The main event this week was the two-day G-20 summit in Japan starting today (Friday 28 June 2019) as Donald Trump and his Chinese counterpart, Xi Jinping have agreed to meet each other on the side-lines tomorrow (Saturday 29 June 2019). However, this has become even more significant as the week has progressed as the US announced that it was adding more Chinese technology companies to its trade blacklist over national security concerns. Unfortunately this is likely to complicate trade deal negotiations, which we had initially hoped would restart.

Week ending 28th June 2019.

1st July 2019

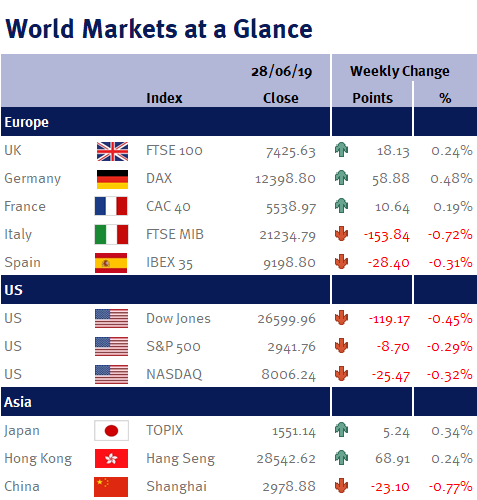

As this backdrop and ‘tough-guy’ posturing is unlikely to result in a productive meeting, optimism faded and global equity markets ended the week broadly flat. Hopefully the meeting will be more than just a handshake and fake smile for the cameras, but probably the best outcome we can now hope for is a truce, which will allow trade talks to restart.

However, bad news can be good news! Assuming tomorrow’s contentious meeting between Donald Trump and Xi Jinping yields little or no progress on trade and tariffs, it is likely to quicken the pace for the major central banks to cut interest rates/loosen monetary policy and spur China into pursuing further strong stimulus measures. Therefore any negativity coming from the G-20 this weekend is unlikely to significantly knock equity markets.

Adding to the cautious tone were Middle East tensions which remain elevated despite the lack of military action last week, as Donald Trump imposed sanctions on Iran’s supreme leader, Ayatollah Ali Khamenei (although they are in reality more symbolic than significant).

It was a quiet week for economic data. Eurozone economic confidence declined to its lowest level since August 2016 thanks to trade tensions, which is weighing on business and consumer sentiment.

Looking ahead to this week coming, we have a number of Fed policymakers speaking including Richard Clarida, Loretta Mester and John Williams – so we will be listening out for clues on the timing and size of the next US interest rate move.

The main focal point for this week’s economic data will be Friday’s (5 July 2019) US employment data (non-farm payrolls; unemployment rate; participation rate; and average earnings). Additionally this Sunday (30 June 2019), we have China’s PMI data.

Investment Management Team

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.