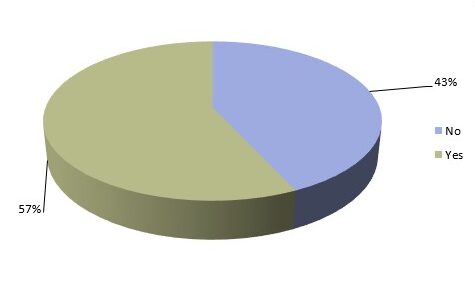

WEALTH at work conducted a poll* to find out what support employers offer to help employees understand their share plans.

The results show that 57% of employers provide financial education and/or guidance for their employees to raise their understanding of how their share plans work.

If you would like to find out how we can help, please get in touch.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website and through the WEALTH at work LinkedIn page from August 2022 to January 2023. The poll asked, ‘Do you currently provide financial education and/or guidance for your employees to raise their understanding of how your share plans work?’ and received 58 responses.

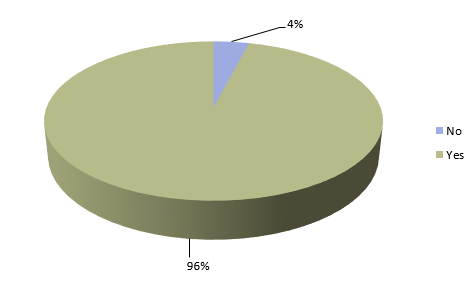

WEALTH at work conducted a poll* to find out whether employers believe having a financial wellbeing strategy in the workplace is becoming more important.

The results show that 96% of respondents believe that it is becoming increasingly important to have a financial wellbeing strategy in the workplace.

If you would like to find out how we can help, please get in touch.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website and through the WEALTH at work LinkedIn page from August 2022 to September 2022. The poll asked, ‘Do you think it is becoming increasingly important to have a financial wellbeing strategy in the workplace?’ and received 50 responses.

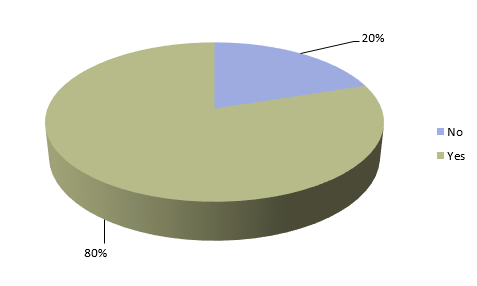

WEALTH at work conducted a poll* to establish whether employers believe that financial worries result in increased absenteeism. The results show that 80% of respondents think that financial worries do lead to higher levels of absenteeism in the workplace.

If you would like to find out how we can help, please get in touch.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website and through the WEALTH at work LinkedIn page from July 2022 to August 2022. The poll asked, ‘Do you think financial worries lead to higher levels of absenteeism in the workplace?’ and received 54 responses.

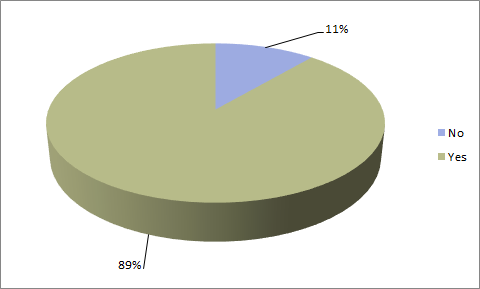

WEALTH at work conducted a poll* to establish whether employers believe that financial stresses result in lower productivity in the workplace.

The results show that 89% of respondents believe that financial worries result in lower workplace productivity.

If you would like to find out how we can help, please get in touch.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website and through the WEALTH at work LinkedIn page from June 2022 to August 2022. The poll asked, ‘Do you think financial worries result in lower workplace productivity?’ and received 71 responses.

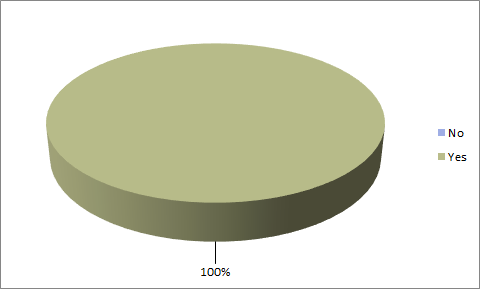

WEALTH at work conducted a poll* to establish whether employers believe financial worries increased levels of stress in the workplace.

The results show that 100% of respondents believe that financial worries do in fact cause increased levels of stress in the workplace.

If you would like to find out how we can help you to improve your employees’ financial wellbeing, please get in touch.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website and through the WEALTH at work LinkedIn page from May 2022 to June 2022. The poll asked, ‘Do you think financial worries cause increased levels of stress in the workplace?’ and received 51 responses.

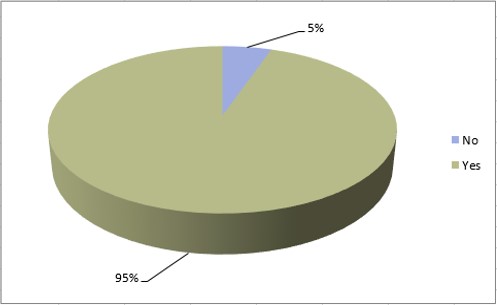

WEALTH at work conducted a poll* to establish whether employers thought it is becoming more important to provide support to employees who are leading up to retirement.

The results show that 95% of respondents believe that it is becoming increasingly important to provide financial education and guidance to employees who are approaching retirement.

If you would like to find out how you could build an effective financial wellbeing strategy for your retiring employees, please get in touch.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website and through the WEALTH at work LinkedIn page from July 2021 to April 2022. The poll asked, ‘Do you think it is becoming increasingly important to provide financial education and guidance to employees who are approaching retirement?’ and received 187 responses.

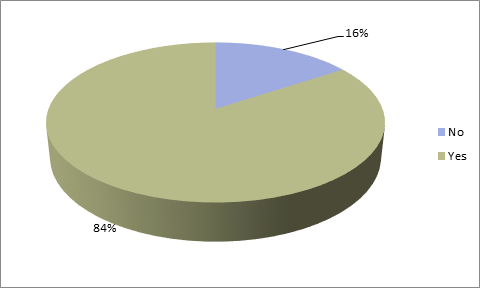

WEALTH at work recently conducted a poll* to determine whether employers thought that the retirement plans of employees had changed due to the effect of COVID-19.

The results show that 84% of respondents think that employees have changed their retirement plans in light of the pandemic.

If you would like more information on any of the issues raised, please contact us.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website and through the WEALTH at work LinkedIn page from May to June 2021. The poll asked, ‘Do you think employees have changed their retirement plans in light of the pandemic?’ and received 51 responses.

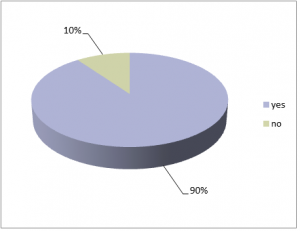

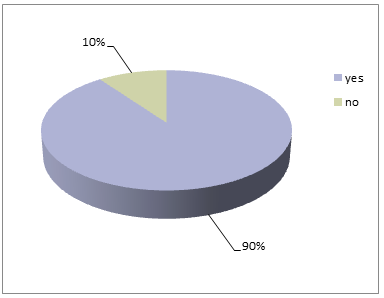

WEALTH at work recently conducted a poll* to determine employers’ opinions on financial wellbeing in the workplace.

The results show that 90% of respondents believe that it’s becoming increasingly important to have a financial wellbeing strategy in the workplace.

If you would like more information on any of the issues raised, please contact us.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website from February until May 2019. The poll asked, ‘Do you think it’s becoming increasingly important to have a financial wellbeing strategy in the workplace?’ and received 50 responses.

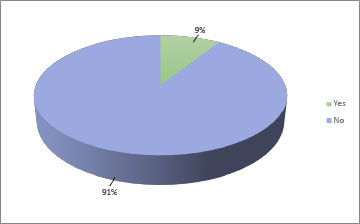

WEALTH at work recently conducted a poll* to determine whether employees understood tax rules when withdrawing money from their pensions.

The results show that 91% of respondents believe that employees do not understand the tax rules when withdrawing pension funds.

If you would like more information on any of the issues raised, please contact us.

*Statistics quoted are from a poll carried out on the ‘WEALTH at work’ website from December 2018 until February 2019. The poll asked ‘Do you believe that employees understand the tax rules when withdrawing money from their pension?’ and received 70 responses.

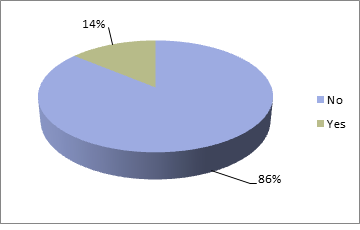

WEALTH at work recently conducted a poll to determine if employees thought that employees with a defined contribution scheme should be defaulted into a decumulation pathway at-retirement without financial guidance.

The results show that 86% of respondents believe that employees should not be defaulted into a decumulation pathway at-retirement without financial guidance.

If you would like more information on any of the issues raised, please contact us.

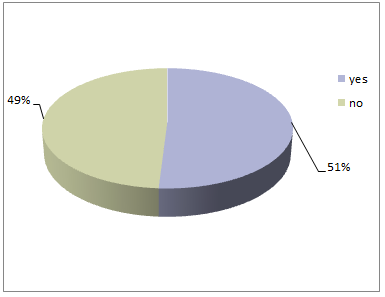

WEALTH at work recently conducted a poll to determine whether employers provide a guidance service* on financial issues such as pensions and retirement income options for their employees.

The results show that 51% of respondents provide a guidance service on financial issues for their employees. To find out more about the benefits of guidance in the workplace please click here.

If you would like more information on any of the issues raised, please contact us.

*By guidance we mean a one to one conversation which helps employees clarify elements of their financial situation either in the workplace or telephone support, and not regulated advice were specific recommendations are made.

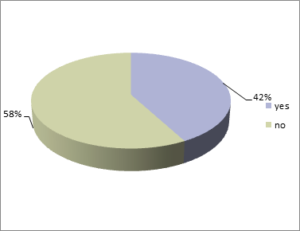

WEALTH at work recently conducted a poll to determine whether employers will provide access to the proposed Lifetime ISA through their reward packages.

The results show 58% of employers that responded will not provide access to the proposed LISA through their reward packages.

If you would like more information on any of the issues raised, please contact us.

WEALTH at work recently conducted a poll to determine whether employers believe their employees save more when workplace savings options are offered. (This could include workplace ISAs, SAYE/ SIP schemes and pensions.)

The results show 90% of respondents believe their employees do save more when workplace savings options are offered. To see comments about what this could mean for employers and employees, please read our news post.

If you would like more information on any of the issues raised, please contact us.

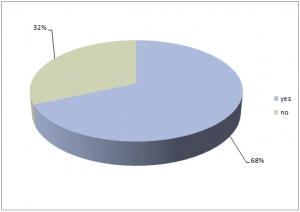

WEALTH at work recently conducted a poll to determine whether employers believed if the Lifetime ISA (LISA) was the start of the drift from pensions to ISAs in the workplace.

The results show 68% of respondents believe that the LISA is the start of the drift from pensions to ISAs in the workplace. To see comments about what this could mean for employers and employees, please read our news post.

If you would like more information on any of the issues raised, please contact us.

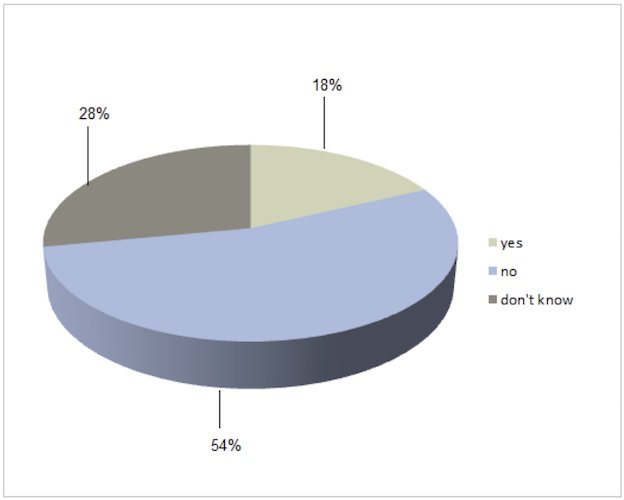

WEALTH at work recently conducted a poll to determine whether employees knew how much they should be saving into their pension to get a good retirement income.

The results show only 18% of respondents believe that their employees know how much they should be saving into their pension to get a good retirement income. The findings indicate that many employees are not getting the financial support they need to enable them to make informed decisions around their retirement.

If you would like more information on any of the issues raised, please contact us.

WEALTH at work recently conducted a poll to determine whether or not there will be an increased requirement for specialist advice at retirement.

The results show that 67% of respondents believe that there will be an increased requirement, which is an increase from the 60% reported in the Rethink Retirement Report survey results. Such specialist advice will be essential if employees are to make appropriate decisions, given the irreversible nature of annuities and the complexity and risk associated with drawdown pension.

If you would like more information on any of the issues raised, please contact us.

It should be noted that often the percentages are rounded up or down to the nearest one percent. Therefore, occasionally, figures may add up to 101% or 99%.

WEALTH at work recently conducted a poll to determine what sort of support is provided to employees.

The results show 57% of participants believe employers will provide written communications.

This is an increase from the 39% reported in the Rethink Retirement report survey results. However, it states that 85% will provide some sort of support through a combination of communications and/or financial education and/or advice.

If you would like more information on any of the issues raised, please contact us.

It should be noted that often the percentages are rounded up or down to the nearest one percent. Therefore, occasionally, figures may add up to 101% or 99%.

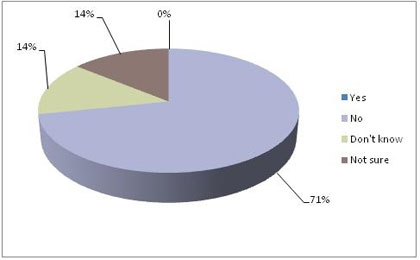

WEALTH at work recently conducted a poll to determine whether organisations believe their employees are making sufficient retirement savings. The results show 71% of participants believe their employees are not saving enough for retirement.

This is an increase from the 58% reported in the Rethink Retirement Report survey results.

If you would like more information on any of the issues raised, please contact us.

It should be noted that often the percentages are rounded up or down to the nearest one percent. Therefore, occasionally, figures may add up to 101% or 99%.