It was a week of two-halves for global equity markets.

It started with a burst of optimism amid the prospect of the major global economies reopening as many of the coronavirus lockdown restrictions are starting to be eased, thanks to data which continues to show a slowing in the number of coronavirus deaths – and by Wednesday 29 April 2020, the FTSE-100 was up 6.31% and in the US, both the Dow Jones and the S&P 500 were up just over 3.6%.

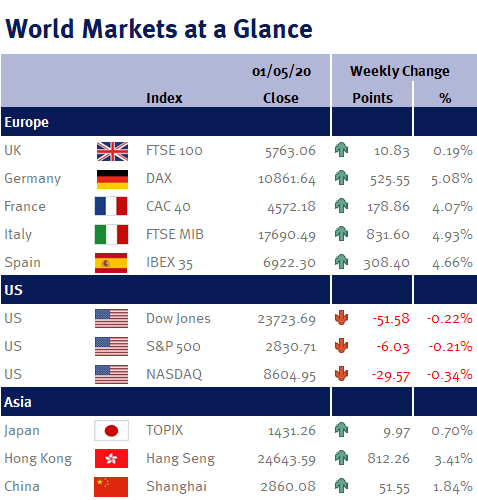

Unfortunately, this fast-and-furious rally, which saw the US markets record their best monthly return since 1987, probably went too far, too fast and as a result most equity markets saw a risk-off tone return on Thursday and Friday – in fact, the FTSE-100 lost 5.76% over these two days, while on Wall Street both the Dow Jones and the S&P 500 fell 3.7%, and consequently ended the week in negative territory.

Sentiment was also knocked after Donald Trump threatened to use tariffs to punish China for the coronavirus outbreak, which if implemented, would almost certainly turn our expectations of a V shaped recovery into a ‘Nike swoosh’ (a more gradual, but still aggressive recovery).

Additionally, we had some poor company results, including those from Amazon and Apple – although we believe that some of the companies that have recently reported may be ‘kitchen sinking’ their results (especially many of the major banks) by basically writing-off assets and making provisions now, in order to boost future profits.

While April’s rebound may seem strange given the economic impact from the coronavirus outbreak is only just getting started (for example, both the US and Eurozone Q1 GDP data showed that their economies have started to contract), more importantly, we believe that the bigger picture shows one that the worst is almost over – especially as China’s economy continued to show signs of recovery as businesses returned to work, with PMI readings for April above 50 (50 is the line separating expansion and contraction, so a reading above 50 signals the Chinese economy is expanding).

Looking ahead to next week, we have plenty of economic data releases, so please watch out for our daily updates to stay on top of our thoughts.

Once again, our focus will be on the US weekly jobless claims on Thursday 7 May 2020. Other key US data releases we are eagerly awaiting include factory orders; durable orders; the trade balance; PMI; and US employment data (non-farm payrolls; unemployment rate; participation rate; and average earnings).

In the UK we have PMI and a BoE monetary policy meeting, while from the Eurozone we have PMI and retail sales.

PS: Watch out for our webcast to be released soon on ‘How to manage your finances in the coronavirus crisis’.

Investment Management Team