It turns out US/Iran tensions was just a lot of noise!

Week ending 10th January 2020.

13th January 2020

We had a miserable start to the week as global equity markets fell after the weekend saw Middle East tensions escalate.

However, the storm clouds quickly cleared as the rhetoric turned out more intense than the action. In fact, Iran’s retaliation was probably the best possible outcome for global equity markets (i.e. the unprovocative retaliatory attack on US bases appeased domestic demands for revenge, but with no casualties, there was no need for the US to respond).

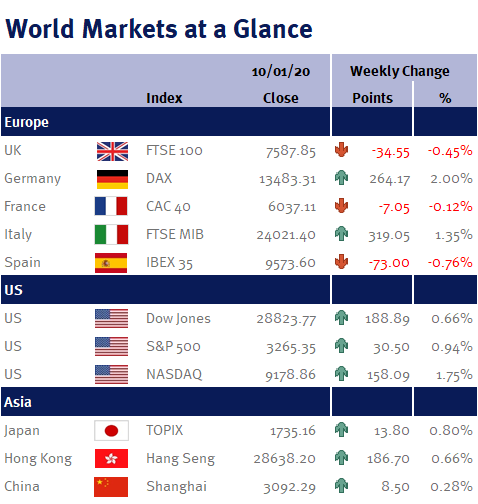

As a result, the week ended as though nothing had happened – with most of the major global equity markets returning to their pre-Iran crisis levels, while the price of a barrel of Brent crude fell back to $65 from nearly $70!

This highlights that sometimes there is nothing to fear, but fear itself: while it is easy to get wrapped up in the news headlines which implied that we are on the edge of an all-out war in the Middle East and there would be an imminent oil shock that would push the global economy into a recession, there have been plenty of reasons to remain calm from a macro growth perspective. For example, monetary policy remains a key driver for equity markets and the world’s major central banks have made it clear that interest rates will remain low.

As a result, any weakness in global equity markets is currently seen as a buying opportunity rather than a reason for panic.

This week’s data releases have been relatively light and mixed: Tuesday (7 January 2020) saw US non-manufacturing ISM come in better than expected, with a reading of 55.0 – the highest since August 2019; while today’s (Friday 10 January 2020) US non-farm payrolls disappointed slightly, with headline payrolls of 145,000 coupled with small downward revisions to the previous two months (November was revised down to 256,000 from 266,000, while October was revised down 4,000 to 152,000). The unemployment rate was unchanged at 3.5%, while average wage growth slowed from 3.1% to 2.9% (it first sub 3% reading since July 2018).

We have a slightly busier week ahead in terms of economic data. We have US and UK CPI, PPI and retail sales. Additionally we have the Fed Beige Book and US housing data. Elsewhere we have Eurozone industrial production and CPI; and Chinese Q4 GDP.

In addition, Wednesday 15 January 2020 sees Liu He, the Chinese Vice Premier, join Donald Trump at the White House to sign the first phase of the US/China trade deal.

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.