Managing your money is key to successful financial wellbeing. In this section we will look at the current cost of living crisis, how to be careful with your money and energy, as well as the support available from the Government.

Money Management

Cost of living increases

The UK’s rate of inflation is rising at its fastest rate in 30 years – with energy, food and fuel increasing in price, in this section we will explore the different ways in which you can make your money go further.

What is inflation?

Inflation is the term used to describe the increase in prices over time. The UK measures this using the Consumer Price Index more commonly known as CPI. CPI looks at the average prices of a typical basket of consumer goods and services, such as transportation, food and utilities. As the price of these goods and services rise and fall, so does the rate of inflation.

How does this affect me?

Broadly speaking, this will mean that the purchasing power of your money will decrease as inflation increases. Inflation may impact people differently as we spend money in different ways. For a good indication on how inflation is impacting you, click here to take a look at the inflation calculator provided by the Office of National Statistics

Even if we’re affected by inflation to a lesser degree, costs will still be rising in some of the goods and services we use, so it’s a good idea to know what your income is, what your expenses are and how you can reduce those costs. One way to do this is by creating a budget. This can be achieved by using apps, spreadsheets or just a pen and paper.

In its simplest form, a budget planner is a list of all of your income and outgoings. Your income would be everything you gain money from including your job, investments or any other income.

1. Calculate your income

Your income will be all of your household income. Mainly, this will be your salary but can also include other income such as benefits, interest from savings, rental income or income from any other assets you may hold.

2. List your outgoings

Your outgoings should be all of your expenses including direct debits, day to day living expenses such as shopping, debt repayments and all other expenditure including one off spends like an annual holidays or planned home improvements.

To create an accurate budget planner you’ll need to be honest with yourself. The easiest way to do this is by having access to your bank and credit card statements.

3. Work out your surplus/deficit

To work out your surplus/deficit you need to add up all of your outgoings & expenses and deduct these from your total income.

If you budget for your household, it is a good idea to do this with your partner if you have one. Not only will this enable you to get accurate figures but by working on this together, you’ll both know where you are financially.

To help you with this, there are a number of budgeting tools you can use such as Money Helper (online), Emma and Money Dashboard (apps).

These Apps use open banking regulations to access all your financial information in one place. Doing this can highlight areas of spending that you hadn’t spotted before. The Financial Conduct Authority (FCA) regulate both the aforementioned apps.

4. Take action

Once you have completed your budget you will know if you have spare money or do not have enough money to meet your regular outgoings. Should you have a surplus, you may look at saving this and building an emergency fund or saving for another objective.

If you have a shortfall you may need to revise your budget planner to identify areas where you can reduce your outgoings. Please continue reading for further hints and tips to make your money go further.

As well as helpful apps there are also websites and web extensions that can help you save money if you are willing to let technology do the hard work for you.

Price tracking websites

Camelcamelcamel and idealo allow you look up the price history of any product by entering its URL or searching the product name. Camelcamelcamel is exclusively used for products on Amazon whereas idealo searches other websites across the internet.

This allows you to see if today’s price is a good price or if you’re viewing an inflated price. Below is an example of how the price of a Nintendo Switch has fluctuated over two years from highs of £300 to lows of £229.

You can also set “price drop” alerts so you receive an email or notification when a product reaches the price you want to purchase it at.

This can be a useful tool. If you were looking for a present for an upcoming birthday or Christmas. By planning, you can make the purchase when it is at a reasonable price and avoid overpaying.

Camelcamelcamel is also available as an internet browser extension.

Idealo is also available as an app.

Discount and promo codes

In addition to purchasing products at their lowest price you can also use these hacks to find promo or discount codes.

Browser extensions

There are internet browser extensions that alert you when a promo code is available once an item is in your “basket”. Some browsers are free which may be suitable for most people but there are also paid for versions which may give enhanced rewards and discounts.

Get an alternate email address

Many companies email promo codes out to people who will subscribe to their newsletters or people who are willing to become free members. Often, people are put off doing this because they don’t want lots of emails clogging up their inbox. One idea is to create a free alternative email address that you exclusively use for signing up to brands that you use regularly. This way, when you want to make a purchase, you can search your inbox for emails from the brand and use any current promo codes.

Contact the company

The current cost-of-living crisis isn’t just impacting consumers. As people are spending less money, businesses are always looking for new customers or methods of making more sales. It’s worth contacting a company and asking if they have any current promo or discount codes before making a purchase, especially if an item isn’t currently on sale or if you know they have a newer model or change of season coming up.

Use a search engine

Sometimes users who have already got discount codes post them on forums or blogs so using a search engine to search for the company name followed by “discount code” can be an effective way of revealing discount codes that you haven’t found elsewhere.

Millions of households that weren’t lucky enough to fix onto a long-term deal are experiencing a rise in their gas and electricity price. The price increases are linked to global increases in fuel prices and ongoing political events such as changes to the Government price cap.

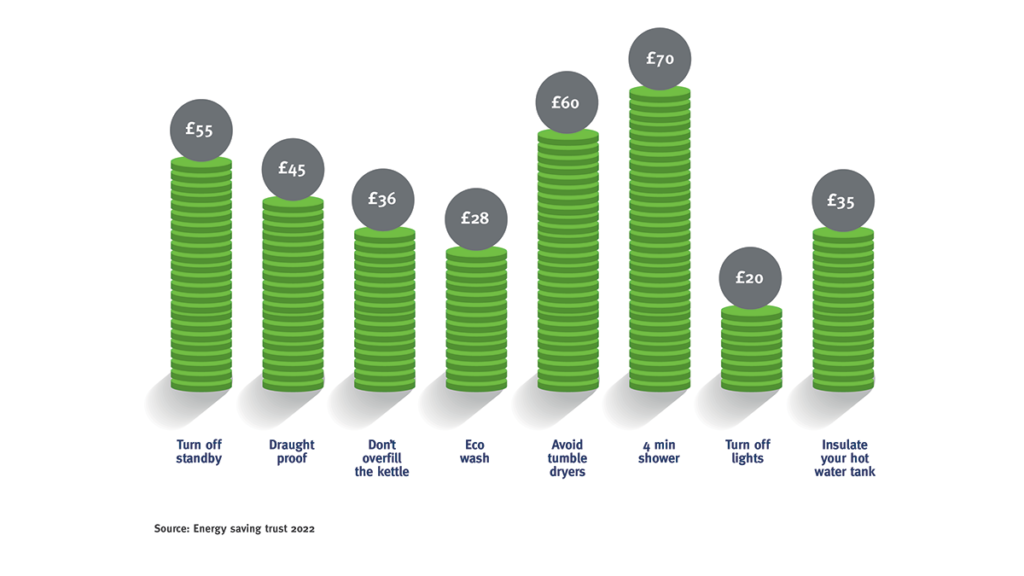

There are ways in which you can change your habits around the home in order to save money and reduce your carbon footprint.

Only use energy where you need it

It’s a good habit to get into turning off appliances when you no longer need them and just by turning appliances off standby and turning off lights you could save approximately £75 a year.

Only heat the rooms you use. Using smart devices with apps like Hive, Nest or Todo can work in the background to only heat the room you’re in or adjust the heating settings.

Heat the human not the home

Rather than heating a whole house you can wear more layers of clothing or purchase energy efficient heating items. MoneySavingExpert recently tested several items and found that electric heating blankets and heated vests can cost 3 pence per hour and items like USB hand warmers or insoles can cost less than 1 pence per hour to use!

Consider how you cook

Sometimes there’s an alternative, less expensive way to do something. So, by considering which appliance you’re using before preparing your food you could save money.

The price comparison website Uswitch has published energy saving guides. These show that ovens use more energy, especially older less efficient ones. So, by heating up your food in a microwave or cooking using a slow cooker you could save up to £60 a year.

Be economic with your washing

If you have a dishwasher or washing machine, only use it when it’s full and consider using Eco mode. These washes take longer but use less water and a lower temperature than most settings.

Although an Eco wash may take longer, it can save money and ensure your items are still clean by washing for longer at a lower temperature. Heating the water is the most energy hungry part of the process so you can save money if you have the time.

Once you’ve done your clothes washing you should also consider how you dry your clothes. One of the highest users of energy in the home is the tumble dryer. If possible, dry items of clothes on a clothes horse or washing line and save approximately £60 per year.

When washing yourself, it could be a good idea to switch from a bath to a shower. The energy savings trust says that by switching a bath for a shower once a week you could save £12 a year and if you can cut your showers down to 4 minutes per shower, you could save £70 a year!

Council tax

If you’re the only adult living in your household or you fit certain other conditions listed here, you may be able to get 25% off your annual council tax bill, even if you’re only living on your own temporarily.

By default, most councils charge council tax over a 10-month period. If you’d like to spread the cost and make a lower monthly payment, most councils will allow you to pay your council tax over 12 months instead. You can contact your local council and request this.

Tax-free childcare

The government offers up to £2,000 a year per child towards your childcare costs from a registered childcare provider. This can include:

- Nursery

- Childminder

- Nannies

- Au Pairs

- Pre-school clubs

- After school clubs

- Play schemes

- Wrap-around care

- Holiday clubs

To use the scheme, you’d create an account on the government’s website and for every 80 pence you pay in, the government will pay in 20 pence. This is limited to £500 of government top up every 3 months and £2,000 per year.

So, you could get £10,000 worth of childcare per child per year for just £8,000.

Quick tip

To calculate how much to pay into your account, multiply your childcare bill by 0.8.

Example:

If your childcare bill was £600. You’d calculate £600 x 0.8 to get £480. The government would pay the extra £120 into your account. You then arrange for your childcare provider to take the £600 from your account.

You can see a full list of providers once you log into your account.

To be eligible for tax free childcare you and your partner (if you have one) need to be working at least 16 hours a week and your child needs to be aged 11 or under. However, there are some circumstances where you may be eligible even if you don’t meet those criteria listed here.

You can apply online for tax free childcare here.

Benefits

It’s commonly thought that benefits are only for people who are not working or who are working part time. However, if your household income is below £50,000 you could be entitled to some benefits or grants. You can find out exactly what benefits you are entitled to by taking approximately 15 minutes to complete a questionnaire on one of the governments approved calculators:

The following image shows typical benefits that you may be entitled to:

Marriage allowance

If you are married and one person earns less than £12,570 per year and the other is a basic rate tax payer, you can transfer your unused tax allowance saving up to £252 click here for more information and how to apply.