penalty charge of 25% on the total value of your withdrawal. Paying this penalty charge is likely to mean that you will lose out. The only time this penalty wouldn’t apply is if you were terminally ill or had passed away.