Global equity markets rang in the New Year with the release of the minutes from the Fed monetary policy meeting held on 15 December 2021 – which were much more hawkish than we expected.

The minutes stated that in general, given the policymakers individual outlooks, “it may become warranted to increase” US interest rates “sooner or at a faster pace” than policymakers had earlier forecast – and as such the accompanying ‘dot-plot’, which is designed to show each policymaker’s interest rate forecast, is now projecting that there will be three interest rate increases in 2022!

As a result, financial markets immediately started to expect, and therefore price-in that the first of these three increases will occur in March.

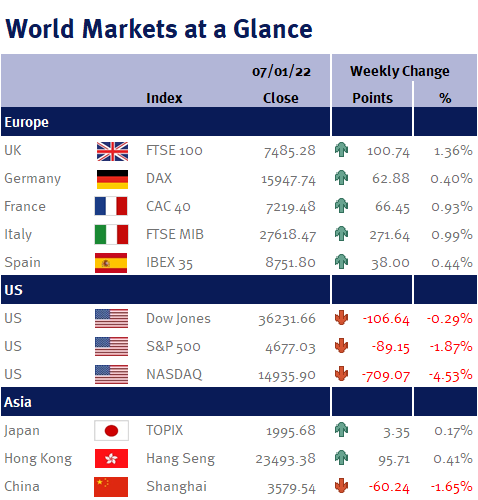

This caused a sharp sell-off in technology companies, as higher interest rates effectively reduces today’s value of future profits (in other words, the ‘NPV’, net present value) – and the technology sector includes many companies that are currently unprofitable but have high valuations based on their expected future profitability.