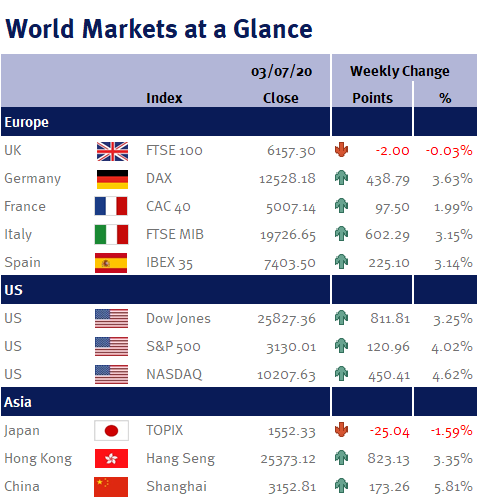

As you can see from the accompanying table, the majority of global equity markets ended the week strongly higher.

Week ending 3rd July 2020.

6th July 2020

However, this does hide some choppy intra-day moves as the tug-of-war between an economic recovery versus a rise in coronavirus cases yo-yoed equity markets.

While uncertainties have obviously increased as the coronavirus continues to spread across America, it is hard to be too negative on equity markets given the rapid pickup in the economic activity.

The quick return to expansion in the ISM manufacturing index on Wednesday (1 July 2020), with a reading of 52.6 (50 is the line separating expansion and contraction) is very encouraging and bodes well for equity markets, especially as it was also the best reading since April 2019!

Then there was Thursday’s (2 July 2020) stunning June non-farm payroll data which showed that the economy added nearly 5m jobs last month – of which the biggest improvements were seen in the areas that were hit hardest by the initial coronavirus outbreak, such as jobs in leisure and hospitality. This not only provides further evidence that an economic recovery is already well underway, but the economic fundamentals appear strong enough to facilitate a V-shaped economic recovery (i.e. a sharp and strong rebound in economic activity).

Additionally, in China the Caixin PMI services index added to this growth momentum as it reached the highest level since April 2010, and in the process this helped the CSI 300 index to continue its strong rally – in fact, the CSI 300 closed this morning (Friday 3 July 2020) at its highest level since June 2015 which is a powerful vote of confidence in the Chinese economy.

Furthermore, in the UK, Andy Haldane, the BoE’s chief economist, said that the UK economy was rebounding faster and stronger than he initially forecasted, and as a result, was also on track for a V-shaped recovery.

However, unfortunately in the very near-term we will continue to take two steps forward and one step back as equity market volatility is likely to remain elevated until we have a coronavirus vaccine – but as we have previously said, there are many promising vaccine candidates in the pipeline and so it is only a matter of time before one is available and we can all look forward to a strong 2021.

We have a relatively quiet economic calendar ahead this week. Of most interest will be the weekly US jobless claims data on Thursday (9 July 2020). Other data includes UK new car registrations; US ISM Non-Manufacturing index; US mortgage applications; Eurozone retail sales; Chinese CPI; and Japanese balance of payments.

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.