Scottish budget 2017.

15th December 2017

The Scottish Government has set out its spending and taxation plans for 2018 in its annual budget.

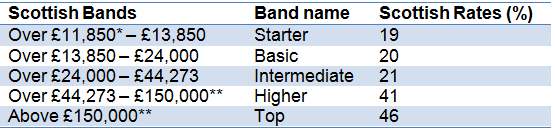

Please see some of the proposed changes to income tax below;

*Assumes individuals are in receipt of the Standard UK Personal Allowance.

**Those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000.

Jonathan Watts-Lay, Director, WEALTH at work, a leading provider of financial education, guidance and advice in the workplace, comments;

“If this is approved by the Scottish Parliament there clearly will be a new level of complexity within the tax system, which employees in Scotland will need to understand, especially when it comes to funding their pension and how tax relief will now be applied. Financial education in the workplace will be key to helping employees understand the implications to these proposed changes.”

For more information, please contact us.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.