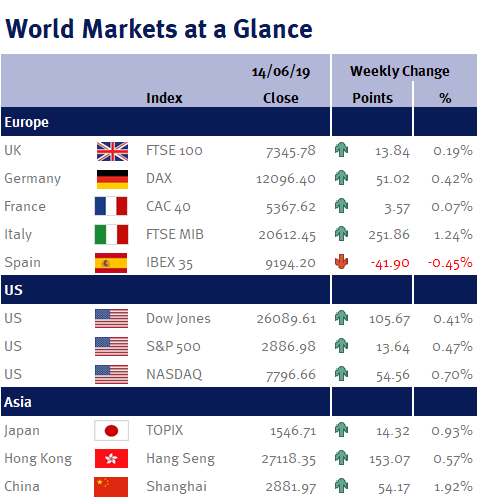

Global equity markets faced crosscurrents this week, as positive US-Mexico trade developments were overshadowed by uncertainty over US-China trade.

Week ending 14th June 2019.

17th June 2019

Lifting the markets early in the week was news that late last Friday (7th June), the US and Mexico had reached a deal on measures to stem the flow of Mexicans migrating to the US. As a result, President Trump indefinitely postponed tariffs on Mexican imports which were scheduled to come into force on Monday (10th June).

Whilst Mexico may have averted US tariffs, positive sentiment was short lived as Trump revealed he was personally blocking a US-China trade deal unless China accepted their previously negotiated terms. He also reiterated his threat to proceed with more tariffs if a trade deal cannot be reached at the G20 meeting later this month.

Industrial production data from China this week implied tariffs were weighing on the Chinese economy as growth of 5.0% was the lowest since 2002 and fell short of analyst expectations of 5.4%.

China has already announced a raft of measures to support the economy and disappointing data helps strengthen the case for further support. China was already demonstrating willingness when earlier this week it encouraged local governments to increase borrowing in order to boost infrastructure spending.

Whilst the industrial data release was disappointing, Chinese retail sales data did beat expectations this week; potentially reflecting the positive effects of recent personal tax reductions.

The case for the Federal Reserve to support the US economy was also bolstered this week as US inflation data fell short of expectations; US Core CPI rose 2.0% from last year vs estimates of 2.1%.

The US will announce monetary policy next Wednesday, and whilst softening US economic data has fuelled expectations of 2-3 US interest rate cuts this year, it wouldn’t be surprising if they held rates next week pending further clarity on US-China trade relations post the G20 meeting later this month.

Finally, the battle for the next UK Conservative Party leader was officially underway this week and saw ten Prime Minister hopefuls whittled down to six. Boris Johnson was a clear favourite amongst his peers, and by the end of next week we should know the final two contenders who will face a vote by the 120,000 Conservative Party Members towards the end of July.

In addition to the Fed, next week the Bank of England and Bank of Japan will be providing updates on their monetary policy.

Peter Quayle, Fund Manager

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.