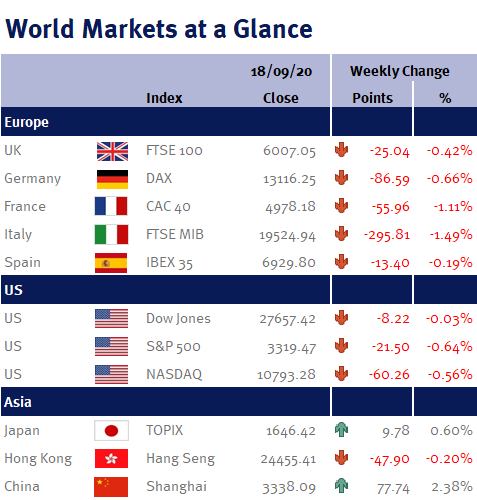

This week’s Fed monetary policy meeting was like an underwhelming party, in that it was disappointing, but hard to say exactly why – and as a result, after a promising start to the week, global equity markets reversed course and ended the week very slightly lower.

Week ending 18th September 2020

21st September 2020

We have long argued that interest rates will remain low for the foreseeable future, and so it was pleasing that the US Central Bank stated that it would keep US interest rates near zero for at least 3 years, despite their projections that the economy will be growing strongly by then. The Fed was able to make this commitment because they recently changed their inflation target from 2% to one that averages 2% – and as such they will allow inflation to overshoot 2% to make up for the time it has spent running below 2% (as we previously stated, please see here, the Fed’s favoured inflation measure, the Core PCE reading, has averaged just 1.60% over the past 10 years and is currently just 1.3%).

Although the US economy is performing much better than we expected just a few months ago in terms of GDP, unemployment and inflation (and we have been among the most positive commentators), it was disappointing that the Fed stopped short of increasing monetary stimulus (such as expanding QE or using negative interest rates) and instead put the emphasis on Congress to provide fiscal stimulus to help those American workers that have been hard-hit by the coronavirus outbreak and associated lockdowns, as we believe this is looking increasingly unlikely before the US Presidential elections on 3 November 2020 given the current stand-off between Republicans and Democrats.

However, what was very interesting to us was the fact that the Fed made increasing US interest rates conditional on inflation running above 2% as well as achieving maximum employment. Hitting one of these targets in the next 3 years will be a challenge and hitting both at the same time seems like an extremely big ask. Consequently, we would not be surprised if 2023 turns out to be way too optimistic for the Fed’s next interest rate increase – especially when you consider that after the 2008/9 global financial crisis, US interest rates were left unchanged for 7 years! This is exceptionally positive, as a loose monetary policy has been, and will continue to be, very supportive for global equity markets.

It was a similarly underwhelming story in the UK yesterday (Thursday 17 September 2020): in what could have been a watershed BoE meeting, ended up as a yawn as nothing significant materialised.

While we fully expected that the BoE would leave interest rates unchanged at 0.1% and its QE (asset-purchase) program at £745bn, we had hoped for firm stimulus signals (negative interest rates and/or more QE), especially after Wednesday’s (16 September 2020) UK CPI inflation data – as we forecast last month (please see here), UK inflation fell sharply from 1.0% in July to just 0.2% in August (its lowest reading since December 2015). Although we believe that UK inflation is likely to rebound slightly in September, as much of this dramatic fall was driven by the government’s ‘eat out to help out’ scheme (which has now finished), we still expect inflation to remain subdued and well below the BoE’s 2% target.

Although we didn’t get a clear commitment from the BoE, we believe it is only a matter of time (potentially before the end of this year) before policymakers cut UK interest rates to below zero given low inflation, a weakening employment market, a resurgence in coronavirus cases and Brexit uncertainty – and, as with the Fed, any dovish evolution in the BoE’s narrative will be will be very positive for equity markets.

Elsewhere, US jobless data indicated that the economic rebound is continuing, as initial jobless claims decreased by 33,000 to 860,000, while continuing claims (i.e. the total number of Americans on unemployment benefits) fell by more than 900,000 to 12.63m. This now means that the US economy has recouped roughly half of the coronavirus lockdown induced job losses. Additionally, today’s (Friday 18 September 2020) University of Michigan sentiment index showed that US consumer confidence increased to a six-month high – indicating that Americans are upbeat about the US economy’s prospects.

Looking at the week ahead, of main interest will be US, UK and Eurozone PMI; US mortgage applications; US home sales; US weekly jobless claims data; and UK and Eurozone

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.