Writing a will is an important step in financial planning, not just for you but for your loved ones too. In this section, we aim to help you understand why it’s important and what could happen if you die without a will. We also cover Powers of Attorney, which is an instruction for someone else to act on your behalf.

Estate planning

Inheritance tax is applied at a flat rate of 40% on an individual’s estate at the point they die. There are however nil rate bands that can apply to an estate before this charge is calculated which in some cases may mean there is no inheritance tax charge to pay. The nil rate bands that can apply are:

- £325,000 nil rate band. No inheritance tax is payable on the first £325,000 of an individual’s estate

- £175,000 residence nil rate band. No inheritance tax is payable on the first £175,000 of an individual’s primary home, provided it is left to their direct descendants.

Another important exemption to be aware of is that any gifts to your spouse/civil partner are exempt from inheritance tax. Any unused portion of the above nil rate bands can also be passed to your spouse / civil partner on your death.

In addition to these allowances and exemptions that apply on death, there are numerous allowances that can be used whilst you are alive that can help reduce a potential tax charge on your death. These include an Annual Allowance for gifts, making gifts from income and exemptions for gifts made more than 7 years prior to death. Read more about all these allowance and exemptions, click here to visit gov.uk.

Why write a will

A will makes it simpler for your family or friends to sort your affairs out when you die and pass the right things on to the people you’d like. Without a will the process can be more time consuming and stressful and not everyone may agree with how your belongings should be shared out.

Writing a will is especially important if you have children or other family who depend on you financially. If you have children, you should make a will so that arrangements for the children can be made if one or both parents die. Within the will you can specify who you would like to be the children’s guardians. If you have not done this, guardians for the children will be appointed and they may not be who you would have wanted.

You may be able to take advantage of free will month and provide some support to charity at the same time. Click here to visit age UK.

What happens if I don’t have a will

Whether you have a will or not, when you die your belongings are grouped together to make up a legal term known as your estate.

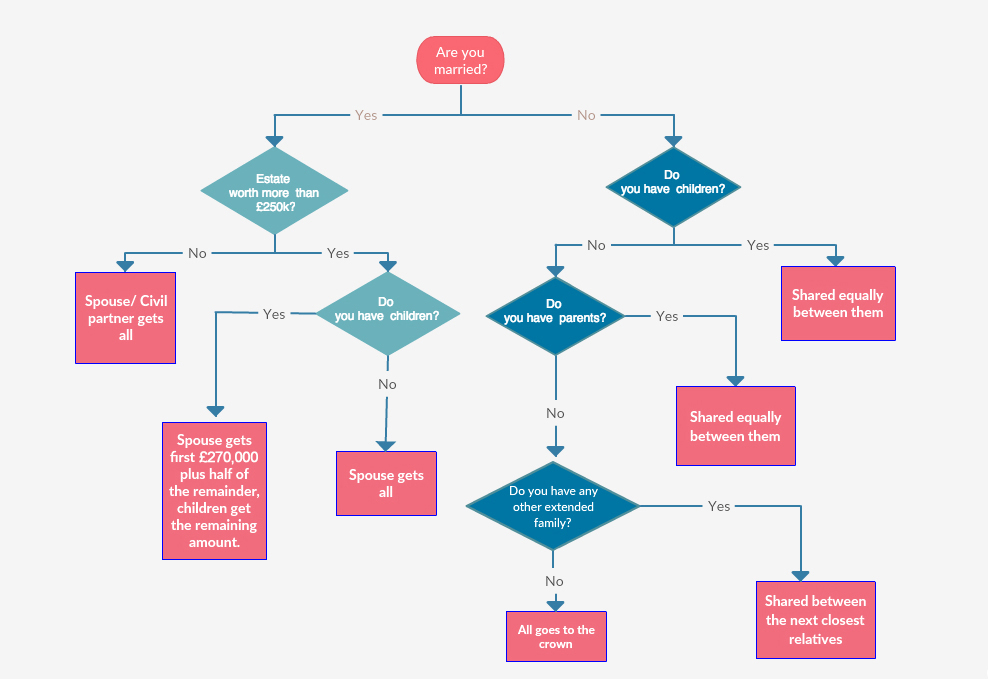

If you die without a will, your estate will be shared out in a standard way which may not be in the way you’d like. The way your belongings are shared out varies depending on which country in the UK you live in. These are called intestacy laws.

Only married or civil partners and some other close relatives can inherit an estate under the rules of intestacy. Unmarried partners or partners not in a civil partnership will inherit nothing without a will. Below is a diagram which shows how your estate would be shared out if you had no will and died while living in England or Wales.

For information on the laws of intestacy for Scotland and Northern Ireland please click here to visit gov.uk.

How to write a will

Although you can write a valid will yourself, it can be complicated if you have shared assets like houses or bank accounts or if you’ve been married or divorced. There are a number of ways you could write a will.

Firstly, a solicitor could produce a valid will for you. This may be the most expensive option in terms of upfront cost, but it could be the best value option if you have a number of people you’d like to inherit your estate, or if you think that inheritance tax may have to be paid. A good solicitor will help you plan your will around current inheritance tax laws, as well as giving you the peace of mind that the will would be valid and has been completed by a regulated professional.

You could use a will writing service available either by arranging a qualified will writer to visit your house or by doing it online. This is normally cheaper than using a solicitor. If you use a will writing professional, they should be a member of the ‘Institute of Professional Will Writers’ or ‘The Society of Will Writers’ which will mean that although they are not regulated in the same way as solicitors, they will have had to undertake training.

If you use an online company to do your will or use a shop bought pack, check the company’s reputation and reviews. There is no guarantee of the will being valid but this could be a good option if your plans are simple and do not require complex instructions.

Alternatively, many charities offer a solicitor will writing scheme at either a discounted cost in the form of a donation to the charity or for free. These wills are usually written or checked by a solicitor so you can have confidence in these wills.

There are also yearly events arranged by charities like ‘Free Wills Month’ and ‘Will Aid’. ‘Free Wills Month’ runs every March and October and allows anyone aged over 55 to get a will written by a solicitor for free. If you’re getting a will as a couple, only one of you needs to be over 55.

‘Will Aid’ runs every November and is available to people of any age. Solicitors involved waive their fee for writing or amending a basic will, and invite people to make a voluntary donation to ‘Will Aid’ which distributes funds to its partner charities.

Although these wills are advertised as free, it is hoped that you would make a donation to the charity or leave something to the charity in your will in exchange for the will writing service.

Once you’ve written a will it’s also important to update it after any major life events. A marriage or divorce will automatically revoke a will, meaning the estate is subject to intestacy laws covered in the intestacy section. Although this is useful as people are not likely to want to leave inheritance to a former partner, it can also be a bad thing as all the other directions in the will are invalid too.

Other considerations

It is possible to change the way in which a person’s estate is divided up with or without a will, so long as all parties who are negatively affected by the change agree.

This is known as a deed of variation. A deed of variation must be used within two years of the person’s death and could be used to help with inheritance tax, or to provide for a partner who has been cut out of inheritance due to intestacy laws or an out of date will.

If you die without a will and have no surviving relatives, everything passes to the crown. In the circumstances where you believe you should be entitled to an estate but the crown has inherited everything, you may challenge this but would need suitable legal advice.

For more information on wills, please click here to visit Money Helper.

One type of power of attorney allows you to give an attorney the power to make decisions about things like medical care and life sustaining treatment, moving into a care home or the way your daily routines are assisted if you’re not able to perform normal activities like getting dressed or washed.

This can only be used when you lose mental capacity. The definition of this varies depending on where you live in the UK so check the links to the government website to find out more in your area.

The other type of power of attorney gives an attorney the power to make decisions about your finances. This can be day to day activities like managing your bank account, receiving benefits and paying bills, but it can also be larger things like selling your home. It’s really important you know and trust the person who would be doing this for you. This type of power of attorney can be used as soon as it’s registered but needs your permission.

Depending on which country you live in in the UK there are slight differences. We’ll now look at the names of the documents in each region and what is possible.

A power of attorney is a legal document detailing who you would like to help you with important decisions about your finances or health when you’re not able to. This could be a partner, a son or daughter over the age of 18, a trusted friend or even a company.

Traditionally, people start to think of this as they get older, however, not being able to make decisions about your health or finances could happen at any time due to accident or illness. If you didn’t have this set up and someone had to try and make these decisions for you when needed, it can end up taking a long time and may involve costly legal fees. So it could be better to have one set up and never use it, than not have one set up when you most need it.

Although the process and names of the forms differ depending on where you live in the UK, broadly there are two types of power of attorney. Those that allow decisions about your finances and those that allow decisions about your health. In most areas of the UK you can either have one of these or both.

England and Wales

In England and Wales you can get a both types of power of attorney explained above.

These are known as health and welfare lasting power of attorney and a property and financial affairs lasting power of attorney.

Click here to visit gov.uk for more information for England and Wales.

Scotland

Both power of attorney documents are available in Scotland but have different names. A welfare power of attorney allows someone to make decisions about your health. A continuing power of attorney allows someone to manage all your financial affairs.

Click here to visit gov.scot for more information on Scotland.

Northern Ireland

In Northern Ireland there is only one type of power of attorney, an enduring power of attorney. It lets someone manage all your financial affairs. There isn’t a power of attorney that lets someone make decisions about your health

Click here to visit indirect.gov for more information on Northern Ireland.

Setting up a Power of Attorney

There are a number of things you need to think about when setting up a power of attorney.

Firstly, you need to decide who the power of attorney is going to be. Ideally, it would be an adult you’ve known for a long time and someone you trust. It may be better to ask someone younger than you to take the role, as someone your own age may experience similar issues at a similar time.

It’s important to note that you could have more than one power of attorney, so two or more people are sharing the responsibility.

Setting up a power of attorney can be done online via the government website. You can do this all yourself, so although you’ll have to pay a fee to create a power of attorney, you don’t have to pay a company to do this for you.

Once your chosen person understands the responsibility and accepts, you can find the forms online through the Government websites listed above.

Once you’ve completed the forms, you’ll then pay a fee and will have to register the power of attorney with the relevant department to make sure it is valid. The government link provided will guide you through the process, click here to access this guide.

Once the power of attorney is registered it can be used when needed, either if you lose mental capacity, or if you need to ask someone to help out with financial decisions.

To find out more and set up a Power of Attorney click here to visit gov.uk.

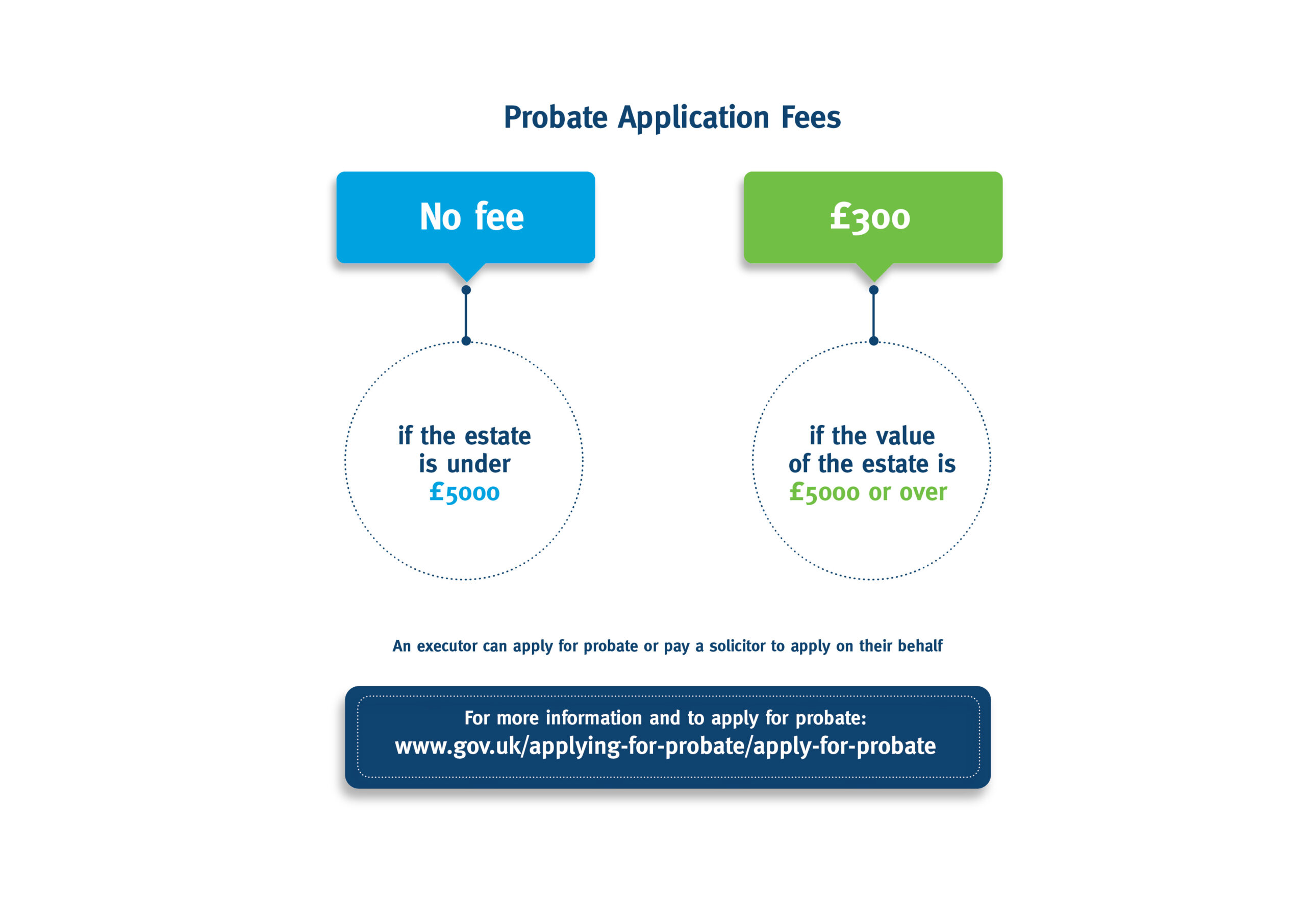

Probate is the legal right to deal with an individual’s estate when they die.

If the person left a will

- You can apply for probate if you’re named as the executor

- You will get a ‘grant of probate’

If the person did not leave a will the administrator deals with the estate

A spouse, civil partner or child can apply to be the administrator. You’ll receive ‘letters of administration’ rather than ‘probate’

If tax is due, at least some of it is normally payable before probate is granted

The executor can claim the tax back from the estate or the beneficiaries.