The minutes of the last Fed monetary policy meeting (held on 4 May 2022) were released on Wednesday (25 May 2022) and reading between the lines, we believe that while policymakers will increase US interest rates by 0.5% at their next two meetings (15 June 2022 and 27 July 2022), there is a strong chance that they will then stop for a breather.

Consequently, we believe that Fed policymakers may have finally realised that inflationary pressures have not only peaked, but are also starting to negatively impact demand, and as such if they aggressively increase interest rates they could trigger a recession.

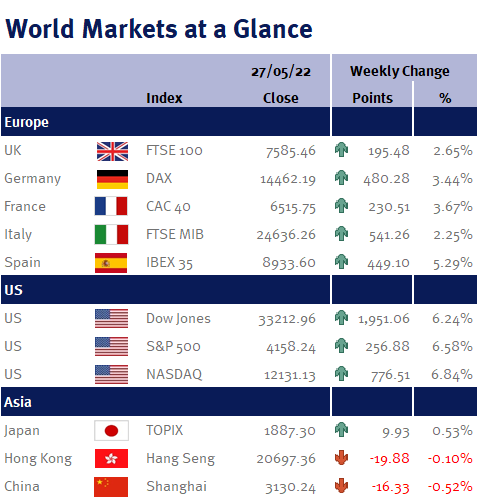

Accordingly, financial market pricing of future interest rate increases has started to subside – and as you can see from the accompanying table, this has been very positive for global equity markets.

Likewise, for the UK we have previously argued that the inflationary squeeze would weaken consumer confidence and spending, which would quickly put a stop to the BoE’s interest rate increases.

However, as John Maynard Keynes is believed to have said: “when the facts change, I change my mind – what do you do, sir?”, and given yesterday’s (Thursday 26 May 2022) support package from the Chancellor of the Exchequer, Rishi Sunak, our view will now have to change as unfortunately, what Rishi Sunak giveth, the BoE is likely to taketh.

This is because the support package will mean that: one, the UK economy will be more resilient than it would have been otherwise and, two, UK inflation will be higher – both of which now make it more likely that BoE policymakers will again increase interest rates!

Looking ahead to this coming week, US markets are closed on Monday (30 May 2022) for Memorial Day, while UK markets are closed on Thursday and Friday for the Queen’s Platinum Jubilee celebrations.

Consequently, it is a relatively quiet week for economic data releases. Of most interest to us will be US consumer confidence; US ISM; US employment data (non-farm payrolls; unemployment rate; participation rate; and average earnings); Eurozone CPI; Chinese PMI; Japanese unemployment; and Japanese industrial production.

Investment Management Team