Borrowing money is a necessity for many people, ranging from large purchases such as homes and cars to credit cards for covering holiday spending. The world of borrowing and debt can be confusing and stressful, in this section we aim to help you improve your understanding by looking at 3 key areas: types of borrowing, paying off debt and credit scores.

Borrowing

Before you decide that you need to borrow money you should first ask yourself:

- Why am I borrowing this money?

- Could I save and buy the item another time?

- Can I afford to pay back the money and how much will it cost me?

A good way to think about borrowing money is that you’re not borrowing money from the lender, you’re in fact borrowing money from your future self. Is this purchase worth making your future selfless well off? There could be alternatives such as buying an item second hand rather than new or getting a cheaper version of the product.

If you’ve decided that you definitely need the item and you can’t use any savings or pay for the item any other way, then you will need to look at how you should finance the purchase.

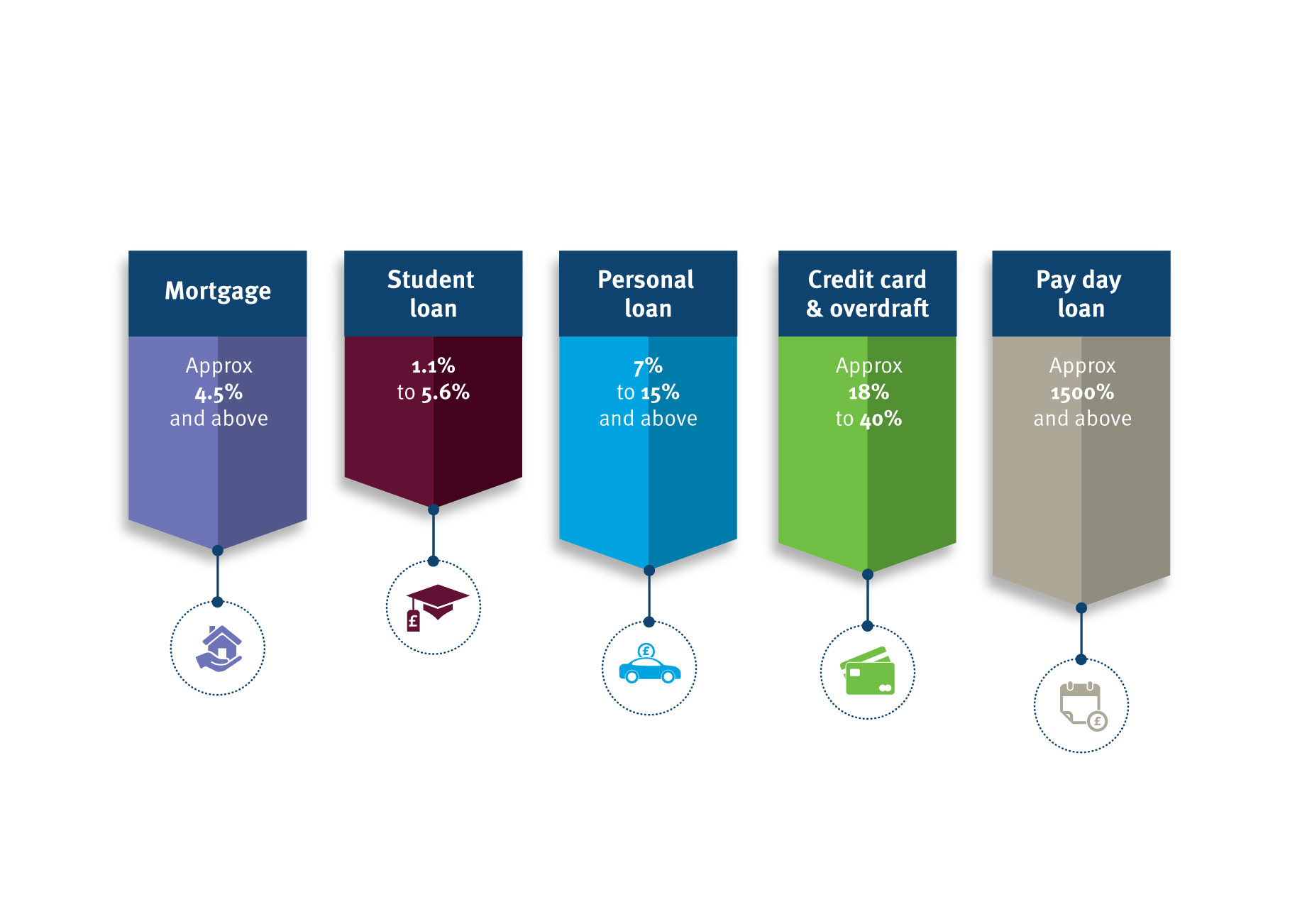

As you can see from the graphic above, rates may vary depending on how you choose to borrow.

When looking at borrowing money, shop around and compare deals, looking at:

- The interest rate and the APR.

- How much you will repay in total.

- The cost per month and if this is fixed or variable.

Some of the most common types of lending are explained below.

Mortgages

A mortgage is exclusively used to finance the purchase of a property and it’s unlikely that you’ll be able to finance this type of purchase in a different way.

To learn more about mortgages, buying your first home or re-mortgaging please click here to visit the topic.

Personal loan

A personal loan could be a good idea if you need to make a large purchase and plan to pay back the money over a number of years. Most loans have a fixed interest rate, meaning you agree to pay back a set amount per month for a set period of time. Remember to shop around as the interest rate offered may vary between lenders and more importantly – so will the total amount you end up paying back.

If you’re looking for a short term loan for a smaller amount, a better option could be a credit card.

For more information on personal loans please click here to visit Money Helper.

Credit cards

Although credit cards can be a more expensive way of borrowing, they often have zero percent offers on, meaning you don’t pay any interest at all if you pay back the money within the interest free period.

Credit cards work by allowing you to spend up to a pre-agreed credit limit. You will normally get a statement each month, if you repay the money within a certain timescale (normally 28 days, although you could be on a zero percent offer for longer) you won’t be liable for interest. If you do not repay the money within the timescale given, then you will pay an interest rate often over 18%!

When you’re making a purchase on a credit card, you also get protection under section 75 of the Consumer Credit Act for any purchase over £100. Section 75 means that the credit provider is responsible for ensuring that the goods you have paid for arrive and are not faulty. If either of these scenarios happen and the retailer won’t help you, you can contact your credit card provider to help out under section 75. This isn’t to be confused with insurance or a warranty. To read more on section 75 visit Money Helper by clicking here.

For more information on credit cards please click here to visit Money Helper.

Overdrafts

Overdrafts are available as either arranged or unarranged, both of which can be an expensive way of lending and should only be used to fall back on in an emergency if you don’t have savings. Recent changes by the FCA mean that banks are changing the way they charge for overdrafts so you should check what your bank’s charging structure is before agreeing to take an overdraft.

For more information on overdrafts please click here to visit Money Helper.

Payday loans

Payday loans are not to be confused with regular loans. They are shorter term (often only one or two months) and crucially they charge a much larger interest rate and APR. They are also viewed negatively by most lenders so having one on your credit file can be detrimental if you’re applying for another sort of borrowing like a mortgage.

Payday loans are one of the most expensive ways of borrowing and should be your last resort. Not only due to the high interest rates but also due to the behaviours of many payday lenders, often encouraging borrowers to take out more loans resulting in a cycle of debt.

If you’re considering taking a payday loan think of the following:

- Do you definitely need the money now?

- Could you borrow the money another way?

- Do you have friends or family that could help?

- Check if your employer offers “Salary Finance”

For more information on payday loans please click here to visit Money Helper.

It is generally advisable to pay off any debt (apart from mortgages) before saving money.

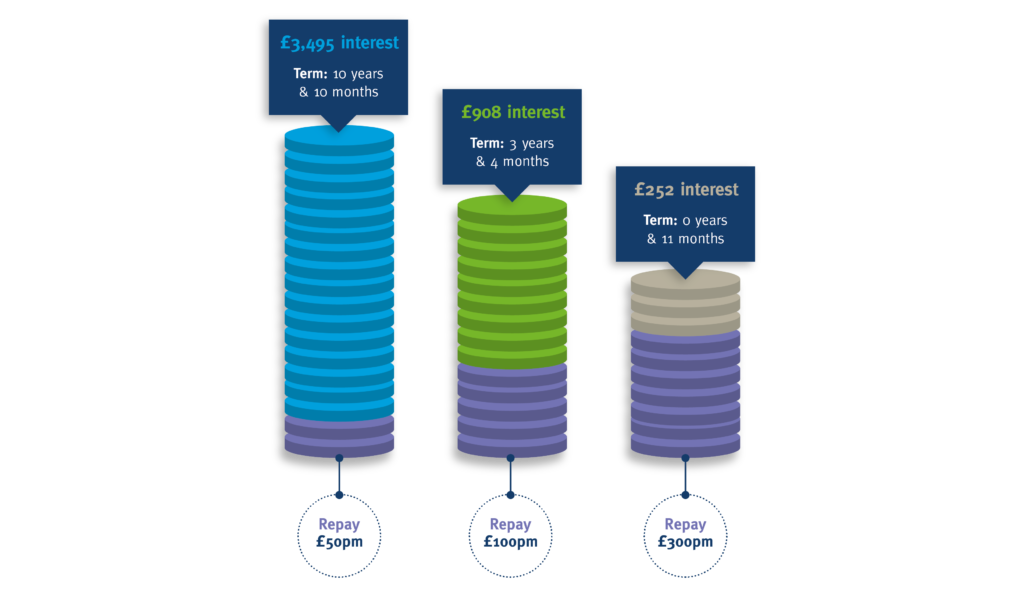

As you can see from the graphic below, saving money while still having outstanding debt can be counterproductive.

Paying off debt can be a long process depending on the scale of your debt. If you have large debts, it can be easy to give up, especially if you’re on a limited budget. Like budgeting, you need to take control of any outstanding debt by creating an action plan to pay it off. First, to create your action plan, find out each of your debts:

- Outstanding balance

- Interest rate & APR

- Any repayment charges

Once you know this information, you’ll be able to organise your debts into a list from the highest interest rate to lowest. You should attempt to pay off the debt with the highest interest rate first. Once you’ve paid off the debt with the highest interest rate you should continue to move down the list until you are debt free.

You can see what impact making overpayments towards your credit card rather than making minimum payments can have on the interest you end up paying:

A credit score or credit rating is used by lenders to help assess the risk that the borrower will repay the debt or default on repayments.

Your credit rating could influence if you’ll be accepted for the application, how much you can borrow and at what rate.

Your credit rating is based on a number of factors ranging from how you’ve behaved with borrowing in the past to if you are on the electoral roll. There are a few different providers of credit scoring services and your score may be different with each. The higher your credit rating, the more likely you’ll be accepted for credit.

You can check your credit score for free online, below are some of the providers you can do this with, but be aware that you may need to cancel any membership after a free trial period ends.

If you have checked your credit score and you think it could be improved, you could try some of the methods on the following list to boost your score:

- Try not to make multiple credit applications in the same month

- Stay with the same bank for a long time

- Avoid moving house too often

- Register on the electoral roll

- Set up Direct Debits to repay debt on time

- Clear any outstanding debt

- Use a well-managed credit card, paying off in full each month

- Stay away from payday loans

- Remove any people linked to you on your credit file, who you are no longer associated with

- Cancel any credit cards that you no longer use

For more information on credit scores please click here to visit Money Helper.