It was another week of mixed trade messages.

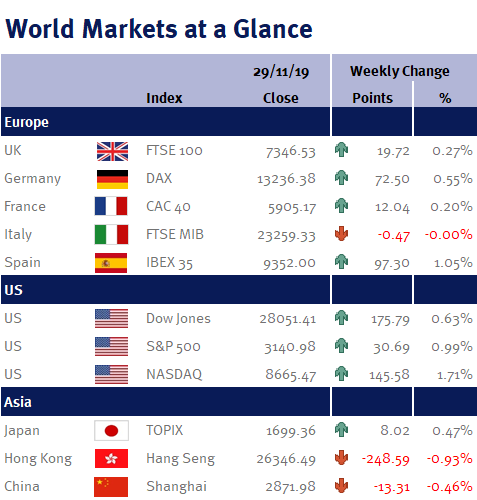

Global equity markets started the week on a positive note amid optimism that the first phase of a US/China trade deal would shortly be agreed after China said it would tighten intellectual property rules (this is what the US has been pushing for).

Unfortunately, despite comments by Donald Trump that the US and China were “in the final throes of a very important deal”, global equities pared their weekly gains when China threatened to retaliate after Donald Trump signed into law the bill supporting Hong Kong’s autonomy (Hong Kong’s special trade status will now be reviewed annually).