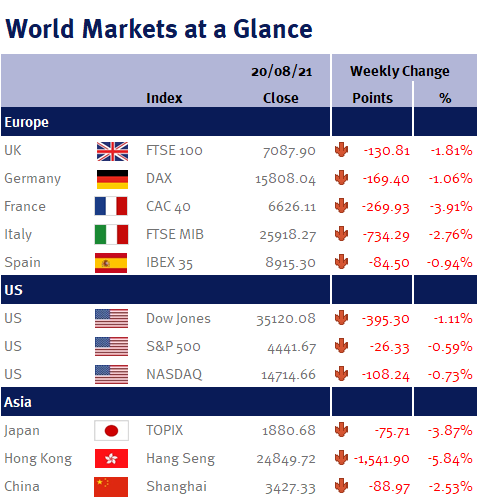

As you can see from the accompanying table, it hasn’t been a pleasant week for global equity markets as the resurgence in coronavirus cases has hurt share prices.

However, as we have previously stated, while the spread of the Delta variant will impact the global economic recovery, it is unlikely to put a stop to it as the bar for reinstating full-scale lockdowns is very high.

Data wise, Wednesday’s (18 August 2021) release of the minutes from the Fed’s last monetary policy meeting (held at the end of July), was the week’s big event. Unsurprisingly, given the comments from a number of Fed policymakers during July, the minutes suggested that if the US economy continues to progress as it is currently, then policymakers would consider starting to taper their monetary stimulus in the coming months.