Following a substantial Conservative victory in the UK elections, it was a clear vote by the British public that a vote for Brexit meant they want Brexit! This win secured Prime Minister, Boris Johnson, the mandate to press ahead and deliver it. The result saw an element of certainty introduced to the market seeing the FTSE close the week up, rallying 1.1% on Friday, and seeing sterling rally significantly against all major currencies (over 1.3% up against the US Dollar and just shy of 1.4% up against the euro at the market close). From an economic perspective this arguably adds some surety to the UK market, but clearly there is still work to be done regarding Brexit in order to give both UK corporates, and indeed sterling, the stability they crave. On Monday we are to see some of the Prime Minister’s cabinet appointments, even if they are set to be minor ones. For further details surrounding the election, please see Friday’s General Election 2019 Market Update.

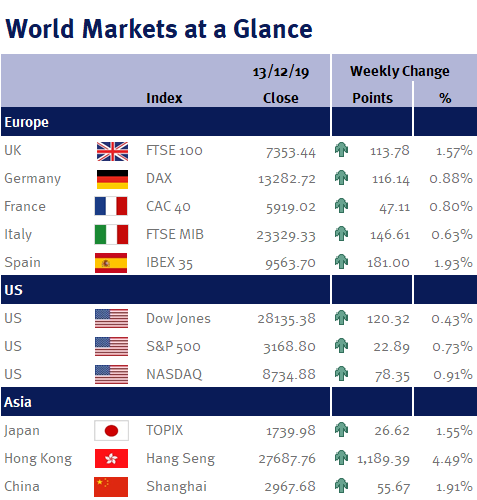

Week ending 13th December 2019.

16th December 2019

Elsewhere news has been relatively timid, with by far and away the most significant announcement being US President Donald Trump signing off on a phase one trade deal with China. Whilst this in itself does not resolve the burning trade rhetoric between the world’s two largest economies, it does stave off the introduction of the planned tariffs that were due to come into play this Sunday, the 15th December. These tariffs were due to hit the more significant sectors from a trade perspective, so the introduction of the phase one trade deal came as a relief to global markets. Initial details of the phase one agreement are to involve the Chinese increasing their consumption of US agricultural goods, in addition to the staggered reductions in current US tariffs on a select number of Chinese goods. We will likely see more detail surrounding this initial deal next week, but it could be thought that the detail of this deal is largely irrelevant, it is the sentiment that sits behind it that is important… Let’s remember, the campaign trails for the 2020 US Presidential Elections have begun, and with that in mind it is becoming increasingly obvious that Donald Trump wants progress on trade as a proverbial ‘flag to wave’ come the election, and wants to avoid an all-out capitulation in US/global economic relations. With that in mind, Trump also confirmed that the next round of trade talks would begin almost straight away.

We saw the policy meetings of both the US Federal Reserve (Fed) and the European Central Bank (ECB) on Wednesday and Thursday respectively. In the US, Fed Chair, Jerome Powell, made no changes to interest rates and suggested that whilst they remain data dependent, as it stands there are no major planned changes to policy for 2020. In contrast, the new President of the ECB, Christine Lagarde, whilst also not making any major changes to policy again suggested that monetary stimulus remains a key supportive measure, but went on to suggest that a marriage with Fiscal stimulus would be key to progressing the region’s economies. Lagarde went on to ask the press not to over interpret and over analyze what she says, as they have been guilty of this in the past… whether they pay any attention remains to be seen! However, with neither central bank making any policy alterations, it suggests that they believe current data out of the core remains robust (the US in particular, with the ECB looking at future fiscal support).

By way of data, on Monday we saw UK Industrial Production miss expectation, however given the election result it will be intriguing to see how this data set now progresses. Monday also saw European Investor Confidence significantly beat expectation at 0.7, a large boost in sentiment going into the new-year. Tuesday saw Chinese inflation beat expectation at 4.5%, with the US also beating inflation expectation on Wednesday with CPI coming in at 2.1% (year on year). On Thursday inflation data in France and Germany (the European core) both came in line with expectation. Indian inflation data was also released on Thursday, beating expectation by 0.14% coming in at 5.54%, and whilst industrial production declined by 3.8%, it significantly beat both prior data and indeed expectation, a huge buoy for the emerging economy.

As an aside, Saudi Aramco (a national petroleum and natural gas company in Saudi Arabia) came to market earlier this week being valued at approximately $1.7 trillion at its IPO (initial public offering). This saw it overtake Microsoft and Apple by quite a considerable margin as the most valuable company in the world. In the following days of trading, the company even briefly touched a valuation of $2 trillion!

Jonathan Wiseman, Fund Manager

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.