Your retirement might seem like a long way off but the more you do now the better your chances are of achieving the retirement plans that you want. In this section, we aim to help you plan for your retirement. We will look at 3 key areas – pensions, retirement planning and retirement income options.

Retirement

The money you have when you reach retirement may come from a number of different sources.

It will be beneficial to make a list of the different workplace and private pensions you may have and who provides them. This is key to understanding how much you might expect to receive.

You may receive more than one type of workplace pension in retirement. There are two main types of pensions, known as Defined Benefit Schemes or Defined Contribution Schemes. It is important to know which you have:

Defined Benefit (DB)

Defined Benefit (DB) schemes provide a secure income that is paid throughout retirement, together with the option to take a tax-free cash lump sum on the date you retire. As a member of one of these schemes, there are two ways you may have built up benefits.

- Career Average Re-evaluated Earnings (CARE) (DB Schemes) – Whilst the way benefits are built up varies between schemes, the principle of a CARE scheme is that the pension income you build up is based on your pensionable salary each year. Each year’s benefits are then adjusted for inflation and added together to provide a secure income in retirement.

- Final Salary – Different pension schemes use different methods of calculating your ‘final salary’. However, benefits calculated in this way will usually provide you with an income in retirement. This is based on your final pensionable salary when you leave the Scheme, or when your membership of the final salary section ends. Most DB schemes no longer provide final salary benefits and are now CARE schemes.

If you joined LSE before 1999 or LCH before 2009, you may have a DB pension with the London Stock Exchange Group Pension Scheme. To find out more, please contact the Scheme’s administrators Isio on 0800 488 0796 or LSEGPS@ISIO.com.

If you have less than 2 years membership of a DB scheme and you leave you maybe entitled to a refund of contributions, subject to scheme rules.

AVC's

Additional Voluntary Contributions (AVC’s) are a way of building up an additional pot of pension money in addition to your regular pension savings. AVCs are a common feature of DB schemes and allow members of these schemes to create additional savings that can be used to generate a pension income or to provide a lump sum at retirement. It may be possible to receive part or all of these savings tax-free at retirement depending on the rules of the DB scheme you may have been a member of.

The graphic below shows how AVC contributions could add up:

Assumptions

- Annual salary increases by 2.5% each year

- Annual pension charges of 0.75% apply

- Investment growth is 5% each year

- All values are shown in today’s money and assume 2.5% inflation each year

- Note that growth, inflation and charges vary and may be higher or lower

Defined Contribution (DC)

LSEG provides the London Stock Exchange Group Pension Plan (LSEGPP) which is a Defined Contribution Scheme.

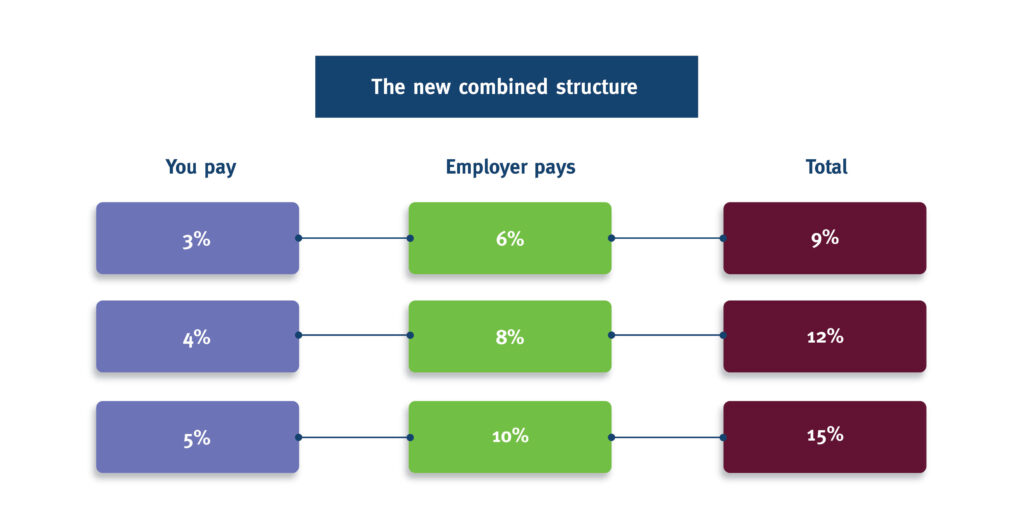

In this type of scheme, you and your employer will normally make contributions that are invested tax-free to build up a pension pot for you. The rules of the pension scheme will set out the contributions you can make from your salary each month together with the contributions from your employer. If you are a member of the LSEGPP, you are required to make a contribution of at least 3% of your pensionable salary. LSEG then pays in 6%, although the contribution LSEG makes will increase if you increase your member contributions. The table below sets out the contribution structure.

Your LSEGPP is held with Legal and General who are responsible for administering the Plan. You can view your account and make changes at any time:

Online: To log in and manage your account click here to access ServiceNow. You can see the different funds and change the way your pension savings are invested.

By phone: you can call Legal & General direct on 0345 070 2063. Call charges may vary and calls may be recorded and monitored.

The size of any DC pension, such as the LSEGPP, will depend on factors such as:

- How well the investments perform

- What charges are applied to the pension

- When you start drawing your pension

- How much you and your employer have contributed

- When you retire

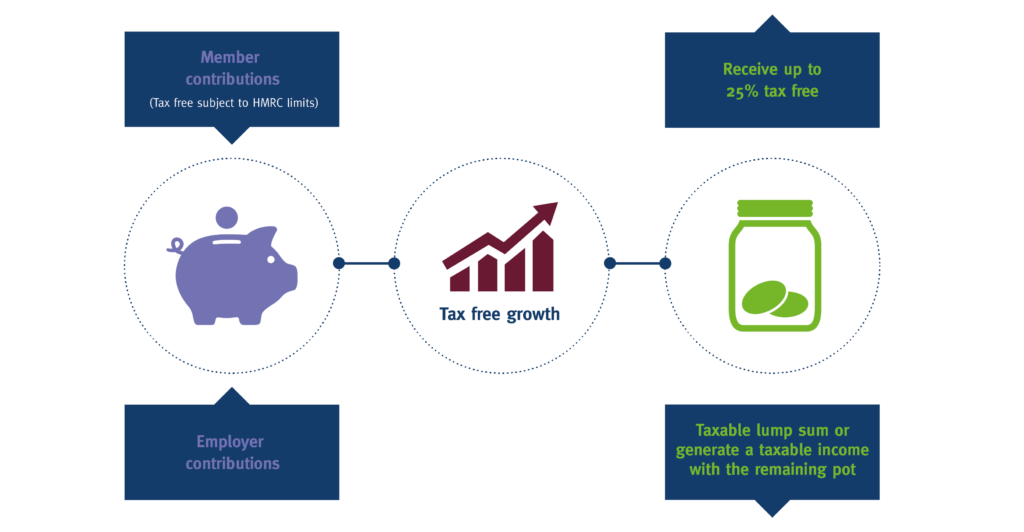

In the graphic below, the piggy bank represents your pension. It shows your contributions, your employer’s contributions and the pension being invested tax-free. Under current rules, you could take up to 25% of that pension pot tax-free from age 55, (the government is looking to increase the minimum pension age to 57 from 2028) and the rest would be used to provide an income. You have a number of choices on how to do that.

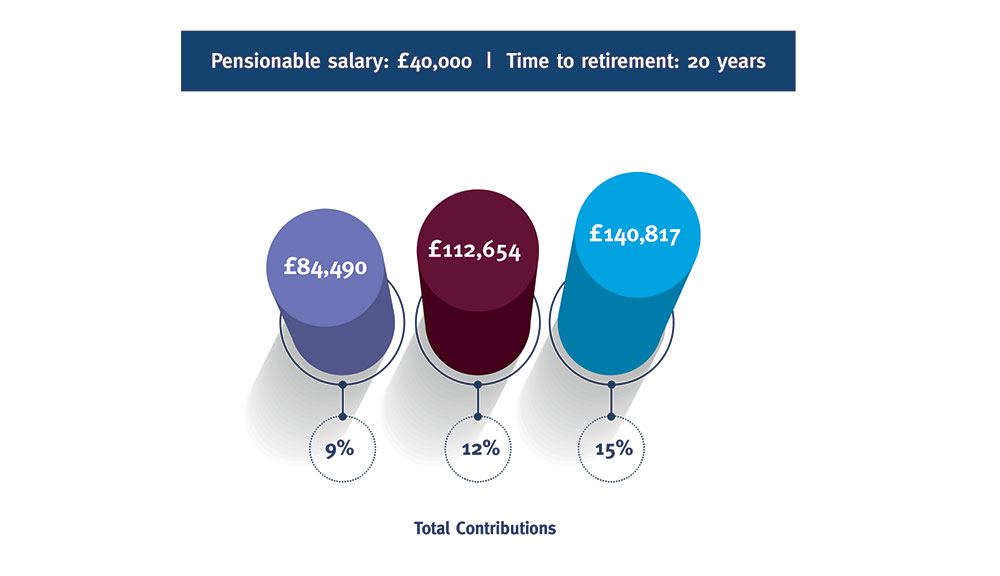

By increasing the contributions that are made into your pension, you can increase the amount you will have saved at retirement. The exact impact of an increase in contributions is not possible to predict, however it can be estimated by making assumptions about investment returns, inflation and any future pay rises you may get.

As an example of the potential impact of increasing contributions, below is an estimate of the value of pension savings a member might have if they paid a total of 9%, 12% or 15% into the Plan. Remember these are made up of both member and employer contributions.

- Annual salary increases by 2.5% each year

- Annual pension charges of 0.75% apply

- Investment growth is 5% each year

- All values are shown in today’s money and assume 2.5% inflation each year

- Note that growth, inflation and charges vary and may be higher or lower

Your LSEGPP investments

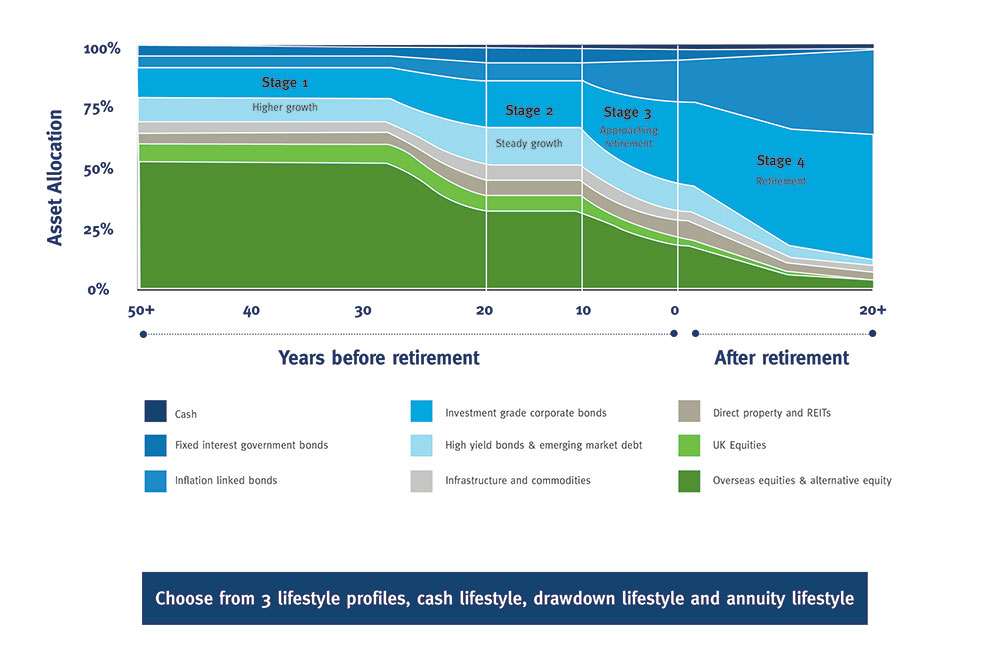

The default investment fund is a target date fund (TDF) – The Legal & General Generation 3 target fund.

Target date funds target an investment mix at retirement that is intended to align with the age you choose to access your pension. The main principle of target date funds is to target long term growth during your career and then to gradually switch your investments as you approach your retirement age. Below is an image that provides an illustration of how this gradual switching can be applied as you approach your chosen retirement age and into retirement.

For those who would prefer greater involvement in the investments they hold in their LSEGPP, there is the option to choose your own investment funds.

You can check the way your pension is currently invested and make any required changes by visiting the account management pages on the Legal and General website.

Pension Scams

Scams around pensions are becoming increasingly sophisticated. Here are some tips to help avoid falling victim to them.

1. Reject unexpected offers

Pensions cold calling has been illegal since – 9th January 2019

Investments cold calling is still legal

2. Spot the warning signs

Visit www.thepensionsregulator.gov.uk/pension-scams

3. Check the firm is FCA authorised

4. Check the FCA warning list

www.fca.org.uk/scamsmart/warning-list

5. If you’re suspicious report it

Report it to the FCA on their consumer helpline:

0800 111 6768

Remember – Often fraudsters claim to represent authorised firms

State Pension

In April 2016, the State Pension changed to a new single tier State Pension known as the new State Pension, still based upon National Insurance (NI) contributions. There is a deduction for individuals who were contracted out of the Additional State Pension.

In reality, not everyone is eligible for the maximum amount of the new State Pension. Therefore, it is important to check your State Pension record and NI contribution history early. To receive the full new State Pension, you normally require 35 years of NI contributions.

Click here to visit gov.uk to find out what your new State Pension amount is currently (based on your NI record to date). Below is an example of what you may see. It shows your forecast based on completing an expected number of years NI payments and an estimate based on your current record.

If you have any gaps in your National Insurance record you may still be able to make up the difference. You can request a State Pension statement using a BR19 form, available online or by calling the government helpline on 0345 3000 168.

You don’t have to claim the State Pension as soon as you reach State Pension age. You can defer it to increase the amount you receive at the agreed later date. However, you should consider all options before making your decision.

Under the current law, the State Pension age is due to increase to 67 between 2026 and 2028 and to further increase to 68 between 2044 and 2046. However, the government are considering reviewing plans to bring this forward and the State Pension age would therefore increase to 68 between 2037 and 2039.

To find out your State Pension age please click here to visit gov.uk.

Annual Allowance

HMRC limits the tax efficiency offered by pensions. The Annual Allowance (AA) – limits the value of contributions or growth that can be made into your pension(s) before a tax charge is applied.

The AA is based on your earnings for the year and is capped at £60,000. This reduces to £10,000 if you’ve started drawing a defined contribution pension through a flexible arrangement. This is called the Money Purchase Annual Allowance (MPAA). If you exceed your available annual allowance you will be charged an annual allowance charge. If the charge is greater than £2,000, you have the option to ask your pension scheme to pay the charge from your pension savings. You should contact your pension scheme directly and ask them how to apply for this and the deadlines for submission.

If you’re a member of a DC scheme this is simple to work out and can be achieved by looking at your contributions for the year. If you’re in a DB scheme this can be a little more complex to work out. Your AA is tested against the increase in the value of your retirement benefits each year if you have a significant salary increase in a particular year you may be at risk of exceeding the AA. If you believe you may be affected by this, please contact your scheme administrator.

Tapered Allowance

For high earners, (i.e. those earning over £200,000) the AA can be reduced. For every £2 of income above £260,000 the AA is reduced by £1 up to a maximum reduction of £50,000. This means that the AA would reduce to £10,000.

The limit on tax-free cash

Lump Sum Allowance (LSA): The maximum tax-free cash is limited to 25% of the pension value, subject to a total cap of £268,275 (which is set to be frozen)

Lump Sum and Death Benefits Allowance (LSDBA): The maximum amount of non-taxable lump sums that can be taken from a pension, set at £1,073,100.

Those individuals who already have a protected right to take higher tax-free cash will continue to be able to do so.

Tax relief and Salary Sacrifice

Salary sacrifice is where you agree to exchange part of your salary so you can get extra benefits from your employer. In terms of a pension, this can mean reduced tax and NI. With salary sacrifice, an employee agrees to reduce their earnings by an amount equal to their pension contributions and in return the employer will make the total pension contribution, meaning no further tax relief can be claimed on pension contributions.

Salary sacrifice can give you the same amount of contributions for a lower overall cost, or a higher level of contribution for the same overall cost.

Whilst salary sacrifice has many benefits there are also considerations. One of which is that once you perform a salary sacrifice your overall pay is lower, so this can affect factors like applying for a mortgage or your employee benefits. You also don’t receive the government contribution towards your pension as you’ve already received tax relief upfront.

The key to a successful retirement is in the planning… but when is the best time to start? As a rule of thumb, the sooner the better! Some people plan in great detail whilst other don’t. However you choose to plan, it is important to understand how much you may need and what you will do in retirement.

To help you understand how much you might need click here to visit Money Helper and use their retirement calculator.

The money you have in retirement may come from a number of different sources. It will be beneficial to get an update on the different workplace and private pensions you may have and who is responsible for providing them. This is key to understanding how much you can expect to receive.

You may receive more than one type of workplace pension in retirement. As mentioned in the pensions section, there are two main types of pensions and it is important to know which you have.

There are many ways you can fund your income in retirement. You can use cash, ISAs, equity from downsizing your home, and other savings and investments you may have as well as pension savings. Please refer to our saving and investing section for more information.

Retirement can last a long time, but by creating a budget, you can estimate how much income you might need.

An important aspect of planning your retirement will be ascertaining where your income will come from.

Some people have to rely on the State Pension as the main source of income; others have many different pension pots they have accumulated over their career.

Whatever your situation is, it’s paramount that you know (by checking your statements) that you are on track for the income level you need when you finally stop working.

You may have other investments and savings you can take an income from or may have plans to downsize your property and release the equity.

Obtain your up to date pension statement and make sure you fully understand it as there are a few options you may wish to consider such as:

- Converting some of your pension to a lump sum

- Defer taking your pension at Normal Pension Age (NPA) and benefit from an increase

- Taking your pension earlier than NPA and reducing the income you receive

- Using any AVCs you may have accumulated to increase your income

- Reducing your working hours and using the “Flexible Retirement” option (depending on which scheme you are in)

If you have a defined contribution (DC) scheme, there are five main options for you to consider:

Do Nothing

From the age of 55 (The government is looking to increase the minimum pension age to 57 from 2028) your pension fund is accessible whenever you want it, but just because it is available doesn’t mean that you should take income from it immediately. You can wait until it is in your best interests to take any income from your pension and in the meantime, your pension savings can remain within the tax efficient pension wrapper. You could also make additional contributions to your pension fund during this time. This means that the capital value of the fund can fluctuate down as well as up, as it is subject to investment risk but continues to enjoy the favourable tax environment offered by pension schemes.

Take all your pension savings as cash

Pension freedoms introduced in 2015 allow you to take all of your pension savings as a cash lump sum. The first 25% you take will normally be tax-free and the remainder will be added to your income and taxed at your marginal rate. Care should be taken when withdrawing money from your pension, especially large amounts, as the taxable element may take you into a higher tax bracket and you could end up with less money than you anticipated. Cashing in a pension fund may be appealing for some, but it is important to consider how you are going to fund your retirement going forward.

Buy a lifetime annuity

You can purchase a lifetime annuity from an insurance company who agrees to pay you a regular income until you die. The annuity available will depend upon various considerations such as the value of your fund, age, health, lifestyle and the type of annuity you choose. You can decide whether the payments from your annuity stay level, increase or decrease over time and whether or not you want any guarantees. If you buy an annuity you will usually have no on-going involvement with the investment of your pension fund. The purchase of an annuity could be the right choice for those who want security of income and no on-going investment risk. However, you should seek regulated financial advice when considering your retirement income options.

Utilise income drawdown

Income drawdown, also known as ‘flexi-access drawdown’ is available to anyone from the age of 55. The pension fund remains invested* and you draw an income from the fund. There is no minimum or maximum level of income, so you have the flexibility to decide on the level of income which suits you.

*This means that the capital value of the fund can fluctuate down as well as up, as it is subject to investment risk but continues to enjoy the favourable tax environment offered by pension schemes.

Phased retirement

Phased retirement is a strategy based on removing some of your money out of your pension savings while leaving the rest invested*. This can be done as and when required; you will receive part of the payment tax-free (usually 25%) with the balance applied to provide income. This can be either by the purchase of an annuity or income through income drawdown.

Whichever option you choose, it is important to:

- Fully understand the different options available, how they work and the tax implications of your choices

- Make sure the options you choose match your objectives and attitude to risk

- Seek regulated financial advice as this can be a complicated area

You should consider the personal and investment risks you might come across when you retire and how they could affect your retirement choices. For example, life expectancy, inflation, and a rise or fall in the stock markets could have an impact on your retirement income.